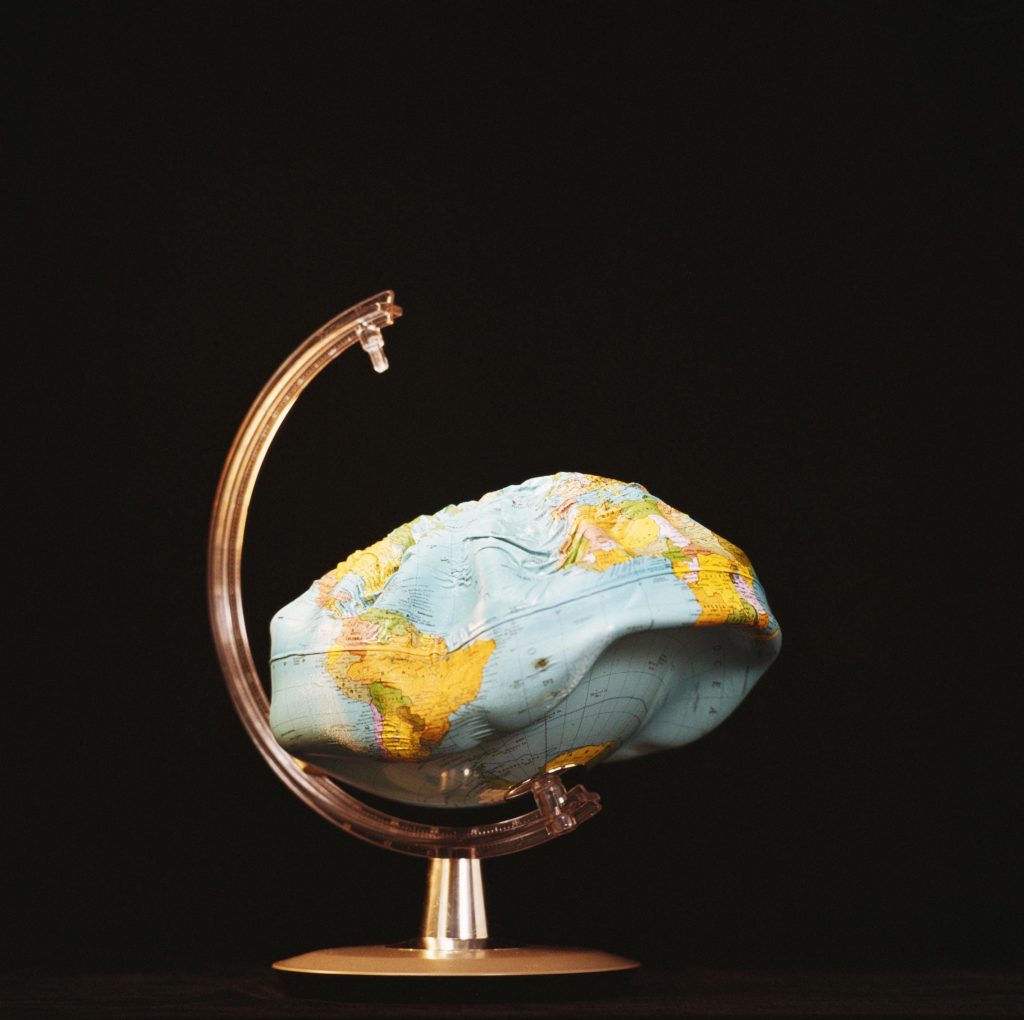

Manufacturing There Is A Playbook For This: How Your Business Should Respond To Inflation Curt Mueller Contributor Opinions expressed by Forbes Contributors are their own. I cover trends in supply chain, technology, workers and sustainability May 23, 2022, 12:26pm EDT | Share to Facebook Share to Twitter Share to Linkedin The phrase “there’s no playbook for this” was used ad nauseum the past couple of years, as businesses around the world faced shutdowns and supply chain shocks the likes of which have no precedent. Now, companies must grapple with inflation that has hit levels not seen in decades. While there’s ongoing debate about the causes (and potential resolution) of these macroeconomic pressures, price increases in combination with geopolitical tension call for new manufacturing and supply chain strategies to build resilient businesses. Companies are grappling with inflation that has hit levels not seen in decades. There is a guide to … [+] help CEOs rethink their response to cost increases, based on the most effective practices of leading companies around the world. Redferns So a playbook would come in handy. Now there is one: a guide to help CEOs rethink their response to cost increases, based on the most effective practices of leading companies around the world. The two conventional responses to cost increases — centered on pricing and procurement strategy — have met their limits. Companies must take a more holistic approach, one that addresses opportunities to control costs and reduce the impact of volatility across the organization’s full spectrum of activities. Doing so may require far-reaching changes to the way products are designed and manufactured, as well as to the structure of the end-to-end value chain. This puts the focus firmly on business operations. Because operations are where the money is spent (on labor, energy, materials, logistics services, etc.), they also bear the brunt of cost increases. Operations are also where there’s opportunity to change a company’s exposure to those costs. Smart decisions on the way value chains are designed, built and run can have a transformative impact on the organization’s cost base. Senior executives tell us that the most effective levers are significantly underutilized today. That’s because making them work requires coordinated action across an organization’s entire ecosystem, including its suppliers. Some of the most powerful responses to rising and volatile prices call for structural changes to supply chains, production footprints, and even entire business models—all of which fall within the remit of the CEO, working with operational leaders. MORE FOR YOU Germany’s Renk Group Seeks To Revitalize An Iconic American Defense Manufacturer What Drives Newly Minted CRISPR Unicorn Mammoth Biosciences A Million Parts Using 3D Printing? Mantle’s Printed Tooling Powers Mass Production To assist in the design and implementation of a portfolio of solutions, it can be useful to think about three main “blocks” of activity across short-, medium- and long-term horizons. Short-term actions (next one to two months): Study up The first step for any organization facing the level of volatility we’ve seen the last two years is to create a comprehensive view of the real underlying costs of the products and services it buys. A major automotive company, for example, has created a dashboard that tracks the price evolution of key raw materials and other inputs in its supply chain. Using data from cleansheet studies and product teardowns, it creates a detailed, component-by-component view of the likely impact of rising prices on real supplier costs. Data from such dashboards help companies to conduct fact-based negotiations with their suppliers, guarding against excessive price increases and ensuring that the impact of rising prices is shared fairly among supply chain participants. Leaders can also use that information to inform pricing decisions and procurement strategy, secure short-term supply of critical items, and identify opportunities to rapidly reduce costs through quick changes to product design or specification. Medium-term actions (next six to 12 months): Look within Companies can double down on efforts to keep in-house costs under control. Improving efficiency, quality and productivity in business operations can produce more value with the same labor, materials, and energy inputs. That can be achieved through a combination of analog approaches, such as lean, and digital ones, such as Fourth Industrial Revolution (4IR) technologies. One manufacturer of electric-vehicle batteries and components, for example, redesigned its entire production system to take advantage of advances in AI and advanced analytics. That helped increase labor productivity by 75 percent while reducing the occurrence of manufacturing defects by 80 percent. Those that see meaningful gains in the use of 4IR technologies know that investment in technology can only pay off with a skilled workforce—itself a challenge amid the tightest labor market in decades. One global consumer goods company has established a digital academy to upskill managers and frontline team leaders across its business operations. In its first year, the academy trained more than 150 people in digital skills using a combination of go-and-see visits, immersive boot camps, and e-learning modules. Sourcing critical inputs from multiple suppliers in different regions can improve both supply chain resilience and price stability. Redesigning or reformulating products to reduce reliance on scare or high-cost inputs also helps. In the food and beverage sector, some companies have adapted both their recipes and their production systems so that they can switch between different combinations of ingredients according to their relative price and availability. Longer-term actions (next two to three years): Consider structural changes Over the longer term, companies may want to pursue structural changes to both their value chains and their business models. That process begins with a reevaluation of make-versus-buy and near- versus offshoring decisions. As well as changing the structure of their value chains, companies may want to reevaluate their position within it. That could involve a return to vertical integration in some sectors as securing a reliable supply of critical inputs becomes more challenging. Food and beverage companies have made strategic investments in ingredient producers for some years, for example. Now carmakers are adopting the same approach, with investments in primary producers of lithium and other key inputs for electric vehicles. Some companies are seeking to reduce the number of intermediaries in their supply chains, bypassing distributors and mid-tier suppliers to purchase directly from the original producers of materials or components. Others have put plans to outsource more of their logistics operations on hold, preferring to stick with the price and service stability offered by their in-house operations. Companies that adapt their business operations quickly and decisively to reduce their exposure to rising costs will be in the best possible position to maintain margins and growth. But what if most of today’s sharp price hikes do turn out to be transitory? That’s the real power of the operations-focused approach. Almost without exception, the levers that help an organization respond to rising costs also equip it with the tools and capabilities it needs to thrive when prices fall. Curt Mueller Editorial Standards Print Reprints & Permissions

From: forbes

URL: https://www.forbes.com/sites/curtmueller/2022/05/23/there-is-a-playbook-for-this-how-your-business-should-respond-to-inflation/