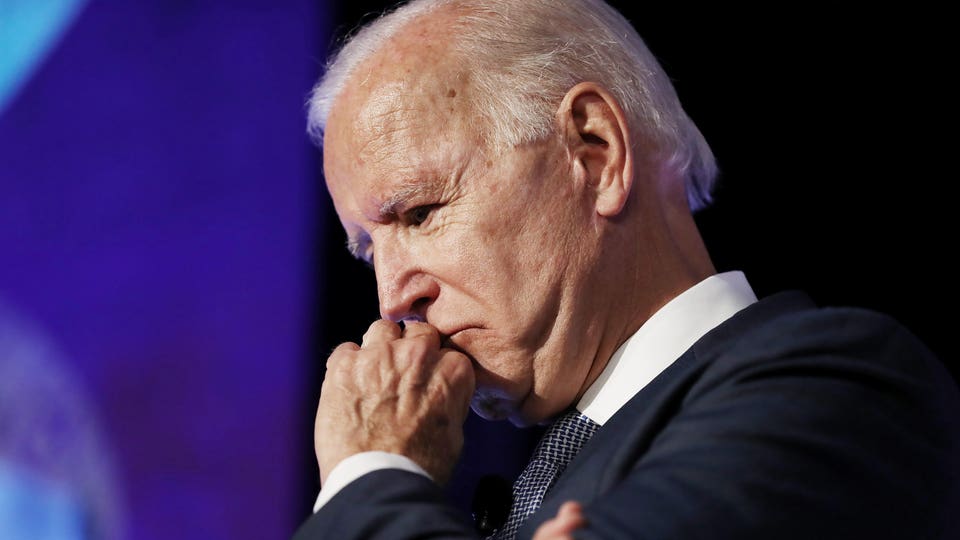

As President Joe Biden gets hip to economic marketing, it’s vital that his White House heed the brutal lessons from Tokyo. To be sure, “ Bidenomics ” might help the besieged U. S.

leader sell his accomplishments on infrastructure, chips production, taming inflation and making life hard on China Inc. But this reboot must be more than slogans. In other words, it can’t be an “Abenomics” redux.

The reference here is Shinzo Abe, who 10 years ago took office with wild pledges to make Japan’s economy great again. Loads have happened since then, including Abe’s July 2022 assassination 21 months after he resigned the premiership. What didn’t happen, though, is Abe using his nearly eight years in power to remake Japan Inc.

Left on the drawing board were bold plans to modernize labor markets, reduce bureaucracy, reinvigorate innovation, increase productivity, empower women and restore Tokyo’s place as a top financial center. In 2013, Abe took his big show on the road to the floor of the New York Stock Exchange. There, he urged global investors to “buy my Abenomics.

” And buy, they did. In 2013 alone, the Nikkei Stock Average surged 57%. Then came the buyer’s remorse.

Early on, Abe’s Liberal Democratic Party put a reform win or two on the scoreboard. Moves in 2014 to prod listed companies to heed shareholders’ demands and add outside directors are paying some dividends. These upgrades are being credited for the current Nikkei surge ( up 27% so far this year).

Mostly, though, Abe left economic matters to the Bank of Japan, which flooded world markets with yen. That pumped up corporate profits. But it meant that Abenomics was really just supply-side economics—“Reaganomics” with Japanese characteristics, if you will.

Donald Trump did the same during his 2017-2021 presidency. Trump’s White House unleashed trillions of dollars of stimulus but few lasting moves to alter the dynamics of the biggest economy. The trouble with Abenomics is that it proved to be contagious in Asia.

From China to India to Malaysia to South Korea to Thailand, this region is awash in examples of leaders making big reform promises that never seem to materialize. In Japan’s case, the Abe era’s all-talk-little-action modus operandi is backfiring anew. Though the stock market is going gangbusters, average households are walking in place.

In April, average monthly wages dropped 3. 0% year-over-year in inflation-adjusted terms. It was the 13th straight month of decline.

The yen’s 10% decline this year is both hurting consumers’ purchasing power and increasing the odds Japan will import more inflation from abroad. It greatly complicates BOJ Governor Kazuo Ueda’s 2023. If Ueda does nothing to exit 23 years of quantitative easing, the yen will fall further.

If he hits the brakes, corporate chieftains might be even less willing to fatten paychecks to kick off the virtuous cycle Abenomics promised. Hopefully, Team Biden is internalizing these lessons. The U.

S. doesn’t need more fiscal or monetary steroids; it must build economic muscle organically. The good news is that Bidenomics already has some key sectors hitting the gym.

Case in point: the $50 billion CHIPS and Science Act to build up the semiconductor industry to counter China. The act is the centerpiece of a bigger effort to keep pace with Beijing’s giant investments in aerospace, artificial intelligence, biotechnology, electric vehicles, green infrastructure, renewable energy, semiconductors and other hot sectors. It’s the mirror image of Trump’s China policies.

With massive tariffs and sharp rhetoric, Trump tried to kneecap Asia’s biggest economy. Trump did little to incentivize companies to take on China with greater innovation and increased productivity. One obvious example: Trump weakening auto emissions standards, reducing Detroit’s odds of taking on Toyota Motor, Volkswagen and other global giants.

Biden, by contrast, is going after China with surgical precision, making it harder and harder for mainland companies to acquire vital technology. More importantly, Biden’s team is raising America’s game to compete with China, not just try to trip it near the finish line, Trump-style. Again, though, the future of Bidenomics must avoid the lessons 7,000 miles away in Tokyo.

A coincidence, perhaps, but it too has three main priorities. Abenomics had a trio of policy “arrows” that were supposed to be fired in unison: monetary loosening, fiscal retooling and major structural reform. Japan deployed the first, but the second two largely remained in the quiver.

The three facets of Bidenomics include increased public investment in industry, educating and empowering the workforce and boosting competition by policing monopolistic behavior. Yet promising to bolster the economy from the bottom up, not the top down, is one thing. Succeeding is another.

The key is implementation, not relying on the central bank to save the day with lower rates, Abe-style. Will Biden’s gambit work? Only time will tell. But the cautionary tale of a Japan that spent the last decade putting sloganeering over bold action should be required-reading for Biden’s economic team.

.

From: forbes

URL: https://www.forbes.com/sites/williampesek/2023/06/29/bidenomics-must-heed-brutal-lessons-from-7000-miles-away/