The US’s biggest banks agreed to deposit $30 billion with First Republic Bank in an effort to stem the turmoil that’s sent depositors fleeing from regional banks and shaken the country’s financial system. JPMorgan Chase & Co. , Bank of America Corp.

, Citigroup Inc. and Wells Fargo & Co. will contribute $5 billion of uninsured deposits each, while Goldman Sachs Group Inc.

and Morgan Stanley will kick in $2. 5 billion apiece, according to a statement Thursday. Other banks will deposit smaller amounts.

TRENDING STORIES See All Premium Global markets: SGX Nifty to First Republic Bank — trig . . .

Premium India’s first seaplane service faces uncertain future Premium Credit Suisse got its lifeline. Now it needs to win bac . .

. Premium Over $1 billion startup money exposed to SVB, as per a . .

. “This action by America’s largest banks reflects their confidence in First Republic and in banks of all sizes,” the banks said in the statement. The consortium cited the outflows of uninsured deposits at a small number of banks following the collapse of Silicon Valley Bank and Signature Bank.

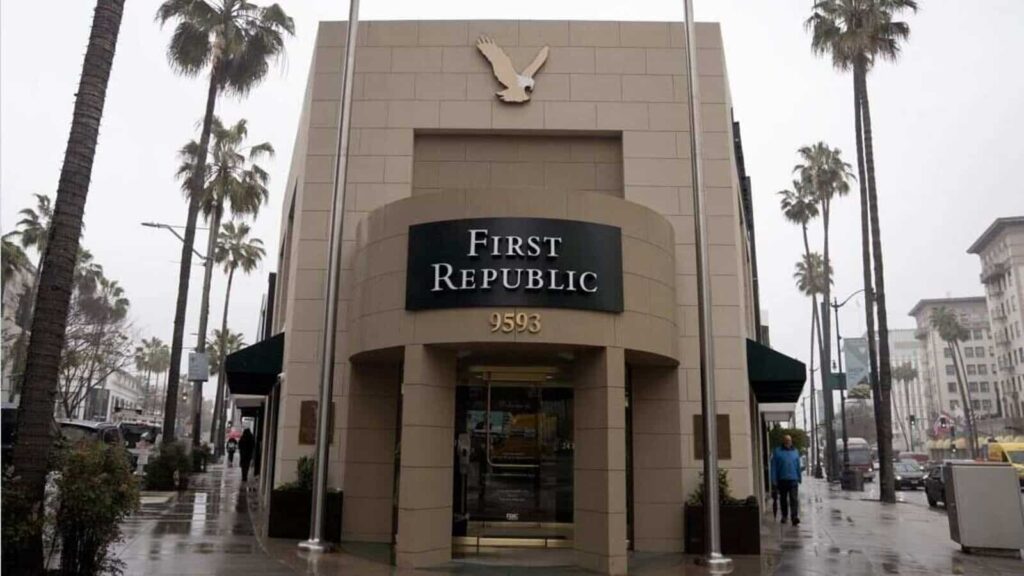

The three-paragraph statement gave no terms for the commitments. Banks’ initial commitments will extend for at least 120 days, though could extend beyond that, according to people familiar with the matter. A representative for the San Francisco-based bank didn’t immediately respond to a request for comment.

First Republic has been exploring strategic options including a possible sale, Bloomberg News reported late Wednesday. The lender’s shares have plummeted in the aftermath of regulators’ seizure of fellow regional lenders Silicon Valley Bank and Signature Bank over the past week. “This show of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system,” US Treasury Secretary Janet Yellen, Federal Reserve Board Chair Jerome Powell, Federal Deposit Insurance Corp.

Chairman Martin Gruenberg and Acting Comptroller of the Currency Michael Hsu said in a joint statement. Also contributing are PNC Financial Services Group Inc. , Bank of New York Mellon Corp.

, Truist Financial Corp. , U. S.

Bancorp and State Street Corp. , which will each deposit $1 billion. “This unprecedented private sector collaboration is a powerful step to bolster liquidity and reflects our confidence in the critical role of regional banks in our economy and across the communities we serve,” Truist Chief Executive Officer Bill Rogers said in an emailed statement.

MINT PREMIUM See All Premium Marathi, Odia, other languages join pan-India movie wave Premium Ola should admit safety risks and go for a recall Premium The end of hyper-globalization should yield a better al . . .

Premium Should you be worried about the H3N2 virus? Shares of First Republic swung wildly Thursday, plunging as much as 36% early in the day, then surging as much as 28% midday after details of the emerging plan were first reported. Shares closed up 10% after trading was paused multiple times during the day for volatility. First Republic, which specializes in private banking and has built up a wealth-management franchise with some $271 billion in assets, has made an effort to differentiate itself from SVB Financial Group’s Silicon Valley Bank.

Unlike SVB, which counted startups and venture firms among its biggest clients, First Republic said that no sector represents more than 9% of total business deposits. Silicon Valley Bank collapsed into FDIC receivership Friday after its customer base of tech startups grew concerned and pulled deposits. First Republic Bank has been working with JPMorgan as it tackles its challenges.

On Sunday, the same day Signature Bank was taken over by regulators, First Republic said it “further enhanced and diversified its financial position” by securing additional liquidity from the Federal Reserve and JPMorgan. “The effort by the federal government to bring together the banking sector, including U. S.

Bank, speaks to the strength of the overall financial system,” said a spokesman for the Minneapolis-based lender. Catch all the Corporate news and Updates on Live Mint. Download The Mint News App to get Daily Market Updates & Live Business News .

More Less OPEN IN APP.

From: livemint

URL: https://www.livemint.com/companies/news/first-republic-gets-30-billion-of-bank-deposits-in-rescue-11678999011174.html