Forbes Money Markets Today’s Monetary And Fiscal Policies Are Incompatible Robert Barone Contributor Great Speculations Contributor Group Opinions expressed by Forbes Contributors are their own. Following Aug 12, 2023, 09:17pm EDT | Press play to listen to this article! Got it! Share to Facebook Share to Twitter Share to Linkedin Deficits, GDP & Inflation Real Investment Advice While monetary policy (the Fed) is working hard to slow the economy and control inflation, the fiscal authority (the Treasury and the Administration) is doing the opposite. According to the Wall Street Journal (“ A Peacetime Fiscal Blowout ” – August 9 th ), the largest expense line item increase in the federal budget was interest on the debt.

For fiscal ’23, it has risen by $146 billion (34%) to $572 billion and is likely to rise to near $675 billion before the fiscal year ends on September 30. That’s nearly half the federal budget. Even if the budget became balanced, interest expenses are only going to rise as the Treasury refinances the low-cost existing debt as it matures over the next few years.

This is true, not only for the federal government, but for state and local government entities and for most of America’s publicly traded companies. Those significantly higher debt costs are sure to slow economic growth, if not kill it altogether. Such growth is already challenged by demographics (retiring baby boomers).

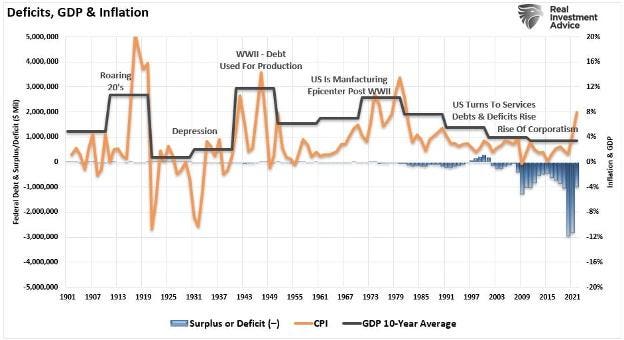

Note on the chart at the top that out-of-control deficits (blue bars) didn’t occur until the Great Recession in 2009, but, unlike in the past, they didn’t stop once the economy healed. Then came the pandemic and two years of real blowout deficits. Note the spike in inflation (gold line) during that time.

Apparently, inflation was the price to pay for all that largesse and free money! But, despite an economy where folks in Washington D. C. are patting themselves on the back because they think the economy will have a “soft-landing,” the deficits now appear to be on automatic and completely out of control.

The chart below shows federal interest payments as a percentage of nominal GDP since 1947. Note the recent spike on the far-right hand side. This is only going to get worse.

US Federal Government Interest Payments as % of Nominal GDP Charlie Bilello, Mauldin Economics The U. S. budget deficit is now 6% of GDP and interest payments, as shown on the chart, are 3.

6% of nominal GDP. This is occurring at a time when the Unemployment Rate (U3) is 3. 5%.

Economists agree that an unemployment rate of 4% represents “full-employment”. In Econ 101, students are taught that fiscal policy should be counter-cyclical, meaning that when the economy is at full-employment (4% or lower) there shouldn’t be a deficit – perhaps, even a surplus. But, as you can see from the chart at the top, it’s been quite a while since we have had a budget surplus.

On August 22 nd , a new currency unit sponsored by China, Russia, Brazil, India etc. , 100% backed by gold, will debut. (No wonder China has been stockpiling gold for the past year!) With the U.

S running banana republic-like deficits, we wonder how long before the world adopts the new currency as its reserve currency. There doesn’t have to be a declaration of such – it will happen when self-interest seeking parties decide that the new currency is “safer” than the dollar. May happen sooner than expected! MORE FOR YOU WWE SmackDown Results: Winners And Grades As Jey Uso Quits WWE No, Zoom Is Not Stealing Your Data.

Here’s Why. Ukrainian Tanks Are In Urozhaine—And Inching Toward Mariupol Inflation Adieu In our last few blogs, we indicated that the July rate of inflation (on a year over year basis) was going to rise above June’ 3. 0% rate.

So, July’s 3. 3% inflation rate didn’t surprise us. Since the Fed seems to be wed to the 12-month lookback in determining policy, there is now a danger that, at their September meeting, they raise rates again based on both the July and August CPI readings as August’s reading will likely remain in that 3.

3% range – so there will have been no progress at all from June’s 3. 0% level. (SF Fed President Mary Daly recently said that “there is more work to do.

”) The good news is that, going forward, inflation will fall below 3%. Indeed, if inflation continues at the +0. 2% month over month rate of June and July, the annual rate that the Fed watches will fall to 2.

8% by year’s end and 2. 4% by mid-2024. And, if inflation falls to +0.

1%/month, then the annual inflation rates for this December and next June will have fallen to 2. 3% and 1. 3% respectively.

CPI ex Shelter YoY Universal Value Advisors If we omitted the shelter component of the CPI (see chart), the year over year CPI index would be under +2%. If we substituted the Apartment List Index (current market behavior) for the BLS’s antiquated methodology in calculating shelter costs (a 30% weight in the CPI calculation), the year over year CPI index would be near zero. [Note: The lagged values of Shelter and Owners’ Equivalent Rent (which comprises the BLS’s housing cost calculation in the CPI) rose +0.

4% and +0. 5% respectively in July, while the Apartment List July Index was -0. 7%.

] Core CPI (ex-food and energy) and an important index for the Fed, rose +0. 2% (+0. 16% to the second decimal) in July.

Setting shelter costs at 0% (instead of using the Apartment List Index of -0. 7%), Rosenberg Research calculated that the month-over-month “core” CPI (ex-food and energy) would have been -0. 1%.

(Inflation is truly melting!) In July, prices fell for airline tickets, at restaurants, and at hotels/motels. Prices were also lower for delivery services, used cars, and even for medical services. As Economist David Rosenberg quipped a couple weeks ago: “Memo to Jay Powell: mission accomplished!” On Friday (August 11), the Producer Price Index (PPI) for July showed up a little hot at +0.

3% (markets were expecting +0. 2%). As a comparison, June’s PPI was -0.

1%. Market didn’t like it, but what nobody talked about was the low +0. 8% year over year reading of the PPI’s “core” (ex-food and energy) index.

Tighter Lending Standards Tighter Lending Standards and C&I Loans Federal Reserve, Capital Economics In our last blog we discussed rising loan delinquencies. This is true for the consumer in the auto and credit card space. Since the March Regional Bank fiascos, one can see from the right-hand portion of the chart above how rapidly banks have tightened their lending standards for business loans and the resulting fall in lending now occurring in the commercial loan space.

This loan contraction process is in its infancy and will only lead to much slower economic growth if not outright Recession. Composition of Consumer Debt New York Fed Consumer Credit Panel/Equifax Consumer Debt and Student Loans The composition of consumer debt is also interesting. The chart above shows that 70% of consumer debt is mortgage related, and, with high mortgage rates (7%), this will put an increasing burden on borrowers with new mortgages, resulting in less of their income available for consumption.

The last large category on the chart is student loan debt. Most of this debt is in the younger age groups which are the age groups with the highest auto and credit card delinquencies. Student loans now comprise 9% of total consumer debt.

For the last 2+ years, there has been a moratorium on student loan payments. That ends in October, and those former students will have to resume (or start) making payments. We do expect a rise in delinquencies, but, for most, making that payment will erode their ability to consume, clearly not good for economic growth.

Credit card debt recently hit an all-time high of more than $1 trillion as consumers have attempted to maintain their living standards. Delinquencies, however, are on the rise. On credit cards, delinquencies of 90+ days are now 8.

5% of total outstanding balances, the highest level since early 2020 during the Covid lockdowns. The delinquency rate on this category was 5. 9% a year ago.

The story is similar for autos. 30-day delinquencies are now 7. 3% vs.

5. 6% in Q2’22. Credit Card Debt Hits $1T yahoo finance Housing Existing home sales and mortgage applications have tanked.

Mortgage apps fell for the third straight week (down -3. 1% the week of August 6 th ). Those applications are below the lows of the past three Recessions.

Existing home sales have fallen -20% vs. a year ago. Basically, households have 3% mortgages, and with current rates at 7%, no one is selling.

Exiting Home Sales; Mortgage Loan Applications Index Universal Value Advisors Employment It is true that the Unemployment Rate (U3) fell from 3. 6% in June to 3. 5% in July.

But this didn’t occur because of strong job growth. It happened because the Labor Force Participation Rate declined. In the monthly Household Survey (HS), the Bureau of Labor Statistics (BLS) counts full-time and part-time jobs as equal, i.

e. , they are both counted as one whole job. In July’s HS, employment growth was reported as +268k.

When we parse this, we find that full-time jobs fell by -585k, while part-time jobs increased +853k. Since these each count as a whole job, the result is +268k. Our view is that if part-time jobs should be counted as half (.

5), and if they were, then, on net, the job count would have been a loss of -158k. Rosenberg Research noted that over the four months ended in July, full time jobs fell -65k while part-time expanded +406k. As noted in our last blog, the workweek declined in July and BLS revised May and June payrolls down by -46k.

All of these are symptoms of a labor market that is weakening rapidly. We expect the U3 unemployment rate to rise above 4% over the next couple of quarters. The Fed would like that too, but they can’t say so for political reasons.

Final Thoughts In our last blog, we discussed the lags between the Fed raising rates and its impact on the economy. To reiterate: The Fed considers 2. 5% to be the “neutral” rate (policy is neither tight nor loose).

The Fed raised the Fed Funds rate to 2. 5% in late July, 2022. If the lag between action by the Fed and reaction in the economy is 12 months, then monetary policy reached “neutral” late last month (July 2023).

(So, the +2. 4% rise in real GDP for Q2 shouldn’t be a surprise. ) The Fed Funds rate today sits at 5.

25%, 275 basis points (2. 75 percentage points) above neutral. We believe that inflation will be a non-issue by year’s end, and if not then, then definitely by the middle of 2024.

Going forward, using the 12-month lag for monetary policy, effective interest rates will rise way above the 2. 5% neutral level, and that means they will bite, and bite hard. Already we see banks constricting credit (the lifeblood of the economy), consumer delinquencies on the rise, and we think it is a sure bet that the upcoming restart of student loan payments will crimp consumption.

We see a struggling housing market, a labor market that is rapidly cooling and, we believe, we will soon see a rising unemployment rate. Add to this the uncertainty over the Fed’s next move, but the certainty that we won’t see any rate relief until the horse has left the barn. As a result, we remain in the “Recession” as opposed to the “Soft-Landing” camp.

( Joshua Barone and Eugene Hoover contributed to this blog ) Follow me on Twitter . Check out my website . Robert Barone Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/greatspeculations/2023/08/12/todays-monetary-and-fiscal-policies-are-incompatible/