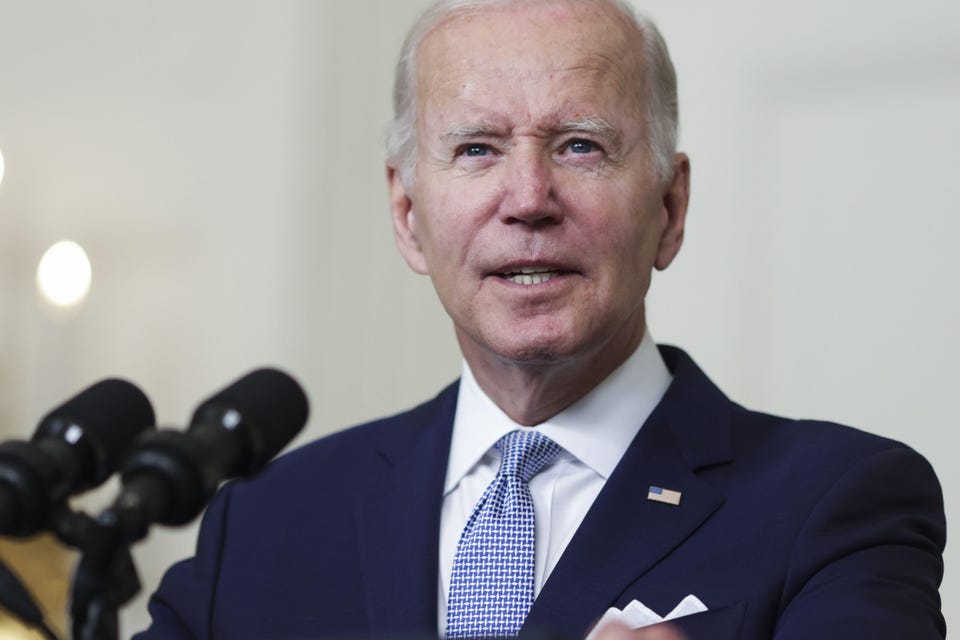

Healthcare Critics Decry Drug Pricing Provisions In Inflation Reduction Act, Say They Will Stifle Innovation Joshua Cohen Contributor Opinions expressed by Forbes Contributors are their own. I write about prescription drug value, market access, healthcare systems, and ethics of distribution of healthcare resources New! Follow this author to improve your content experience. Got it! Aug 2, 2022, 11:28am EDT | New! Click on the conversation bubble to join the conversation Got it! Share to Facebook Share to Twitter Share to Linkedin US President Joe Biden speaks on the Inflation Reduction Act Of 2022 in the State Dining Room of the .

. . [+] White House in Washington, D.

C. , on Thursday, July 28, 2022. The legislation includes several key drug pricing provisions.

Photographer Oliver Contreras/Bloomberg © 2022 Bloomberg Finance LP The push back against the prescription drug pricing provisions in the Inflation Reduction Act is relentless and hyperbolic. It’s not uncommon to hear detractors suggest that the measures will “stifle innovation” and “devastate” the pharmaceutical industry. Certainly, imposing rebates on list prices of drugs that exceed an inflation index, restructuring Medicare Part D (outpatient), and requiring Medicare negotiations for certain drugs, will challenge the industry in unprecedented ways.

Furthermore, critics who question why the drug industry is being targeted and not other healthcare sectors – such as hospital inpatient care – that have more impact on overall expenditures, are making a legitimate point. Pharmaceuticals comprise around 15% of healthcare spending. Yet, they’re disproportionately singled out for legislative policy measures.

But, drug prices – and this includes list prices due to how patients’ co-insurance is calculated – are salient to Medicare beneficiaries in ways that other healthcare costs are not. They’re acutely felt by beneficiaries, because the relative and absolute amounts of out-of-pocket spending on pharmaceuticals are so comparatively high. For example, the typical Medicare beneficiary on insulin cares about the drug’s list price – which has been rising steeply for years – because that forms the basis for how much is spent at the pharmacy counter.

Furthermore, for Medicare beneficiaries, the out-of-pocket costs are especially burdensome. On fixed and limited incomes – and often having to deal with paying for multiple prescriptions on a daily basis – Medicare beneficiaries spend thousands and sometimes tens of thousands of dollars out-of-pocket on needed drugs, such as cancer therapeutics. For many of them, the proposed annual cap of $2,000 on out-of-pocket spending isn’t a luxury.

It’s a necessity. MORE FOR YOU CDC: Salmonella Outbreak Has Left 279 Ill, 26 Hospitalized In 29 States Canadians End Up In ICU After Attending ‘Covid Party’ White House Mandates Pfizer Vaccines for Millions of Citizens . .

. Before the FDA Clinical or Safety Reviews Have Been Made Public Along with the cap on out-of-pocket spending, the proposed legislation includes a massive shift in cost management liability in the catastrophic phase of the Medicare Part D benefit. Currently, Medicare picks up the tab for 80% of costs in the catastrophic phase; plans, 15%; and beneficiaries, 5%.

In the restructured Part D benefit, the drug manufacturer would be responsible for 20% of catastrophic costs; plans, 60%; Medicare, 20%; and Medicare beneficiaries, 0%. As for the specific drug pricing provisions, a small number of single-source branded pharmaceuticals – 10 Part D drugs in 2026; 15 Part D drugs in 2027; 15 Part B and Part D drugs in 2028; and 20 Part B and Part D drugs in 2029 and later years – would be selected from among the 50 drugs with the highest aggregate Medicare Part D spending, and the 50 drugs with the highest total Medicare Part B expenditures. The legislation exempts from negotiation drugs which are less than 9 years (for small-molecule drugs) or 13 years (for large-molecule biologics) from their FDA-approval date.

What’s important to add is that the selected drugs would have to lack generic or biosimilar competitors. And, orphan drugs would not be subject to Medicare negotiations. Medicare would establish so-called maximum “fair prices” for the selected drugs.

Here, the amount of a minimum discount off of the average manufacturer’s price is based on how long the drug has been on the market. For drugs marketed more than 9 years, a minimum 25% discount is required; greater than 12 years, 35%; and greater than 16 years, 60%. The discounts negotiated could be higher.

This would depend on a number of factors, including clinical effectiveness indicators which drug manufacturers may explicitly call attention to in the negotiation process to mitigate the discounts. As readers reflect on the possible long-term implications of the bill, it’s vital that they are cognizant of the limited scope of the Medicare price negotiations (often called “price controls”), especially those placed on non-insulin products. First, the price setting of new drugs would not be affected by the legislation, except indirectly through the shifting of cost management in the Part D benefit.

Where in the current situation branded drug manufacturers are responsible for 70% of costs in the coverage gap phase, that would change to 10% in the initial coverage phase and 20% in the catastrophic phase. Second, besides insulin, there aren’t many drugs that would even qualify to be selected for negotiation. Frankly, it’s probably going to be difficult to find 20 eligible drugs in, say, 2028.

Last year, the Kaiser Family Foundation (KFF) carried out a simulation of how drug price negotiations would work in practice. In the hypothetical scenario – as stipulated in the House bill which passed in 2021 – the study found that at most 20 non-insulin drugs and biologics (18 Part D and two Part B products) would qualify to be possibly selected for Medicare negotiations in 2022. In addition, some of the 20 non-insulin drugs that would be eligible for Medicare negotiation today, would not be in 2025, when the House version of the bill’s proposed negotiations would commence.

Among the high-profile drugs mentioned in the KFF report are the blood thinner Xarelto (rivaroxaban), Soliris (eculizumab), indicated for paroxysmal nocturnal hemoglobinuria, the multiple myeloma drug Revlimid (lenalidomide), and Humira (adalimumab), which targets auto-immune disorders. All four drugs will have generic or biosimilar competition by 2025. Accordingly, none of them would be subject to Medicare price negotiations.

Fast forward to today’s projections of which drugs could be targeted for negotiation. Very recently, SVB Securities listed a number of high-profile drugs that could be eligible five and in some cases 10 years down the road. Based on its projection, SVB Securities warns that “innovators’ willingness to develop new drugs, in particular small molecule therapies for seniors, would likely diminish.

” Well, that may be true to some extent. But, it’s hard enough to know for sure whether a drug would be eligible for negotiation in, say, 2026, let alone 2032. Therefore, there’s a lot of uncertainty surrounding any such predictions.

Another factor that could play a role and has been conspicuously absent from policy discussions is the potential for volume offset. As has been known since the Rand experiment in the 1970s, better health insurance coverage drives higher usage and volume. Medicare Part D, in particular, would provide significantly better coverage for specialty pharmaceuticals under the proposed plan.

Of course, this applies to all outpatient drugs, not just those chosen for negotiation. More beneficiaries will be able to take their medications and stay on them, with enhanced coverage. Drug pricing itself is not only complex, it also reverberates throughout the pharmaceutical ecosystem.

How drugs are priced in the current and future market can reach back, if you will, to impact drug development. Hence, observers speak of the negative impact that Medicare negotiations would have on “innovation. ” Setting aside arguments on whether all newly approved drugs constitute innovations, if passed, the proposed legislation would likely have an impact on future drug development.

The Congressional Budget Office estimates that there will be approximately 10 fewer drugs over the next 30 years , out of what is expected to be around 1,300 new drugs launched. Notably, the figure of 10 drugs is much lower than 60 fewer drugs if HR. 3 (Lower Drug Costs Now Act) had been implemented, as HR.

3 would have subjected a significantly larger number of drugs to the much more draconian step of international price referencing, as would have the Trump Administration’s Most Favored Nation executive order . Overall, according to RBC Capital Markets , revenues for some pharmaceutical and biotechnology companies would take a hit. However, it wouldn’t be “devastating.

” The RBC group suggests that the legislation could impact up to 10%-15% of revenues for the affected companies. Follow me on Twitter . Joshua Cohen Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/joshuacohen/2022/08/02/critics-decry-drug-pricing-provisions-in-inflation-reduction-act-say-they-will-stifle-innovation/