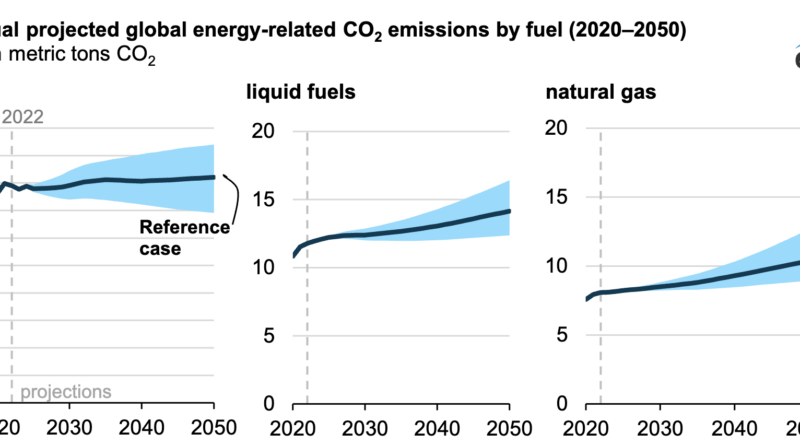

We project that global energy-related CO 2 emissions from consumption of coal, liquid fuels, and natural gas will increase over the next 30 years across most of the cases we analyzed in our International Energy Outlook 2023 (IEO2023). By 2050, energy-related CO 2 emissions vary between a 2% decrease and a 34% increase compared with 2022 in all cases we modeled. Growing populations and incomes increase fossil fuel consumption and emissions, particularly in the industrial and electric power sectors.

These trends offset emissions reductions from improved energy efficiency, lower carbon intensity of fuel mix, and growth in non-fossil fuel energy. IEO2023 analyzes long-term world energy markets in 16 regions through 2050. We studied seven cases that explore differing assumptions of economic growth, crude oil prices, and technology costs.

These cases consider only the international laws and regulations adopted through March 2023 and rely on the U. S. projections published in the Annual Energy Outlook 2023 (AEO2023), which assumed U.

S. laws and regulations as of November 2022. Across sectors, the highest growth in global coal consumption through 2050 occurs in the electric power sector.

Although zero-carbon technologies account for the most growth in electricity capacity and generation, we expect coal-fired generators to continue to operate. Across all cases, China and India account for about two-thirds of the world’s coal consumption between 2022 and 2050. Although China is currently the largest coal consumer, we project its coal consumption to decline by 18% between 2022 and 2050.

Coal consumption in India nearly doubles over the same projection period. We project global consumption of liquid fuels—which include gasoline, diesel, and biofuels—will increase through 2050. Across all sectors, the largest share and the fastest growth in liquid fuels consumption is in industrial applications, such as chemical production.

Increased liquid fuels consumption in the industrial sector is partially offset by declining liquid fuels consumption in the transportation sector as adoption of electric vehicles (EV) grows. Regionally, we project the United States, China, and Western Europe to remain the top liquid fuels consumers, even though fuel consumption in these regions either declines or plateaus by the mid-2030s due to government policies and growing EV adoption. India has the fastest projected growth in liquid fuels consumption, more than doubling across all cases.

We project natural gas consumption will increase in the electric power and industrial sectors through 2050. In the cases we modeled, the electric power sector continues to rely on existing natural gas-fired plants despite growth in zero-carbon electricity generation. In the industrial sector, increased production of basic chemicals in countries such as the United States propels an increase in natural gas consumption, both as fuel and petrochemical feedstock.

Natural gas demand also grows in the Middle East because of the fuel’s role in producing and processing natural gas and oil for export. The United States is projected to remain the world’s top natural gas consumer throughout the projection horizon, but the Middle East shows significant growth during that timeframe and approaches U. S.

consumption by 2050, ranging from a 29% to 54% growth rate from 2022 to 2050 in the IEO2023 cases. Principal contributors: Kevin Nakolan, Michelle Bowman Originally published on U. S.

EIA’s Today in Energy blog . Click to download . LinkedIn WhatsApp Facebook X Email Mastodon Reddit.

From: cleantechnica

URL: https://cleantechnica.com/2023/12/04/global-co2-emissions-rise-through-2050-in-most-ieo2023-cases/