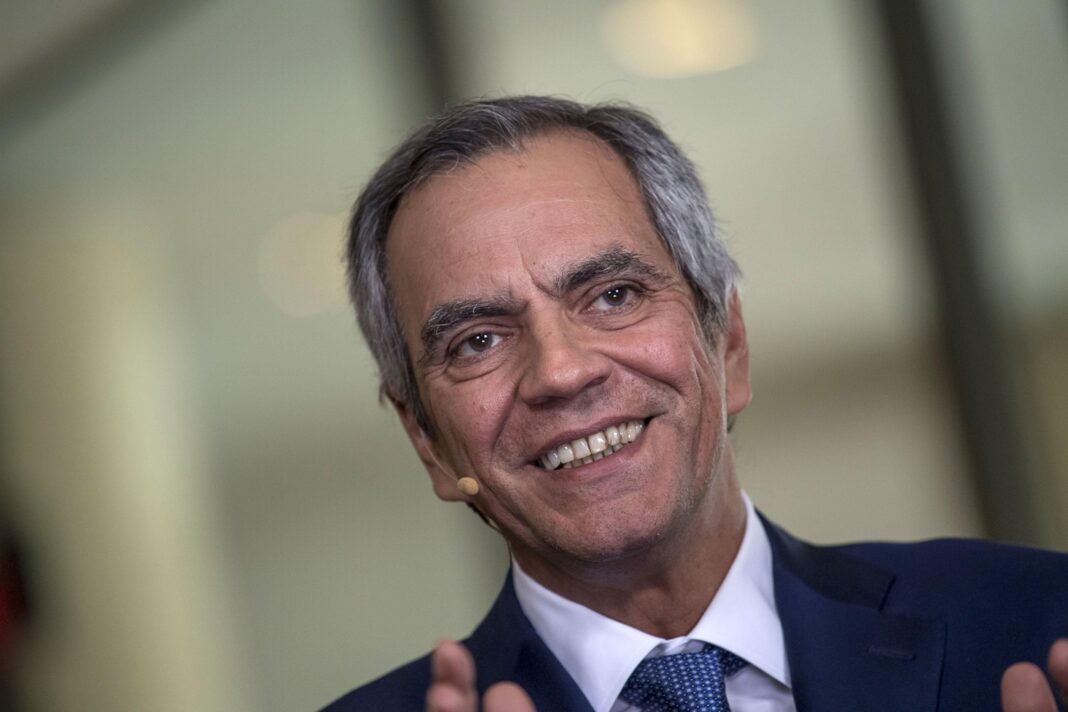

Asia Billionaire Enrique Razon’s Prime Infra To Raise Up To $518 Million From Philippine IPO Jonathan Burgos Forbes Staff New! Follow this author to improve your content experience. Got it! Jun 21, 2022, 11:30pm EDT | Share to Facebook Share to Twitter Share to Linkedin Billionaire Enrique Razon, chairman of International Container Terminal Services Inc. (ICTSI) and .

. . [+] Bloomberry Resorts Corp.

, speaks during a Bloomberg Television interview at the Milken Institute Global Conference in Beverly Hills, California, U. S. , on Monday, May 1, 2017.

The conference is a unique setting that convenes individuals with the capital, power and influence to move the world forward meet face-to-face with those whose expertise and creativity are reinventing industry, philanthropy and media. Photographer: David Paul Morris/Bloomberg © 2017 Bloomberg Finance LP Prime Infrastructure Capital —controlled by billionaire Enrique Razon, Jr. —is raising as much as 28.

2 billion pesos ($518 million) in an initial public offering on the Philippine Stock Exchange in October to bankroll investments in renewable energy and water utilities. The company plans to sell as much as 1. 94 billion shares (including an overallotment option of up to 175.

6 million shares) at a maximum price of 14. 60 pesos each, according to the IPO prospectus it submitted to the Securities and Exchange Commission on Tuesday. The IPO—which is being handled by CLSA as global coordinator and bookrunner, and by BDO Capital and BPI Capital as domestic underwriters—comes as Prime Infra steps up investments in renewable energy and water utilities.

Prime Infra had earlier this month announced plans to build the world’s biggest solar farm in partnership with Solar Philippines—which was founded by businessman Leandro Leviste, a Forbes 30 Under 30 alumnus—and at the same time acquire a controlling interest in the Malampaya gas project in the West Philippine Sea from Davao-based tycoon Dennis Uy. The company will proceed with the maiden share sale if market sentiment is favorable, Razon told Bloomberg, which previously reported the IPO plans. Recent domestic listings have faced headwinds amid mounting inflationary pressures and soaring interest rates.

Meat supplier North Star Meat Merchants deferred its IPO due to market volatility, while shares of Vista REIT—controlled by Razon’s fellow billionaire Manuel Villar —slipped on its first trading day last week even after the commercial landlord reduced the size and price of the offering. MORE FOR YOU China Detains Fallen HNA Ex-Billionaire Chairman Ahead Of Airline Restructuring Vote Nasdaq Listing Of Freshworks Creates Windfall For Indian Founder And Hundreds Of Employees Ninja Van Becomes Singapore’s Newest Unicorn After Raising $578 Million From Alibaba, B Capital Besides solar energy, Razon through Prime Infra has been investing in hydropower plants and water utilities in recent years. In June 2021, Trident Water, a subsidiary of his infrastructure-focused Prime Strategic Holdings, took control of water utility Manila Water from Ayala Corp.

Razon is also the controlling shareholder of global port giant International Container Terminal Services Inc. and Bloomberry Resorts, operator of the Solaire Resort and Casino in Manila. Razon has a net worth of $5.

7 billion, according to Forbes ’ real-time data . Send me a secure tip . Jonathan Burgos Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/jonathanburgos/2022/06/21/billionaire-enrique-razons-prime-infra-to-raise-up-to-518-million-from-philippine-ipo/