Gautam Adani is the public face of Adani Group, the sprawling Indian conglomerate that has been accused by an American short-seller firm of stock manipulation and accounting fraud. Behind the scenes, another family member has played a pivotal role in the company—and the activities that critics say misled investors: his elder brother, Vinod Adani. TRENDING STORIES See All Premium UK PM Sunak to unveil measures to crack down on anti-so .

. . Premium Five key charts to watch in global commodities this week Premium Elon Musk puts Twitter’s value at just $20 billion Premium Fire damages complex housing Wright Brothers plane factory For decades, according to allegations published by Hindenburg Research, the elder Mr.

Adani was instrumental in managing overseas shell companies that Hindenburg says Adani Group used to manipulate the stock price of Adani companies, and artificially boost the financial health of its family-run firms in ways that were hidden from investors. In one example, Hindenburg alleged that Vinod Adani used a Singaporean entity to remove impaired assets from the books of an Adani mining company in Australia so that the business wouldn’t have to reflect the losses on its balance sheet. In another instance, which hasn’t been reported previously, a Singaporean entity that lists Vinod Adani as a director received large loans from a Dubai investment firm that he manages, and then lent funds to Adani firms in Australia.

The loans occurred around the same time that Adani Group was planning to build a railroad in Australia, but ran into funding complications after an Australian state government vetoed a federal government plan to extend a loan for the project. The Wall Street Journal wasn’t able to determine the source of the Dubai company’s funds. The rail line was eventually built in 2020 and 2021.

The Hindenburg report prompted a stock selloff that wiped out $105 billion in market value from the seven public companies that bear the Adani name. India’s Supreme Court recently formed an expert panel and asked the country’s market regulator to investigate the Hindenburg report’s allegations, including whether Adani Group failed to disclose transactions from groups related to the Adani family. In a 413-page rebuttal to the Hindenburg report, Adani Group denied allegations that it committed fraud or stock manipulation, and said it properly disclosed all related-party transactions, including some involving overseas companies, as required by law.

MINT PREMIUM See All Premium LIC plans record ₹2. 4 tn investments next fiscal Premium Heavier tax on debt funds will hit our corporate bond m . .

. Premium Business concentration may pose inflation risks Premium Debt mutual funds are no longer more tax-efficient than . .

. Adani Group also said that Vinod Adani has no managerial position or role in the day-to-day operations of Adani companies, and that it has no control over the investment decisions of many overseas entities mentioned in the report. In response to a request for further comment, an Adani Group spokesperson said it had disclosed Vinod Adani’s role as part of Adani’s promoters, a term used in India for founders and their associates, when required.

The spokesperson said it was inappropriate to comment further, pending the Supreme Court expert panel’s review. Efforts to reach Vinod Adani through multiple email addresses for him, an investment company he runs, Adani Group’s spokesperson and people who know him were unsuccessful. Corporate filings in Mauritius, the Bahamas, Cyprus and other countries, reviewed by the Journal, show that Vinod Adani has been deeply entwined with Adani Group operations for decades.

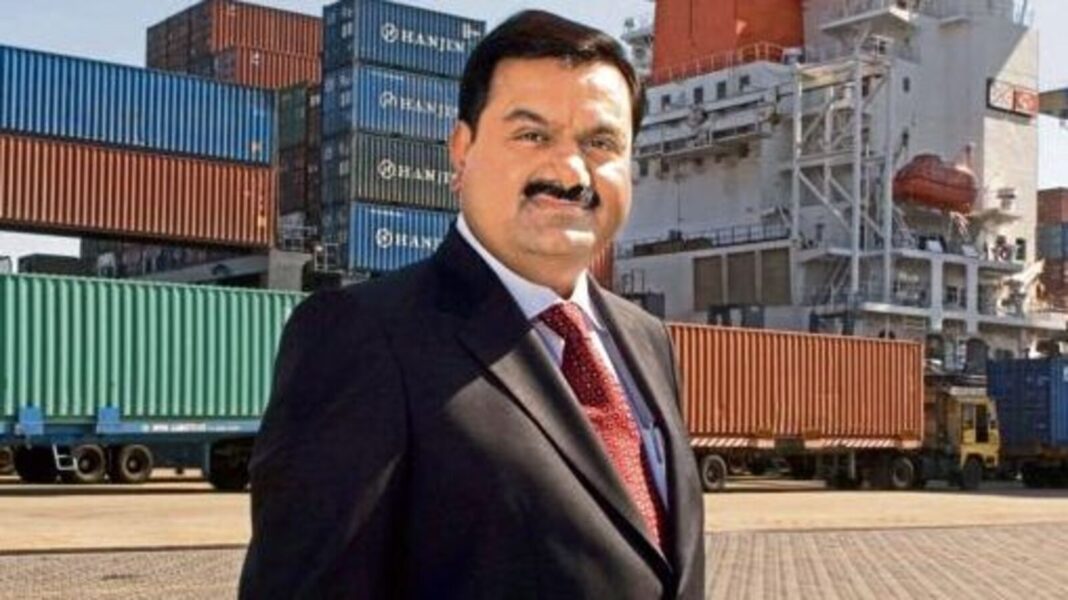

In some of the filings, the conglomerate said that the name “Adani Group” refers to three people and their relatives: Gautam Adani, Vinod Adani and Rajesh Adani, a younger brother who serves as a managing director. Unlike Gautam Adani, who has done interviews over the years, little is known about Vinod Adani, beyond a few paid advertorials in Indian media boasting of his business prowess and strong moral core. The Wire and The Morning Context, two well-known news sites in India, have dubbed him “the elusive brother.

” One of the few photos available online shows a bespectacled Mr. Adani holding a glass trophy encasing an Indian flag and bearing his name. The 74-year-old has operated largely overseas for decades, living in Dubai and holding a Cyprus passport and permanent residency in Singapore, according to Indian government documents and corporate filings in the Bahamas and the British Virgin Islands that were leaked as part of the Pandora Papers and Panama Papers and disclosed by the International Consortium of Investigative Journalists and Süddeutsche Zeitung, a German newspaper.

Growing up in the Indian state of Gujarat, where the Adani family were commodity traders, Gautam Adani considered Vinod Adani a father figure, said R. N. Bhaskar, who wrote a biography of Gautam Adani published last year.

Vinod Adani was operating a textile business in Mumbai when he took in a teenage Gautam Adani, who quit school and got into the diamond trade, Mr. Bhaskar said. When Gautam Adani went into the import-export business, Vinod Adani oversaw international shipments in Dubai from the port of Jebel Ali.

He later helped raise funds for building his brother’s port in the Indian city of Mundra, which became the cornerstone of the Adani Group’s business, Mr. Bhaskar said. Vinod was “his man on the ground,” Mr.

Bhaskar said. “The two are close, extremely close. ” In 1994, Adani Exports, which later became the Adani flagship company Adani Enterprises, went public.

That same year, Vinod Adani moved to Dubai, according to his paid advertorial in Indian media, and began building a network of overseas shell companies, according to registration and corporate filing documents from the Bahamas, revealed during the Panama Papers leaks. In January 1994, Vinod Adani set up a company in the Bahamas, which listed him and his wife, Ranjanben Vinod Adani, as directors, according to registration documents in the Bahamas in the Panama Papers leaks database. Two years later, he applied for a correction to his name, from Vinod Shantilal Adani to Vinod Shantilal Shah, according to an internal document from the Mossack Fonseca law firm that comprised the Panama Papers leaks.

That name has appeared over the years in numerous corporate filings related to Adani companies. Hindenburg said in its report that it had identified 38 Mauritius shell entities controlled by Vinod Adani or close associates, as well as shell companies controlled by Vinod Adani in Cyprus, the United Arab Emirates, Singapore and several Caribbean islands. Many of the foreign entities controlled by Vinod Adani appear to function as middlemen for shifting money around the conglomerate while obscuring the source of those funds, analysts and critics said.

Many of the companies had no obvious signs of operations or reported employees, yet collectively moved billions of dollars into Indian Adani entities, often without required disclosures, Hindenburg said. “I’ve never seen a corporate structure so opaque, so untraceable,” said Tim Buckley, director of Sydney-based research firm Climate Energy Finance, which has examined the Adani Group and its Australian operations. In the instance that wasn’t included in the Hindenburg report, a Singapore-based company named Abbot Point Port Holdings Pte.

Ltd. received more than $1. 1 billion in loans in the 2021 and 2022 fiscal years from Adani Global Investment DMCC, according to corporate filings in Singapore.

Adani Global Investment is a Dubai-based investment firm managed by Vinod Adani, according to its website. The source of Adani Global Investment’s funds couldn’t be determined. Over that two-year period, Abbot Point, which is a wholly owned subsidiary of another Singapore entity that lists Vinod Adani as its sole director, lent out $955 million to Adani companies involved in the Adani Group’s Australian coal, railway and port businesses, according to its last annual report.

The Adani operations in Australia had been planning to use a $600 million federal government loan to help pay for building a rail line. But a state government vetoed that plan amid opposition from environmentalists. Vinod Adani’s activities have also drawn scrutiny in Indian investigations into Adani entities.

In 2014, the Directorate of Revenue Intelligence, the Indian agency that investigates tax fraud, accused Vinod Adani of taking part in a scam to inflate the cost of imported power machinery in order to avoid paying taxes and to siphon nearly $900 million into a Mauritius company that Vinod Adani was linked to, according to a notice issued by the agency. The agency didn’t say what the money was intended for. The agency later expanded its investigation and alleged that Adani Group inflated the price of imported coal, which would allow its companies to charge higher prices for supplying power to electricity-distribution companies in India.

The finance ministry said that the investigation into over-invoicing of power equipment was finished and a report had been sent to relevant authorities, but it didn’t release any judgment. The case involving imported coal is pending. One former Adani employee who worked from 2010 to 2012 at the Tiroda coal power plant, which is owned by Adani Power Ltd.

, said in an interview that he created false invoices on behalf of PMC Projects (India) Pvt. Ltd. , a contractor that Adani hired to manage the plant’s construction in the state of Maharashtra, and which government investigators alleged was a shell company.

The employee said he used to write up inflated work orders—sometimes pricing goods and services at 10 times the real cost—on behalf of PMC and submitted them to the Adani firm in charge of the power plant. He said the invoices were always approved. An Adani spokesperson said the company couldn’t comment on the agency’s allegations of over-invoicing of power equipment because the case was under judicial consideration.

The Adani Group has submitted all necessary documents in the case of the imported coal, the spokesperson added. The spokesperson said the former employee’s account was baseless. OPEN IN APP.

From: livemint

URL: https://www.livemint.com/companies/news/behind-adani-deals-an-elusive-elder-brother-11679855363952.html