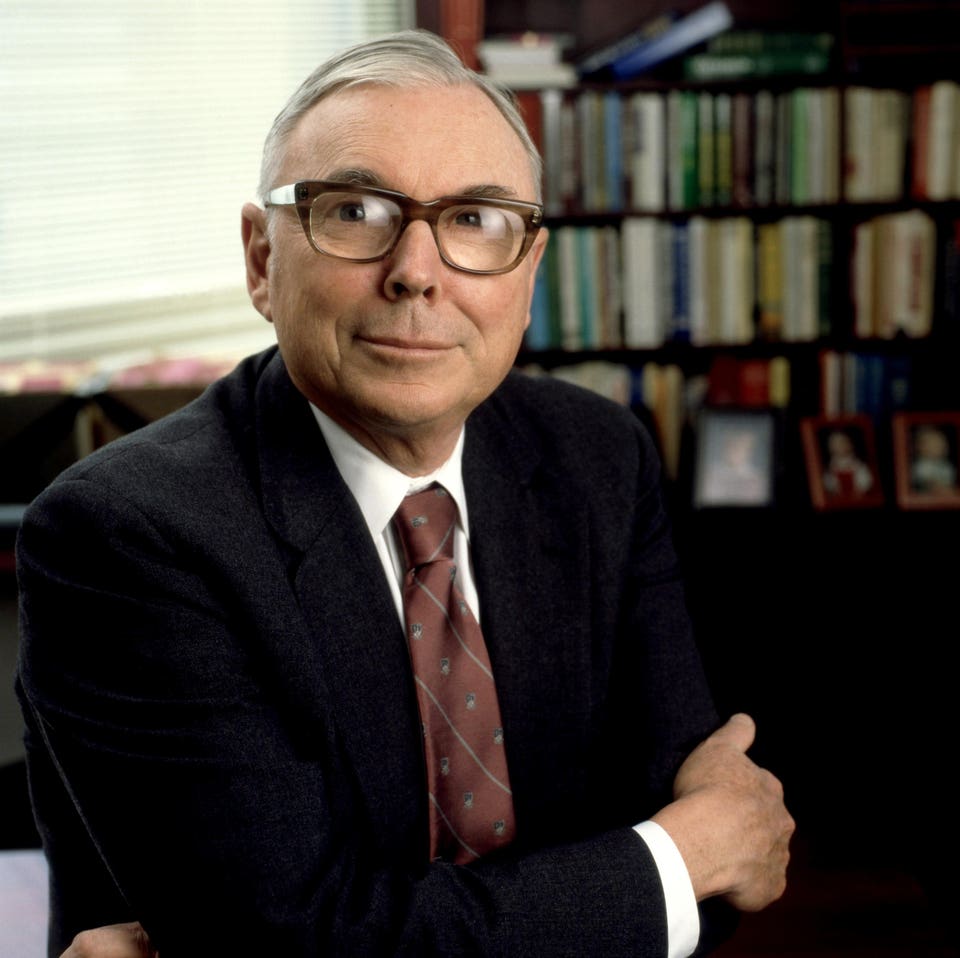

American billionaire investor Charles Munger poses for a portrait with his arms folded in Los Charlie Munger, one of the greatest investors of all-time, this week. He was 99. Munger was a successful attorney and Warren Buffett’s most trusted partner at Berkshire Hathaway.

Munger was able to wisely opine on many subjects. This article is about the most important investing lesson I learned from Charlie Munger: only invest in high-quality businesses. High-Quality Stocks Compound Best When Warren Buffett first met Charlie Munger at a dinner party in 1959, Buffett was more of a classic value investor who focused on investing in companies at cheap prices.

Munger helped Buffett transform Berkshire Hathaway into the Mona Lisa of corporate conglomerates by convincing Buffett to only invest in wonderful businesses at a fair price. Munger has long advocated for investing in high-quality businesses with strong brands, competitive advantages, and the ability to raise prices over time. One of Berkshire’s best investments of all time, See’s Candies, fit these criteria.

When Berkshire bought the company in 1972, it was a well-established confectionary company based in California. As a California native, Munger was familiar with the brand and its sterling reputation. He convinced Buffett to deviate from his traditional approach of buying cheap, undervalued companies and instead pay a premium for a company Munger considered a high-quality compounder.

Turns out, Munger was right. See’s Candies, originally purchased for $25 million, has since generated over $2 billion in pre-tax earnings. This investment not only provided substantial returns, but also taught Buffett valuable lessons about the power of brands and quality, shaping future investment decisions.

For example, Berkshire later bought a large stake in Coca-Cola, based on a similar premise. Munger had a unique ability to simplify complex topics down to their essential truths. He said, “Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns.

If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return—even if you originally buy it at a huge discount. ” There is so much wisdom wrapped up in that sentence. I encourage you to read it again and really try to remember it.

The point Munger was making is that the value of common equity follows a company’s profit trajectory over the long-term. Highly profitable companies with durable competitive advantages earn above average returns on capital, which reflects the fundamental quality of a company. Sometimes the market assigns an above-average or below-average valuation to those fundamentals.

However, if a company is fundamentally strong and steadily grows, the market will reward shareholders for that value creation. This is why Munger favored very long holding periods, once he found something worth investing in. For example, if you backtest the top 20% of the Russell 3000 Index based on 5-year average return on capital (to normalize for cyclical fluctuations), and assume annual rebalancing every year on December 31st, a hypothetical investor would have earned more than double the long-term compounded return of the index (770% cumulative return vs.

323%) from 2000 – 2022. Top 20% of the Russell 3000 Index, annually rebalanced and ranked by 5-year average return on How To Find Wonderful Companies The type of companies Munger considered high-quality compounders rarely go on sale. But when they do, it generally pays to buy.

To screen for high-quality companies, you can use stock screeners available from your online broker, or via a website that tracks fundamental data. You can also use the criteria in the backtest above, or focus on other profitability metrics and indicators of balance sheet strength. Another option is to subscribe to a service like Morningstar.

They have analysts who specialize in different sectors and assign Economic Moat scores to individual companies. Generally speaking, ‘ ’ firms are the type of high-quality franchises that Munger favored. These are companies that consistently earn above average returns on capital due to their enduring strategic attributes.

Sometimes a wide-moat businesses misses a quarterly earnings number, or encounters some other friction that temporarily sours Wall Street sentiment toward the company. When a great company faces a short-term uncertainty (and all of them do eventually), Wall Street frequently misinterprets it as a signal of longer-term risk. This can cause great companies to get marked down to valuations that may still exceed the broader index, but represent a below-average premium.

When I spot situations like this, I often think of Munger and pounce. Early in Charlie Munger’s career, one could argue that investing was simpler. There weren’t as many algorithms or clever analysts dissecting every tick by tick move.

Yet, his mental model of favoring high-quality companies still very much applies today. In my experience, one of the most common ways equity investors get into trouble is when they forget or ignore Munger’s point about business fundamentals. For example, remember the meme stock mania from a few years ago? AMC Entertainment (AMC) got bid up aggressively by retail investors to an enormous valuation well beyond its intrinsic value.

That price action temporarily minted a lot of millionaires. The CEO of AMC, for instance, did very well thanks to the Reddit crowd. He earned $25.

2 million in total compensation in 2021, and another $48. 2 million in 2022. However, AMC shares have fallen 98% since peaking on June 2, 2021! AMC has cratered because it is the of a high return on capital company.

The company has lost money every year since 2020, while reducing its workforce and closing theaters. In retrospect, the meme stock phase represented a gargantuan misallocation of capital into a few low-quality companies that were incapable of recycling that capital in profitable ways for the betterment of shareholders. In 2023, many investors have been commenting about how small-cap stocks have lagged large-caps.

Whereas the Russell 1000 large-cap index is up 21. 5% year-to-date, the Russell 2000 small-cap index is only up 7. 2%.

A big reason for the dramatic disparity: 41% of Russell 2000 firms are unprofitable, compared to only 17% in the Russell 1000. Charlie Munger taught many great lessons in his life. And even though life may be finite, his teachings can still serve investors long into the future.

.

From: forbes

URL: https://www.forbes.com/sites/michaelcannivet/2023/12/03/charlie-mungers-most-important-investing-lesson/