Breaking Business Nasdaq Hits 2-Year Low As JPMorgan Billionaire Warns It Could Take Months For Stock Market To Bottom Derek Saul Forbes Staff I cover breaking news with a focus on markets and sports business. Following New! Follow this author to stay notified about their latest stories. Got it! Oct 10, 2022, 03:03pm EDT | Updated Oct 10, 2022, 04:02pm EDT Share to Facebook Share to Twitter Share to Linkedin Topline Major stock indices reached or neared multiyear lows Monday as the market continues to tank, and the head of the largest bank in the U.

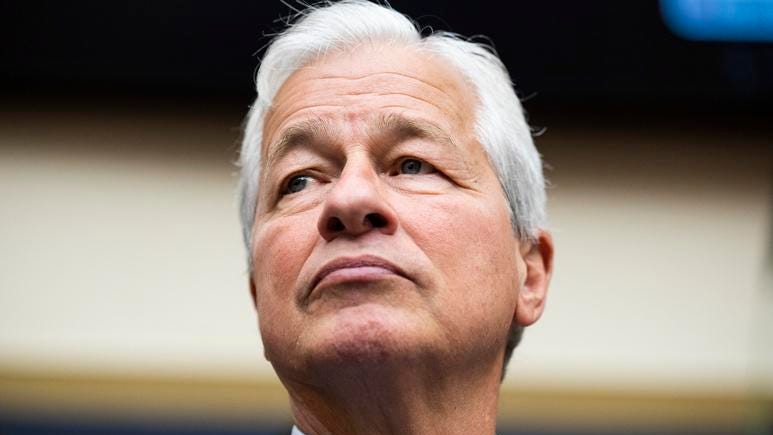

S. said the worst may still be on the horizon for stocks and the economy, outlining how a forthcoming recession may play out. JPMorgan Chase CEO Jamie Dimon says the U.

S. will probably fall into a recession in the next nine . .

. [+] months. CQ-Roll Call, Inc via Getty Images Key Facts The tech-heavy Nasdaq slipped as much as 1.

9% to 10,449 points Monday afternoon—hitting its lowest level since September 3, 2020. The S&P 500 came just six points from hitting its lowest level since November, falling 0. 8%, while the Dow Jones Industrial Average fell 0.

3%. It’s the fourth straight day of losses for each index as investors fear the worst for stocks as the Federal Reserve sticks by its aggressive monetary policy. Even still, JPMorgan Chase CEO Dimon told CNBC Monday the economy is “actually still doing well,” but the rate hikes, sticky inflation and sociopolitical uncertainty are “likely to put the U.

S. in some kind of recession six to nine months from now. ” Dimon also predicted the S&P, which is down 25% year-to-date, could fall “another easy 20%,” putting the index at about 2,900.

That decline is at the high end of banks’ predictions, with Goldman Sachs predicting the S&P would end the year at 3,600, a less than 1% decline, while Morgan Stanley projects the index would bottom out between 3,000 and 3,400. Big Number 33%. That’s how much the Nasdaq is down this year, on pace for its biggest loss since 2008.

The Dow is down 20%, which would also be its worst performance since 2008. Key Background The U. S.

economy is actually already technically in a recession according to one popular marker, with its gross domestic product declining over the last two quarters. The Dollar Index, which measures the dollar against a weighted basket of six global currencies, has surged about 20% year-to-date to its highest level in two decades as investors pack into the safe asset. The Dow rose 5% last Monday and Tuesday as the market traded on hopes the Fed would back off of its most aggressive plans, but pared gains after several important data points indicated more rate hikes are on the way, including a falling unemployment rate.

Further Reading Recession Watch: Bear Market Deepens As Fed Official Warns Rate Hikes Will Trigger ‘Failures’ Around Global Economy ( Forbes ) ‘Real Danger’ Of Global Recession Intensifies As Rate Hikes Threaten $4 Trillion In Economic Losses, World Bank Warns ( Forbes ) ‘This is serious’: JPMorgan’s Jamie Dimon warns U. S. likely to tip into recession in 6 to 9 months (CNBC) A Better-Than-Expected Jobs Report Causes Markets To Plummet: Here’s Why ( Forbes ) Follow me on Twitter .

Send me a secure tip . Derek Saul Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/dereksaul/2022/10/10/nasdaq-hits-2-year-low-as-jpmorgan-billionaire-warns-it-could-take-months-for-stock-market-to-bottom/