Asia Bank Of China “Quite Cautious” About U. S. Growth Outlook: U.

S. -China Business Forum Russell Flannery Forbes Staff New! Follow this author to stay notified about their latest stories. Got it! Aug 19, 2022, 07:07pm EDT | Share to Facebook Share to Twitter Share to Linkedin Bank of China’s U.

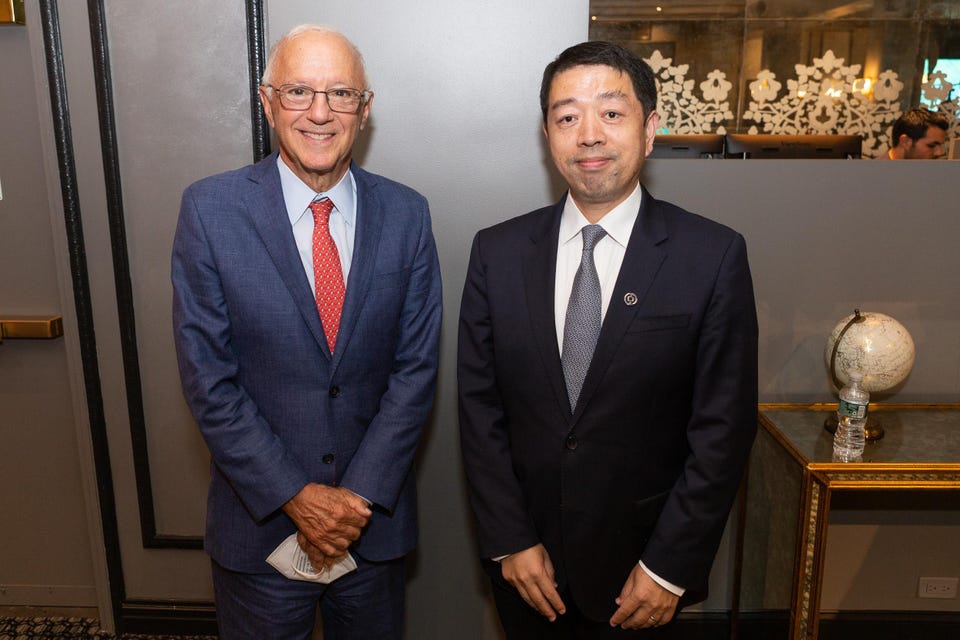

S. President Hu Wei, right, with Steve Orlins, president of the National Committee . .

. [+] on U. S.

-China Relations, at the U. S. -China Business Forum at Forbes on Fifth in New York on Aug.

9. Ethan Covey Photography The Bank of China is one of the world’s largest banks, ranking No. 13 on the 2022 Forbes Global 2000 list of the world’s top publicly traded companies.

The Beijing-headquartered institution was among a record number of businesses from China to make the list this year (see related post here . ) Wei Hu, president of the bank’s U. S.

operation, spoke at the “U. S. -China Business Forum” organized by Forbes China and held at Forbes on Fifth in New York on Aug.

9. I had a chance to speak with Hu about the bank’s U. S.

business, the outlook for the U. S. economy, and the impact of geopolitical tensions between the U.

S. and China. Hu is also chairman of the China General Chamber of Commerce, an organization of Chinese businesses in the U.

S. whose members contribute directly and indirectly to the employment of more than one million Americans. Edited excerpts follow.

Flannery: The bank has expanded greatly since you opened your first branch here in 1981. To what extent does your business mix here differ from China? Hu: The bank is the most international of all the banks in China. Although the market is a bit different, we share the same strategy — to serve the local community while connecting with the globe.

Nevertheless, we also utilize different resources. In the U. S.

, our resources are limited – in China, our branch network is naturally much larger. We focus the resources that we have locally (in the U. S.

) toward key clients – larger companies, key real estate developers and Chinese companies going global, and we are working with them to support local economic growth, together with trade and investment between U. S. and China, as well as the rest of the world.

Flannery: How does the U. S. rank among all of your overseas markets? Hu: Bank of China is operating in more than 60 countries and regions around the globe, and the U.

S. is definitely one of the key markets, given the size and the opportunities between the two economies. Fortunately, we have the market (at home), we have a strong reputation, and we have a dynamic talent pool.

MORE FOR YOU China Detains Fallen HNA Ex-Billionaire Chairman Ahead Of Airline Restructuring Vote Nasdaq Listing Of Freshworks Creates Windfall For Indian Founder And Hundreds Of Employees Ninja Van Becomes Singapore’s Newest Unicorn After Raising $578 Million From Alibaba, B Capital Flannery: The U. S. by some definitions has entered into recession in the first half of the year.

Whether we call it that or not, growth is sluggish. How’s that impacting your business? Hu: We understand that economic growth during the past two quarters has been negative, and we are seeing some continued cooling down in the overall economy. We are quite cautious about the progress of the economy, about the potential impact from interest rate hikes and also the credit cycles.

However, we remain cautiously optimistic about our growth in the near future. Our customers are top-tier customers with solid credit profiles. We always take a prudent approach and have strict standards for risk management.

We will continue to monitor the evolving market closely. Flannery: What about the geopolitical difficulties in the world right now, particularly the U. S.

and China? What’s the impact of that on your business? Hu: I would say that’s actually quite a challenging problem for us, not only for the bank, but also for our member companies of the China General Chamber of Commerce. As the two largest economies in the world, the U. S.

and China are inextricably linked. A mutually beneficial and strong relationship is extremely critical. Unfortunately, the conflict is observable.

Many activities between the two have drastically declined. The impact, uncertainty and complexity exist on many fronts. We have many opportunities to connect with different partners, both from the U.

S. and China. We hope to help the two sides create some actionable or practical solutions.

We believe that is in the interests of both countries, especially to the businesses, consumers and employment of both sides. Flannery: What’s ahead for the value of China’s currency relative to the U. S.

dollar? Hu: That’s another important question. When you’re talking about the renminbi, you have to take the whole world into consideration, not only just China and the United States. In the first and second quarters, China’s economy has been a little bit affected by the pandemic.

However, we do see signs of (it) bouncing back beginning this June. We also observed the global trend (of growth) to come down, especially in emerging economies, with the impact of Fed interest rate hikes, which influences the comparison between the renminbi and other currencies. If you take that into consideration, we still do see the renminbi as a safe harbor for global economies * * * The 4 th U.

S. -China Business Forum was organized by Forbes China, the Chinese-language edition of Forbes. The gathering was held in person for the first time since 2019; it was held online in 2020 and 2021 during the height of the Covid 19 pandemic.

Other speakers included China Ambassador to the U. S. Qin Gang; James Shih, vice president, SEMCORP; Abby Li, Director of Corporate Communication and Research, China General Chamber of Commerce; Audrey Li, Managing Director, BYD America; Lu Cao, Managing Director, Global Corporate Bank, Corporate & Investment Bank, J.

P. Morgan. Also speaking were Stephen A.

Orlins, President, The National Committee on United States-China Relations; Ken Jarrett, Senior Advisor, Albright Stonebridge Group; Dr. Bob Li, Physician Ambassador to China and Asia-Pacific, Memorial Sloan Kettering Cancer Center; and Yue-Sai Kan, Co-Chair, China Institute. See related posts: American Universities Are Losing Chinese Students To Rivals: U.

S. -China Business Forum American Companies Escape China Sanctions Over Pelosi Visit: U. S.

-China Business Forum Growth Prospects Top Today’s Angst Among American Businesses: U. S. -China Business Forum New Technology Brings New Opportunities: U.

S. -China Business Forum Pandemic’s Impact On China’s Economy Only Short Term, U. S.

Ambassador Says U. S. -China Business Outlook: New Paths Forward @rflannerychina Send me a secure tip .

Russell Flannery Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/russellflannery/2022/08/19/bank-of-china-quite-cautious-about-us-growth-outlook-us-china-business-forum/