Breaking Business Truth Social SPAC Reportedly Fails To Get Shareholder Support To Prolong Acquisition Siladitya Ray Forbes Staff Covering breaking news and tech policy stories at Forbes. Following New! Follow this author to stay notified about their latest stories. Got it! Sep 6, 2022, 04:34am EDT | Share to Facebook Share to Twitter Share to Linkedin Topline A request to extend the deadline for the merger between former President Donald Trump’s Truth Social platform and a special purpose acquisition company could not gather shareholder support, Reuters reported , signaling more turmoil for the deal which also faces multiple federal investigations.

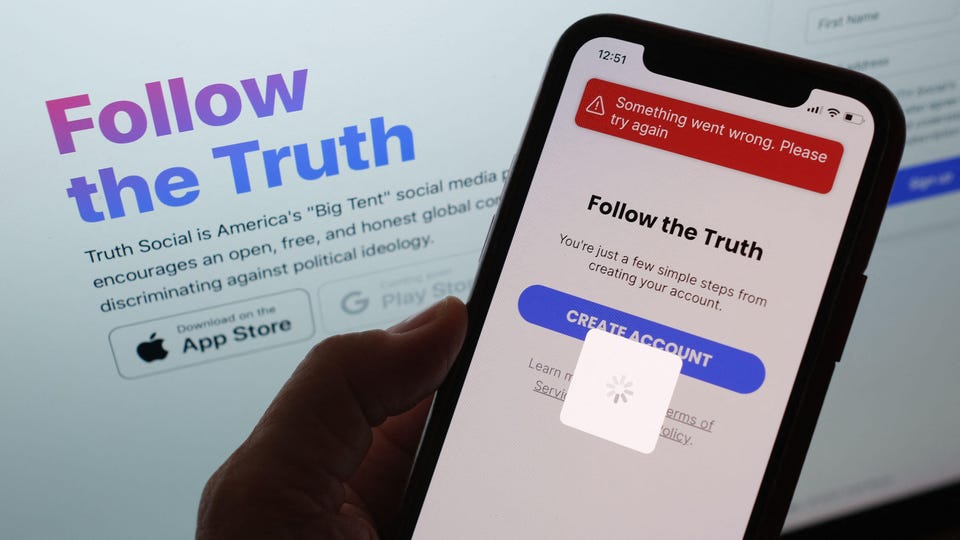

This illustration photo shows Donald Trump’s new social media app Truth Social, glitching on a . . .

[+] smartphone in Los Angeles. AFP via Getty Images Key Facts Digital World Acquisition Corp (DWAC)—the Nasdaq-listed blank check company which has agreed to acquire Truth Social’s parent company Trump Media & Technology Group (TMTG) and take it public—failed to garner the requisite 65% votes needed to extend the completion of the deal by an additional year, Reuters reported , citing “people familiar with the matter. ” The company recently claimed the voting process has been challenging because most of its shareholders are individuals and their votes need to be secured through their brokers.

The company has sought until September 8, 2023 to complete the deal, an extension beyond the customary two-year deadline —which expires on Thursday—during which a SPAC is required to complete an acquisition. The final vote tally will be announced Tuesday, but Reuters reports that the company’s executives are already exploring alternatives—which include a unilateral six-month extension without shareholder approval—as they believe they will meet the 65% threshold. If DWAC fails to deal with the issue before Thursday’s September 8 deadline, it will be forced to liquidate its shares and return the money it raised in its initial public offering.

Big Number 18. 86%. That’s how much DWAC shares have plummeted in the past month amid reports of Truth Social failing to pay more than $1.

6 million in bills to vendors. Crucial Quote In a Securities and Exchange Commission filing last month, the company said: “Without the Extension, the Board believes that there is significant risk that we might not, despite our best efforts, be able to complete the Business Combination on or before the Termination Date. If that were to occur, we…would be forced to liquidate.

” Key Background The company announced plans to seek a one-year extension from its shareholders last month, pointing to at least two federal probes into the planned acquisition. The SEC is investigating allegations that DWAC’s executives held talks with Truth Social’s parent company before the blank check company went public. The alleged meeting would be in violation of regulations that disallow SPACs from establishing deals and merger agreements before even going public.

In a separate investigation, a federal grand jury in New York subpoenaed two members of DWAC’s board in June. The grand jury investigation has requested some of the same documents sought by the SEC along with information on communications with “multiple individuals, and information regarding Rocket One Capital,” a Miami-based private equity firm. Tangent After a bumper 2021, SPAC mergers have faced serious headwinds in 2022.

According to a CNBC tracker , companies that went public through SPAC mergers have seen their values crater by more than 50% since the start of this year. Further Reading Exclusive: Deal partner for Trump’s Truth Social fails to get backing for SPAC extension (Reuters) DWAC Seeks To Delay Merger With Trump’s Truth Social Company Amid Federal Investigations (Forbes) Truth Social SPAC Down 9% As Trump Denies Reports Of Financial Trouble (Forbes) Follow me on Twitter . Send me a secure tip .

Siladitya Ray Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/siladityaray/2022/09/06/truth-social-spac-reportedly-fails-to-get-shareholder-support-to-prolong-acquisition/