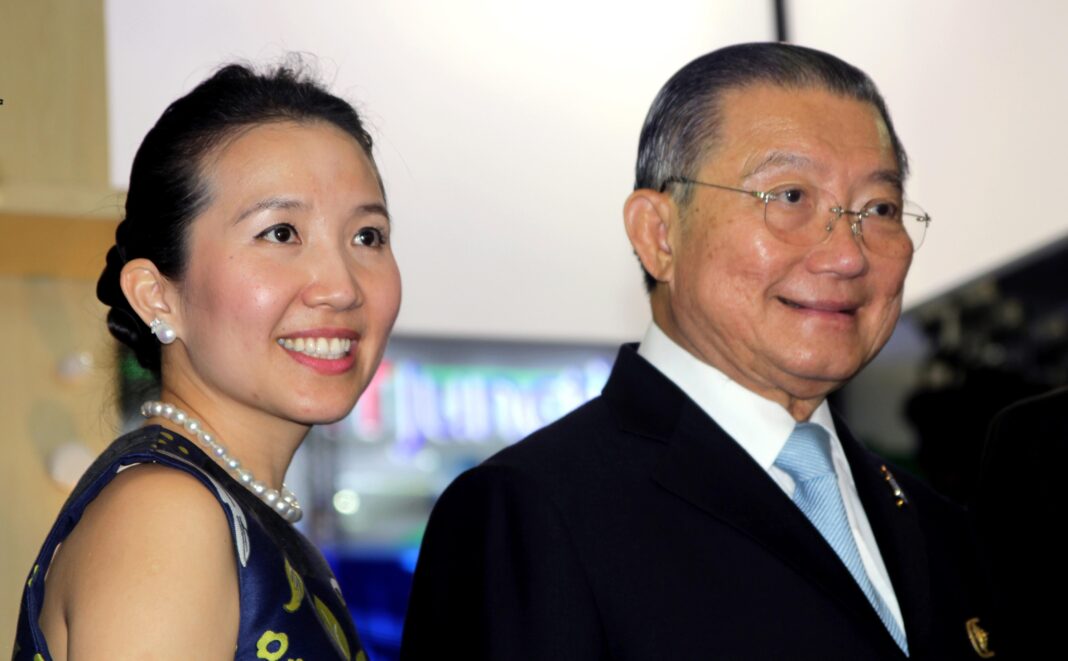

Asia Tycoon Charoen Sirivadhanabhakdi’s Frasers Property To Buyout Hotel REIT In Deal Valued At $970 Million Jonathan Burgos Forbes Staff Jun 14, 2022, 02:15am EDT | Share to Facebook Share to Twitter Share to Linkedin Charoen Sirivadhanabhakdi, chairman of Thai Beverage, appears with his daughter Wallapa . . .

[+] Sirivadhanabhakdi during the relaunch ceremony of Pantip Plaza IT Shopping Mall in Bangkok. Piti A Sahakorn/LightRocket via Getty Images Frasers Property —controlled by Thai billionaire Charoen Sirivadhanabhakdi— has offered to buy Frasers Hospitality Trust (FHT) in a deal valuing the Singapore-listed real estate investment trust at S$1. 35 billion ($970 million).

The offer comes as Frasers Hospitality—which manages 14 hotels and serviced residences with more than 2,600 rooms across key gateway cities in Asia, Australia and Europe—faces headwinds brought on by the Covid-19 pandemic that has upended the travel and tourism industry in the past two years. Despite improvements in occupancy levels, revenue per available room at its properties are still well below pre-pandemic levels, according to FHT. Under the deal, which is subject to regulatory approvals, Frasers Property is offering to buy the rest of the REIT that it doesn’t own at S$0.

70 per share, the real estate giant said in a regulatory filing on Monday. The Singapore-listed developer currently owns 25. 8% of FHT, while Charoen’s TCC Group holds another 36.

7% with minority investors owning the rest. “Following our proactive strategic review to unlock value for our stapled securityholders and having considered the long-term challenges facing FHT, we believe that the proposed trust scheme is the best option and represents a credible opportunity for our stapled securityholders to realize their investments at an attractive valuation,” Eu Chin Fen, CEO of FHT managers, said in a statement. While the hospitality business environment is improving as governments around the world relax Covid-19 travel restrictions, uncertainties arising from the ongoing pandemic and geopolitical tensions following Russia’s invasion of Ukraine prevail.

“We anticipate the recovery trajectory to remain bumpy due to headwinds from inflationary pressures as a result of continued supply chain disruptions, rising energy, commodity and labor costs, leading to the potential risk of an economic slowdown,” Eu said in April as FHT announced its first half results ending March 31. MORE FOR YOU China Detains Fallen HNA Ex-Billionaire Chairman Ahead Of Airline Restructuring Vote Nasdaq Listing Of Freshworks Creates Windfall For Indian Founder And Hundreds Of Employees Ninja Van Becomes Singapore’s Newest Unicorn After Raising $578 Million From Alibaba, B Capital Frasers Property said its buyout of FHT will help the group optimize the value of its hospitality assets. “This transaction will allow FPL Group to increase its investment in hospitality assets at locations that we are already familiar with,” Loo Choo Leong, FPL Group’s chief financial officer, said.

“As with all assets in our investment portfolio, FPL Group will leverage our deep understanding of FHT’s assets and adopt a rigorous and disciplined approach to drive performance. ” Charoen, 78, took control of Frasers Property—which owns about S$40 billion in residential, commercial, retail, logistics and hospitality assets across Australia, China, Europe and Southeast Asia—following his successful takeover of Fraser & Neave in 2013. He is also the controlling shareholder of Chang beer maker Thai Beverages and Bangkok-based hotel developer Asset World Corp.

With a net worth of $12. 7 billion, the self-made billionaire was ranked No. 3 when the list of Thailand’s 50 Richest was published in June last year.

Send me a secure tip . Jonathan Burgos Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/jonathanburgos/2022/06/14/tycoon-charoen-sirivadhanabhakdis-frasers-property-to-buyout-hotel-reit-in-deal-valued-at-970-million/