We normally just cover plugin vehicle sales here on CleanTechnica , and just full battery electric (BEV) sales for the US market. And I’ll have a new US EV sales report out soon. However, there’s no denying that hybrid vehicles are significantly more fuel efficient than gas-powered and diesel-powered vehicles, and thus help cut CO2 emissions and other pollution if they replace those fossil-powered options.

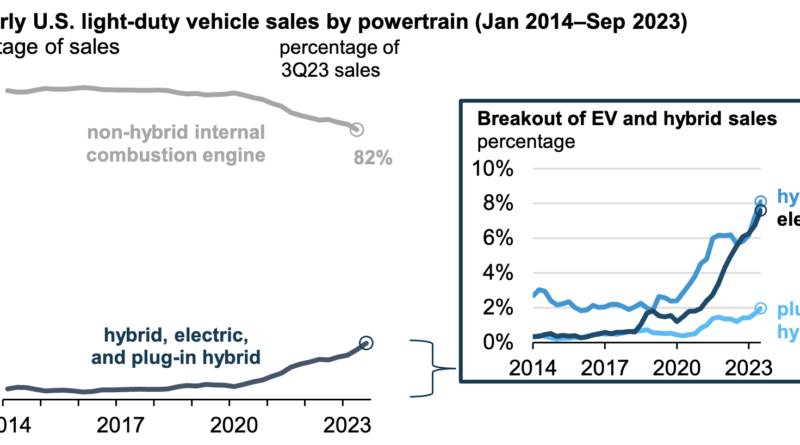

So, it’s good to see an update from the U. S. Energy Information Administration (EIA) showing that combined electric vehicle and hybrid vehicle sales are up to a record-high 18% of the US new vehicle market.

“Sales of hybrid, plug-in hybrid, and battery-electric vehicles (BEV) in the United States rose to 17. 7% of new light-duty vehicle sales in third-quarter 2023, according to data from Wards Intelligence. Sales of hybrids, plug-in hybrids, and BEVs have accounted for 16.

0% of all new light-duty vehicle sales in the United States so far this year, compared with 12. 5% in 2022 and 9. 0% in 2021,” the EIA writes.

“The share of total light-duty vehicle sales for hybrids, plug-in hybrids, and BEVs rose due to both a decline in sales of non-hybrid gasoline- and diesel-fueled vehicles as well as an increase in sales of several existing BEV models. BEV prices declined across the most popular models, contributing to the rise in third-quarter sales. The average transaction price for BEVs dropped 5% during the third quarter to $50,283, bringing the price 24% lower than at the price peak in the second quarter of 2022.

The average price paid for all light-duty vehicles fell less than 0. 5% during that same time. BEV prices are now within $3,000 of the overall industry average transaction price for light-duty vehicles.

” The EIA also highlights that BEV prices tend toward the higher end of the market — a surprise to no one. What actually surprised me was how close BEV prices actually were to the overall auto industry average. The average BEV price is nearly down to the overall average.

(It’s also interesting that the average new hybrid costs well below the average new vehicle. ) Nonetheless, “BEV sales continue to be concentrated in the luxury category, growing to 34% of the total luxury vehicle market in the third quarter but remaining below 2% of the non-luxury vehicle market. As a share of sales within each powertrain type, vehicle sales classified as luxury accounted for 83% of all BEV sales and 13% of non-hybrid gasoline- or diesel-fueled engine vehicles, compared with 19% of the total light-duty vehicle market.

This breakdown aligns with the current slate of BEV models offered by manufacturers: more than two-thirds are classified as luxury vehicles by Wards Intelligence. ” So, clearly, BEVs are predominantly in the luxury classes, but more heavily in the lower end of the luxury market. Stay tuned — perhaps will see some notably shifts to the other side of the market before the decade is up! Click to download .

LinkedIn WhatsApp Facebook X Email Mastodon Reddit.

From: cleantechnica

URL: https://cleantechnica.com/2023/12/01/electric-vehicles-hybrids-18-of-us-new-vehicle-market/