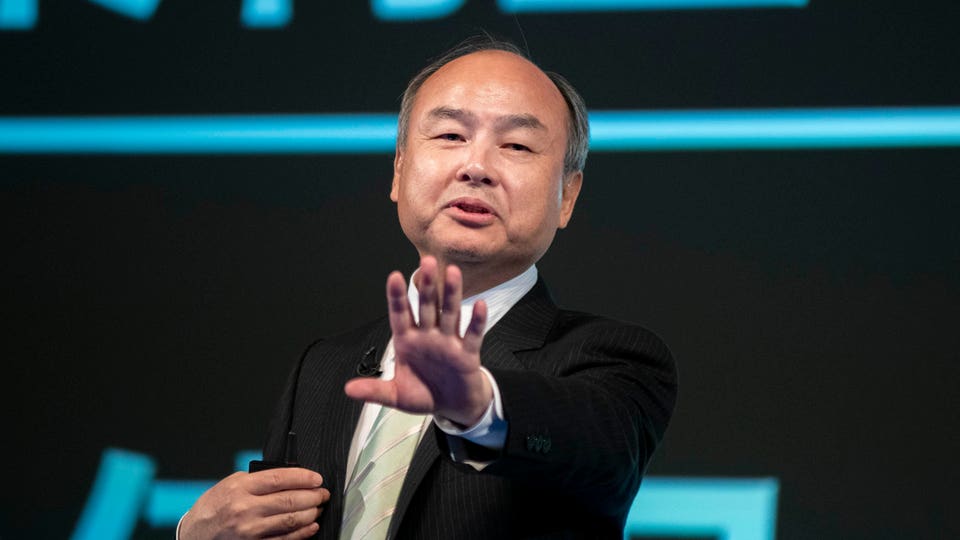

SoftBank founder Masayoshi Son likes to say he invests with a 300-year time horizon. Now though, the billionaire finds himself fretting events in 30-day intervals. Case in point: the shifting odds of SoftBank pulling off a successful initial public offering of chip designer Arm at a valuation north of $60 billion as soon as next month.

A big IPO would enable Son to claim his $100 billion Vision Fund has a new lease on life for the next 300 weeks, never mind three centuries. But there are two big risks here. The first is a whopping valuation that seems more aspirational than serious.

The second is whether Son’s financial empire can settle on what it wants to be when it grows up. There are many reasons to think a $60 billion-$70 billion valuation is a bit much. These tantalizing numbers could make Arm the biggest tech debut since Alibaba Group and Facebook, which has since changed its name to Meta Platforms.

Never mind that Arm stumbled in the latest quarter as sales dropped 11%. The slowdown in demand for smartphones and rising inventories for electronics goods in general makes now a curious moment to list. And never mind that Son’s Vision Fund lost a record $30 billion -plus last year alone.

The issue is how Arm thrives over the next few years. The bull case on U. K.

-based Arm is that it’s at the nexus of the coming artificial intelligence boom, pivotal to the ability of tech giants from Google parent Alphabet to Amazon to Nvidia to source energy-efficient chips. The vast computing power AI requires could make such technology increasingly vital. As investors wait—and hope—for that future to arrive, Arm’s revenue streams are highly reliant on licensing, royalties and a smartphone sector losing altitude.

The unit’s biggest customer is Arm China, which presents a number of wildcards as China’s economy stumbles. It hardly helps that Son’s team plans to maintain a firm grip on Arm’s management, able to choose the majority of the spin-off’s directors. Count the ways investors might harbor governance concerns from the start.

Here, Son’s talk of very long time horizons is cold comfort to investors wondering about the next few quarters. The second question—bearing on the Vision Fund’s future—may be the biggest. Over the years, Son had proven himself to be something of a magician.

His first big trick was helping conjure up Jack Ma’s Alibaba empire with a $20 million investment back in 2000. When Ma took his e-commerce juggernaut public in 2014, SoftBank’s stake was worth more than $50 billion. The Vision Fund that Son created in 2016 and 2017 was an attempt to pull off that trick again and again.

Things aren’t going to plan. Since then, Son’s fund has plowed at least $140 billion into profitable startups . All too often, he overpaid spectacularly, morphing himself into a one-man bubble blower.

Then came the Covid-19 crisis, China’s tech crackdown and the Federal Reserve’s most aggressive tightening in nearly 30 years to wreck whatever magic might be left. It’s not that simple, of course. Another reason the trance had over Son lost potency was a disastrous bet on WeWork.

You’d think Son would’ve seen through the office sharing company’s claims it was destined to be the next Apple or Facebook. Nope. Earlier this month, the company Son bet on massively admitted there’s “ substantial doubt ” it will stay in business.

The Arm IPO is Son’s chance to rearm the Vision Fund and chase new deals. To what effect, though? Son’s team used the last year to good effect cleaning up the balance sheet. Earlier this month, Yoshimitsu Goto, chief financial officer, said SoftBank had accumulated a $42 billion cash pile.

Yet an Arm IPO windfall—if it even materializes—will mean little in the long run without a recalibration of Son’s investment model. Sprinkling billions here and there hoping to strike lightning isn’t a way to generate steady returns. It’s been a while since serious investment types referred to Son as the “ Warren Buffett of Japan .

” Likewise, it’s been a while since the business world found humor or charm in Son saying he prefers to be known as “ the crazy guy who bet on the future . ” Given the track record of recent years, investors would be happier just to see steady and sane returns. For a while there, in 2018 to be exact, Son toyed with the idea of grabbing a stake in Swiss Re AG .

It would’ve been a Buffett-esque move of the kind that grounds Berkshire Hathaway. Thing is, it’s not clear what Son’s real investment vision is these days. That’s a question that no one particular IPO can answer for SoftBank or its investors.

.

From: forbes

URL: https://www.forbes.com/sites/williampesek/2023/08/23/softbanks-60-billion-plus-ipo-challenges-masayoshi-sons-crazy-talk/