XTB, a global fintech offering an online investing platform and a mobile app, launched today a new product for long-term passive investing. Investors in the UAE can now tap into the growing potential of Exchange-Traded Funds (ETFs) and build their individual portfolios on the go via the XTB mobile app. Exchange-Traded Fund (ETF) is a diversified basket of assets (e.

g. stocks or bonds) that is traded throughout the day on the stock exchange just like shares. ETFs can either track the performance of a specific index (e.

g. American S&P 500), provide exposure to a certain industry (e. g.

technology, pharmaceuticals), commodity (e. g. oil, gold) or type of companies (e.

g. dividend stocks). In recent years, ETFs have become one of the hottest investing topics globally.

As the MENA investment community also appreciates the benefits of this asset class, XTB decided to pioneer its ETF-based product in the region. We see a great potential in ETFs and passive investing as this is a powerful investment option to build a diversified portfolio without the need to hand-pick the instruments one-by-one. As the Investment Plans make passive investing even simpler and more intuitive, it can be an additional booster for this asset class in the local market – said Achraf Drid, CEO – Middle East & North Africa at XTB.

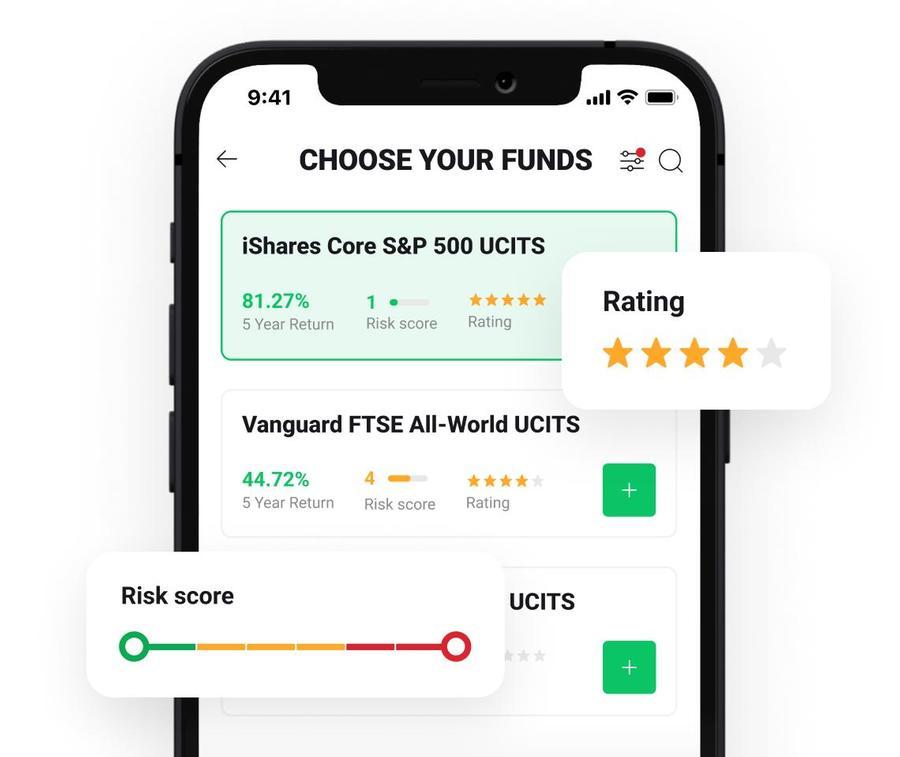

With a minimum investment of USD 15, XTB clients in the UAE are now able to build a maximum of 10 portfolios comprising up to 9 ETFs each. Currently, investors can choose from over 300 ETFs and Investment Plans make the choice easier by filtering suggestions based on individual preferences – such as type of ETF, composition and geographical reach, Morningstar rating or the performance of the plan over the last 5 years. When creating their individual Plan in the XTB app, investors can choose the exact amount they want to invest.

The allocation of funds within the Plan is done automatically depending on individual risk profile and selected investment horizon. Plans can be open and closed at any time which allows for re-allocation of funds when the priorities change. Thanks to the newly-added recurring payments feature, the individual plans can be topped up regularly via free funds from the XTB account.

Each deposit will be automatically invested in line with the preferred allocation. Investment Plans are suited to cater the needs of investors looking for ways to invest their funds but they don’t want to spend too much time on it. As we have just added recurring payments as an important enhancement to the Investment Plans, long-term investments are now even more hassle-free – added Drid.

In line with the overall XTB’s offering, there is 0% commission on ETF investing* and the set up and maintenance of Investment Plans is free of charge. This means the investment grows without the drag of unnecessary costs. * For monthly turnover up to 100,000 EUR (then comm.

0. 2%, min. 10 EUR).

0. 5% currency conversion cost may apply. About XTB XTB is a global fintech company that provides individual investors with instant access to financial markets from around the world through an innovative online investing platform and the XTB mobile app.

Founded in Poland in 2002, we support over 847,000 customers globally in achieving their trading ambitions. At XTB, we are committed to the ongoing development of the online investing platform enabling our customers to trade 5,900+ instruments including stocks, ETFs, CFDs based on currency pairs, commodities, indices, stocks, ETFs, and cryptocurrencies. Our online platform is a top destination not only for investing but also market analysis and education.

We offer an extensive library of educational materials, videos, webinars, and courses to help our customers become better investors irrespective of their trading experience. Our customer service team provides support in 18 languages and is available 24/5 via email, chat or phone. In over two decades of activity in the financial markets, we have established 12 offices worldwide including Poland, Dubai, the UK, Germany, Romania, Spain, Czech Republic, Slovakia, Portugal, France, and Chile.

Since 2016, XTB shares have been listed on the Warsaw Stock Exchange. We are regulated by the world’s largest supervisory authorities: Financial Conduct Authority, Polish Financial Supervision Authority, Cyprus Securities & Exchange Commission, Financial Services Commission in the Seychelles and Dubai Financial Services Authority. Visit xtb.

com for more information. .

From: zawya

URL: https://www.zawya.com/en/press-release/companies-news/xtb-employs-technology-to-make-passive-investing-more-convenient-g5f7srfm