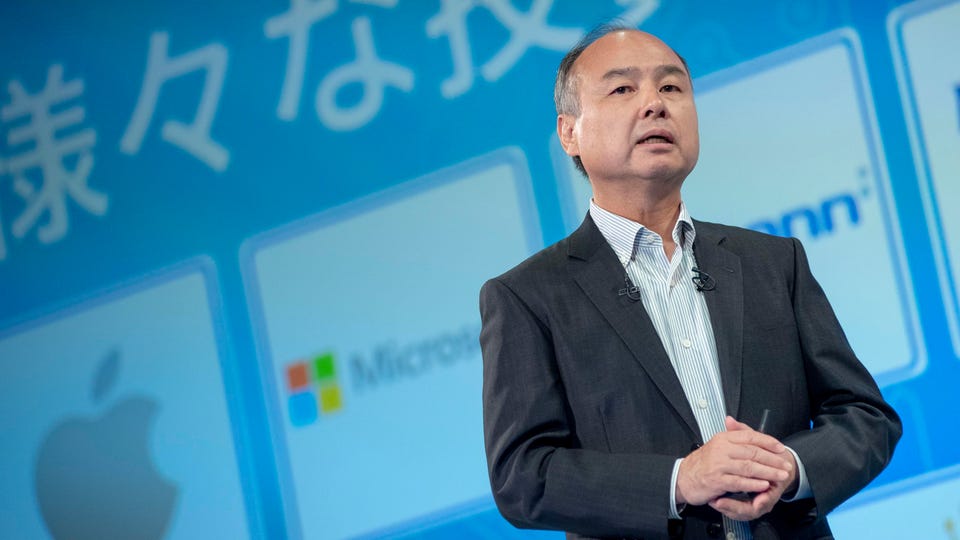

Billionaire Masayoshi Son ’s SoftBank Group is expecting to post a $34 billion gain by cutting its stake in Chinese e-commerce giant Alibaba by more than one-third, as the Japanese conglomerate continues to unwind its most successful investment to date to bolster its coffers amid the uncertainty of China’s regulatory crackdown. In a statement released on Wednesday, SoftBank said its board had approved the early physical settlement of prepaid forward contracts corresponding to roughly 242 million of Alibaba’s American Depository Receipts. The derivative sale will take place from mid-August to end of September, and SoftBank’s ownership in the Chinese company will subsequently be reduced to 14.

6% from 23. 7%. The move confirms earlier reports that SoftBank was intending to sell down its Alibaba stake through a series of complex derivative transactions.

It also marks another turning point in the relationship between Son and Alibaba’s cofounder Jack Ma , after the two billionaires stepped down from each other’s boards in 2020. SoftBank had previously cut its Alibaba stake in 2016 that resulted in a realized gain of $7. 9 billion.

“It [the $34 billion sale] could be a signal that SoftBank expects global tech has a lot further to fall and that is certainly an idea that has gained traction in some quarters as interest rates rise,” writes Kirk Boodry, an analyst who publishes via research platform Smartkarma. “Or management concerns may be China-specific as a combination of regulatory action, economic weakness and Covid uncertainty leaves a lot outside of SoftBank’s control. ” The Japanese company, which made its first investment of $20 million in Alibaba in 2000, said in its statement that it would “continue to maintain a good relationship with Alibaba.

” But the New York-listed shares in the Chinese company have lost more than 70% of value from its peak in October 2020, as Beijing remains intent on reining in the market influence of the tech titans and has slapped Alibaba with a record $2. 8 billion anti-trust fine in 2021. Growth, in the meantime, has all but been vanquished, and the e-commerce platform reported zero year-over-year gain in revenue for the June quarter amid lockdowns and China’s sluggish economic conditions.

SoftBank, for its part, is seeking to shore up its cashflow amid what it describes as a “challenging” equity market. Son has said this week that the Japanese conglomerate and its Vision Fund investment arm are planning widespread cost-cutting measures after posting a record $23. 4 billion loss.

The billionaire blamed this on foreign exchange losses and a markdown in the value of its holdings in companies such as Coupang, DoorDash and SenseTime Group. “By settling these contracts early, SBG (SoftBank Group) will be able to eliminate concerns about future cash outflows, and furthermore, reduce costs associated with these prepaid forward contracts,” the company wrote in its statement. “These will further strengthen our defense against the severe market environment.

”.

From: forbes

URL: https://www.forbes.com/sites/ywang/2022/08/11/softbank-to-gain-34-billion-by-cutting-one-third-of-alibaba-stake/