Forbes Money Fintech Canton Network Launch Signals The Tokenization Of The Real Economy Has Arrived Lawrence Wintermeyer Contributor Opinions expressed by Forbes Contributors are their own. I cover fintech, crypto and digital assets, and sustainable finance. Following May 25, 2023, 06:00pm EDT | Press play to listen to this article! Got it! Share to Facebook Share to Twitter Share to Linkedin Canton Financial Market Participants Digital Assets This month saw the launch of the Canton Network, the financial services sector’s first privacy-enabled interoperable blockchain “network of networks” designed for institutions focused on real world assets.

At a time of global political and market instability and a new banking crisis, the launch of the network signals that the capital markets are ready to embrace blockchain as a critical enabler of the next era of financial services – digital transformation. Tokenization and fractionalization of real world assets using distributed ledger technology (DLT) are set to unlock a universe of new opportunities to transform all types of assets – traditional and new – while broadening access to these assets to new and existing investors. BlackRock’s Larry Fink has come out strongly supporting tokenization as “the next generation for markets”.

BlackRock estimates that tokenization of private market assets will open markets worth $290 trillion. Boston Consulting Group predicts that some $16 trillion worth of assets, most of which are illiquid, will be tokenized by 2030. Cathy Clay, Executive Vice President, Global Digital and Data Solutions, Cboe Global Markets says, “At Cboe, we believe the tokenization of real world assets may offer an unprecedented opportunity to create new market infrastructure and drive efficiency in the trading of products across the globe.

By leveraging new blockchain technologies, we can potentially unlock new opportunities for market participants. ” MORE FOR YOU Forget Apple Watch: Huawei Watch Ultimate Beats Apple To Game-Changing New Features DeSantis 2024 Announcement: Blasts Biden And ‘Elites’—But Not Trump—In Talk With Elon Musk ‘#DeSaster’: DeSantis Roasted Over Botched Twitter Campaign Launch—By Trump, Biden And Others Attracting more money into more markets and engendering greater market participation is “Capitalism 101” – the more the merrier – however, it is the promise of the economic benefits to all involved: investors, issuers, network participants, and market operators that are compelling and will need to be demonstrably delivered to successfully scale. Greater capital efficiency through the release of trapped capital in the latency of the brokerage to settlement value chain is a focus area, along with the role of new fintech entrants in networks offering new products and services, from originators to liquidity and digital custody providers.

“Cash on Ledger” is a “killer app” with this new technology enabling network participants maximize asset and capital efficiency through real time positions and managing the optimal deployment of risk, leverage, and capital. With today’s 97 zettabytes of data to harvest from the internet, doubling to an estimated 189 zettabytes by 2025 (up from 6. 5 zetabytes 10 years ago), the additional “rich data” to supplement asset price discovery will drive better risk adjusted asset pricing in networks and cannot be overlooked as a part of this symphony of digital asset tokenization.

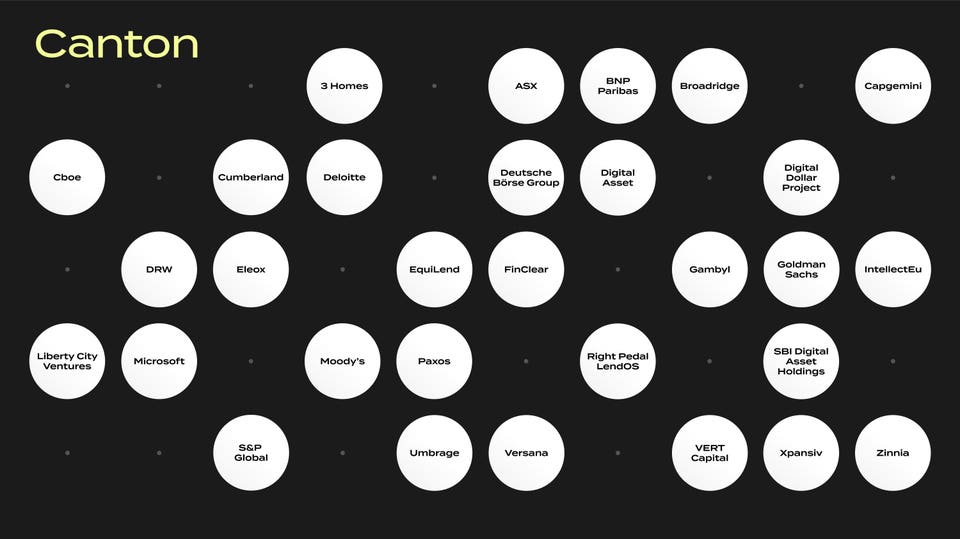

The Canton Network includes a growing list of who’s who of innovators: 3Homes, ASX, BNP Paribas, Broadridge, Capgemini, Cboe Global Markets, Cumberland, Deloitte, Deutsche Börse Group, Digital Assets, DRW, Eleox, EquiLend, FinClear, FCX, Gambyl, Goldman Sachs, IntellectEU, Liberty City Ventures, Microsoft, Paxos, Right Pedal LendOS, SBI Digital Asset Holdings, The Digital Dollar Project, Umbrage, Versana, VERT Capital, Xpansiv, and Zinnia. The network, an example of the diversity of both fintechs and traditional institutions, is underpinned by technology from Digital Asset, a New York-based technology company. Beyond serving as the network’s technology provider, Digital Asset exerts no more control over the network than any other participant, a hallmark of the constitution and governance of blockchain networks.

Yuval Rooz, Co-Founder and CEO at Digital Asset, says, “We are proud to be a founding participant of the Canton Network. For the first time, financial institutions can realize the full benefits of a global blockchain network while operating within the regulatory guardrails that ensure a safe, sound, and fair financial system. A Very Brief History Of Financial Services Technology For hundreds of years, markets and exchanges brought together buyers and sellers to transact everything from agricultural commodities, to shares in joint-stock companies.

Financial markets were automated on computers from the 1970s, electronically imitating paper certificates and money transactions, routing orders through a central exchange. Both distributed database and cryptography technologies are over 40 years old but were united in the computing intensive public blockchain Bitcoin Network, thanks to someone named Satoshi Nakamoto in 2009. Blockchain is the face that launched a thousand DLT projects, including Ethereum, and between the two of these protocols, make up the lion’s share of the public blockchain market.

Fast forward to today, and legacy capital markets infrastructure is being replaced by this next generation of digital technology. Distributed ledger technology, cryptography, smart contracts, machine learning and AI, decentralized applications, networks, and cloud computing are replacing legacy centralized technologies, and as importantly, the way that market participants engage with markets and with each other. The big benefit of distributed ledger technology, whether public or private, is the participation and strength of the nodes in network.

Larger networks of (known) regulated entities with strong balance sheets go some way to engendering security, privacy, and confidence in the financial system. These emerging decentralized finance networks are aligned to underpin decentralized economies by opening to greater participation in markets. Jens Hachmeister, Head of Issuer Services & New Digital Markets at Deutsche Börse Group says, “The Canton Network vision strives to enable seamless connectivity across various blockchain networks in the industry.

Such solutions are a key building block for future digital and distributed financial market infrastructures. ” Critics And Charlatans Are Vocal Blockchain is most popularly associated with cryptocurrencies – these tokens were the first and noisiest iteration of what the blockchain’s underlying distributed ledger technology makes possible. When “enterprise blockchain” became the hot topic for banking CxOs in late 2015, it only did so by overcoming bitcoin credibility issues like The Silk Road or the Mount Gox hack .

Cryptocurrencies and tokens on public blockchains continue to have limitations that are untenable for many regulated financial operators and the expectations of their customers or safekeeping, security and privacy. Then, just as today, many discussions about blockchain are clouded by false dichotomies that are not technological deficiencies or constraints and are often not relevant to real problems that financial institutions are trying to solve. This is not helped by a fragmented crypto industry that has failed to set minimum standards of conduct to align protections offered to retail customers in regulated financial markets.

The industry has attracted its share of unscrupulous and often messianic leaders. This is nowhere better evident than the collapse of FTX and the indictment of the virtue signaling Sam Bankman-Fried, a modern Faustian tragedy. Dogmatic debates about regulation are similarly off the mark.

Rather than ask whether new regulation is needed for a given technology (or whether a new technology makes regulation unnecessary, a highly unlikely probability), the point is that regulation is and should be, as Michael Barr, the Fed’s Vice Chair for Supervision, put it, “based on the principle of same risk, same activity, same regulation, regardless of the technology used for the activity. ” Critics of blockchain technology are widely spread across the community from technologists to policymakers and make many valid points about the deficiencies of public technologies and solutions and often speak of blockchain as some monolithic panacea claiming to heal all the ills of the financial system – “a solution looking for a problem”. Rather than debate what technology to use, the point is to determine how technology can be used to solve real problems faced by financial institutions and to focus on the value and utility provided by technology, all within regulatory constraints.

In “Innovation Theatre”, you must kiss a lot of frogs to find a prince, and the forces of creative destruction of blockchain and distributed ledger technologies appear to be at greater play than destructive creation. The fact that vast amounts of venture capital have been invested in DLT projects appears to be a conflation of the popularity of fast moving digital technology correlated to 40 years of cheap money. The empirical observation you can make is that there is a lot of smart money and a relatively small population of smart people in the blockchain ecosystem.

Historically, the beneficiaries of creative destruction are often those with deep pockets that can play the long game. While well capitalized leading blockchain companies continue to survive, evolve, grow, and compete, they are increasingly faced with two better capitalized constituents: central banks and financial institutions. With an estimated 100 central bank digital currency (CBDC) projects underway , 11 CBDCs launched, 18 in pilot – including the Central Bank of China, and projects being developed by the Bank of England, the European Central Bank, and the U.

S. Fed, these agencies, mainly independent of, but important to government, appear seriously committed to the future of DLT. The Canton Network was launched with 30 financial market participants to offer a third option to the public versus private blockchain dilemma, combining the advantages of both.

Any organization can participate in the network by running an application or node and connecting applications with others on the network but must meet the network’s stringent demands of participants retaining full sovereignty over their applications, and enabling user control over privacy and data, while supporting interoperability across the entire network. A Marathon Not A Sprint Those that do agree on the benefits of blockchain, and there are a lot of adults in this room, are focused on its potential to help transform the financial market infrastructure from the issuance of securities to their post-trade settlement. Connecting these bulkheads of financial market operations in ways not possible with the siloed legacy technology of today.

The big question is: How do we get there from here, and when are we going to arrive? Regulators, markets, and financial institutions are naturally, and understandably conservative about adopting new infrastructure that society critically depends on. It took until 1973 for the world’s banks to recognize that telex machines weren’t ideal for international payments to establish Swift, and another four years for the first message to be sent. Technology adoption is often complex, and blockchain adoption appears even more complex to both the casual and experienced observer.

As some financial institutions race ahead with adoption, others will have to connect with their competitors to trade products being issued via their platforms. In any event, the probability of greater future network participation on the supply side of financial services is high. The plans for the Canton Network, announced on May 9, 2023, include the commencement of the testing of interoperability capabilities across a range of applications and use cases from July 2023.

Following extensive testing, the network expects to make itself more widely available in 2024. Building the rails for the next generation of digital financial market infrastructure takes time – scaling doesn’t happen overnight, and nor should it. The adoption of blockchain in financial services is gaining greater momentum but proceeds incrementally.

Sound financial institutions are rarely ideological or dogmatic about technology, like they are about risk, capital efficiency, and liquidity, and that includes blockchain. Financial institutions and their networks will seek to apply blockchain-based solutions if, where, and when it is the best solution to a particular problem. Those in production today have pursued an incremental approach to realizing real-world benefits quickly and now have the foothold to forge new synchronized connections.

One this is for sure – the starting gun has fired for the race to institutionally scale blockchain. The race is on to build the decentralized networks that seek to carve out the competitive advantages of early innovation of future financial markets. Follow me on Twitter or LinkedIn .

Lawrence Wintermeyer Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/lawrencewintermeyer/2023/05/25/canton-network-launch-signals-the-tokenization-of-the-real-economy-has-arrived/