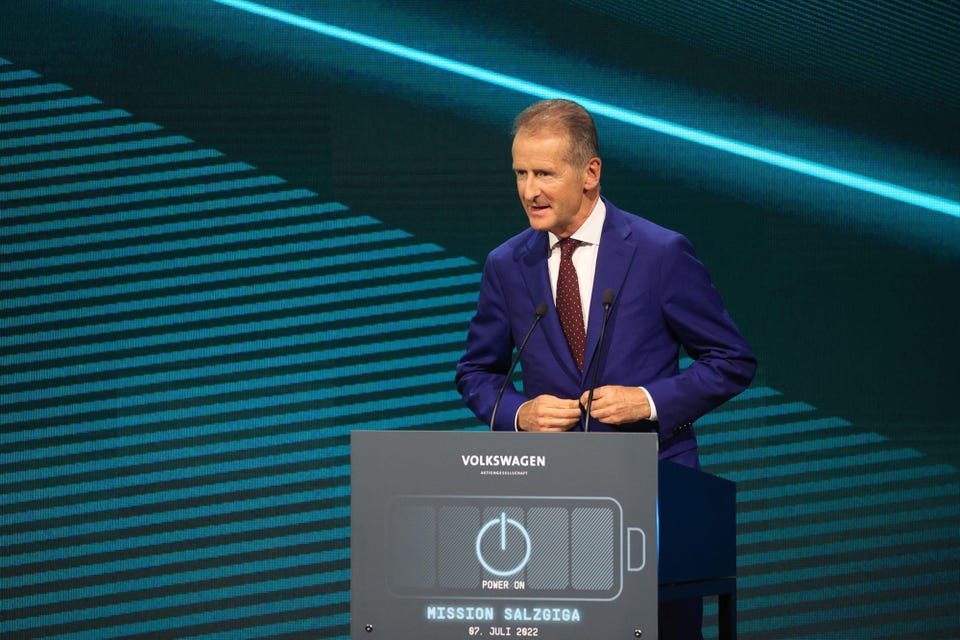

Transportation VW’s Diess Goes, As Flawed Governance Foils Another Leader Neil Winton Senior Contributor Opinions expressed by Forbes Contributors are their own. New! Follow this author to improve your content experience. Got it! Jul 24, 2022, 08:31am EDT | New! Click on the conversation bubble to join the conversation Got it! Share to Facebook Share to Twitter Share to Linkedin Herbert Diess, chief executive officer of Volkswagen AG, who is leaving at the end of August.

. . .

[+] Photographer: Krisztian Bocsi/Bloomberg © 2022 Bloomberg Finance LP A software spat probably triggered the demise of Volkswagen group CEO Herbert Diess but he was ultimately the victim of the weird and unwieldy management structure which allows politicians and unions a veto over strategic decisions. It was only a matter of time. Diess had enraged the powerful engineering workers union with his aggression.

They didn’t like his talk about the need to shed tens of thousands of jobs as VW chased Tesla TSLA for electric car leadership, while he expressed admiration for the swashbuckling and anti-union Elon Musk. Because of the antagonistic relationship between VW managers and the board, investors have probably already started the clock to measure the tenure of Diess’s replacement , Oliver Blume, leader of the Porsche subsidiary. Blume’s whisky and pistol moment will also come unexpectedly no doubt, probably quite soon after VW renews his contract.

A year ago, VW extended Diess’s contract until 2025. Other subsidiaries of Volkswagen include the VW brand, Audi, Skoda, SEAT, Bentley and Lamborghini. Big tasks for Blume will be how to develop software – should it be in-house or contracted out – and the struggling businesses in China and the U.

S. VW is controlled by a 20-seat supervisory board where unions control half the votes and two politicians from the state of Lower Saxony often vote with labor. For decades investors have backed off dabbling in VW shares because the clunky management structure has blocked many attempts to turn VW into a normal corporation where profit-conscious shareholders call the shots.

MORE FOR YOU Tesla Challenger Polestar Powers Up With Nasdaq Listing Plan Valuing It At $20 Billion Driver Killed By His Own Car Door While Waiting In Line At Fast-Food Drive-Thru, Providing Cautionary Insights For AI Self-Driving Cars Tesla Cofounder’s Recycling Startup Plans To Become EV Battery Material Powerhouse Diess has been in control at VW since 2018 after being hired from BMW. VW needed an outsider who wasn’t tainted by the “dieselgate” emissions scandal. Diess aggravated unions with his expressed desire to streamline VW output along Tesla lines and cut 30,000 jobs in Germany.

Diess also said it took about 30 hours for VW to make an electric car, compared with 10 hours at Tesla, a figure the union disputes. VW hopes a Porsche stake float later this year will help fund its €50 billion plus ($51 billion) electrification plans. VW didn’t offer any reasons for the Diess departure, which reportedly came after Porsche-Piech family shareholders called a meeting to discuss his future.

Investors said it might be linked to worries about the software problem. VW’s Cariad software subsidiary was set up in 2020 to coordinate software development as the company cranked up accelerating electric car development. Recent setbacks had cast a shadow over plans to develop a single software platform for VW brand’s next generation Trinity EV project in 2026.

But there had been no hint it might be serious enough to end the Diess regime. A common complaint, according to VW owner’s websites, has been poor quality software in its first electric car, the ID. 3 “The hope of the supervisory board must be for new group CEO Blume to have more success in guiding the software strategy of the group.

However, it will take months to come up with a new plan and creating unrest as the group is heading into a challenging 2023 is the wrong time in our view,” said Bernstein Research, in a report headed “Volkswagen is making a bad governance situation even worse – Blume is now part-time CEO for VW and Porsche”. Professor Ferdinand Dudenhoeffer, director of Germany’s Center for Automotive Research (CAR AR ) said software would be Blume’s most urgent task. “I think a big issue will be the realignment of the software strategy.

Cariad will not remain as it was. The plan to do everything independently and centrally should be reconsidered. Cooperation and the individual brands will become more important.

Whether there will be a central VW Group operating system for vehicles of all brands seems less realistic. In my opinion, the failures of the one-size-fits-all solution and the resistance from the individual brands will lead to a general rethink. What Cariad’s role will be in the future is unclear,” Dudenhoeffer said.

Herbert Diess, chief executive officer of Volkswagen AG, speaks via video link alongside a VW ID . . .

[+] Buzz electric microbus in Doha, Qatar. Photographer: Christopher Pike/Bloomberg © 2022 Bloomberg Finance LP Some investors claim to have seen some uncertainty surrounding Diess’s position. “We had initially been impressed by Dr Diess’ strategic vision and the aggressive repositioning of the group on EVs and we saw operational progress during his tenure.

However, we feel he did not transform his grasp of the challenges and his ability to engage with investors to effect internal change at VW and he alienated key VW constituents. At this stage, it looks like VW has fallen behind in some key developments – sales, software implementation – while the strategy remains capital-intensive, including M&A and vertical integration of batteries,” investment researcher Jefferies said in a report. Media reports said the hugely expensive program to switch to electric power might have been seen as overly ambitious.

Others said VW’s massive business in China wasn’t performing well enough. VW has said 70% of its sales in Europe by 2030 will be battery electric. VW has been praised for the strength of its electric commitment, but there are worries that when EU CO2 rules make small internal combustion engine (ICE) powered vehicles unaffordable, VW, and other mass car makers in Europe, are ill-prepared for the provision of cheap electric runabouts.

This is an open door for Chinese companies to devastate up to half of European car sales. VW has been jostling with Toyota of Japan for global auto sales leadership. Last year Toyota led the sales charts easily with 10.

5 million sales. VW was 2nd with 8. 9 million, although in normal times the tallies likely would have been much closer.

But the key fact here is Toyota does this with roughly half the workforce at VW. VW’s market share in the first half of 2022 was 23. 8% in Western Europe in 1 st place, down from 25.

3% in 2021, on sales of 1. 2 million Meanwhile, in 2022, VW shares performed poorly. VW preferred shares hit about €193 in January and have fallen about 30% to just over €134 Friday.

Over the same period the STOXX 600 Europe Auto index has fallen about 24%. CAR’s Dudenhoeffer expects Blume to maintain the VW electric plan, although he might allow individual brands like Audi or Porsche to pursue different cell structure solutions. China and the U.

S. have presented problems to be addressed. “Blume will be measured by how successful the VW group will be in China.

In the last two years, there has been a clear loss of market share. That has to be fixed and should be one of the really big challenges for Blume and his team. And then comes the eternal problem USA.

Since the days of the Beetle, VW hasn’t done anything sensible in the USA. VW needs a strong market position in the USA. Blume will therefore continue the Scout strategy and win the U.

S. market with the electric pick-up. In principle, this is also the continuation of the Diess strategy,” Dudenhoeffer said.

VW Beetle getty VW recently set up Scout in the U. S. to build electric pickup trucks and sport utility vehicles.

Jefferies is getting tired of governance problems but sees some hope in a new beginning. “A new dawn, again, for VW Preference shares? We have been here before, with new management or a crisis bringing hopes of change. Nevertheless with industry challenges accelerating and a growing number of new and fast-follower challengers, new management offers an opportunity to revisit strategy or jump-start stalled relationships with a leader well versed in the VW Group culture and in navigating governance intricacies,” Jefferies said.

Follow me on Twitter . Check out my website . Neil Winton Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/neilwinton/2022/07/24/vws-diess-goes-as-flawed-governance-foils-another-leader/