Sustainability Climate Scenarios For Finance: What’s New In The Latest NGFS Pathways? David Carlin Contributor Opinions expressed by Forbes Contributors are their own. Helping you to understand and thrive in our changing world Following New! Follow this author to stay notified about their latest stories. Got it! Oct 18, 2022, 10:17am EDT | New! Click on the conversation bubble to join the conversation Got it! Share to Facebook Share to Twitter Share to Linkedin A summary of the key features of the latest NGFS climate scenarios.

NGFS, 2022 Each year, the financial sector has waited with anticipation for the release of the Network on Greening the Financial System (NGFS) climate scenarios. To produce these scenarios, the NGFS, a collection of over 100 central banks, partners with leading climate and economic modelers. The NGFS scenarios have numerous financial sector applications, including climate risk disclosures, supervisory climate stress tests, and net-zero target-setting.

The newest set of NGFS scenarios was released in September 2022. This article provides financial actors a primer on what has changed, what has stayed the same, current limitations, and future enhancements. What has changed The third set of NGFS scenarios offers updated data, improved sectoral granularity, and deeper integration of physical hazards to the benefit of users.

Over the past year, many nations have made net-zero commitments and strengthened policies to accelerate decarbonization. The new scenarios incorporate this heightened level of climate ambition and climate policy. Current technological advancements and the plummeting price of renewable energy are reflected in the scenarios’ energy mix and mitigation costs.

Socioeconomic trends within the scenarios are informed by the latest estimates of the International Monetary Fund (IMF), including the post-Covid recovery. However, the effects of the invasion of Ukraine and the attendant energy crisis are not integrated into the scenarios. For financial institutions using the NGFS scenarios for climate risk analysis or decarbonization target-setting, understanding sectoral transition pathways is essential.

In earlier vintages, the granularity for non-energy or power sectors was more limited. Now, the underlying models can provide more detail on the behavior of other sectors, notably the industrial and transportation sectors. Demand and price variables in these sectors provide additional insights into the dynamics of the climate transition.

An NGFS pilot exercise with the G-Cubed model (another economic model) suggests ambitions of further sectoral detail in the future. Increased sectoral granularity enables users to see emissions pathways for a variety of industries. NGFS, 2022 MORE FOR YOU Patrick Byrne Of Overstock Fame Says He Was Involved In Monthslong Effort To Overturn 2020 Election MacKenzie Scott Just Gave The Girl Scouts A Record-Breaking Donation Three Ways AI Transforms Security Enhanced physical risk modeling has also been a major focus of the NGFS.

For the first time, the impacts of extreme events are integrated into macroeconomic outputs. The NGFS computed economic shocks by examining historic damages from acute hazards and combining them with trends of future frequency and severity. These damage projections enable financial users to begin to understand the growing magnitude of acute hazards.

Chronic physical risks (e. g. , rising sea levels or decreased agricultural productivity) also were updated in the NGFS scenarios.

New modeling choices also better capture the tail risks of climate change. While previously, damage functions for physical risks had used median estimates to calculate impacts, the new scenarios consider the 95 th percentile of impacts. This produces higher estimates of climate-related economic losses.

In the new scenarios, without further climate action, impacts from climate risk would claim 6% of GDP by 2050, and soar to 18% by 2100. Economic losses due to climate risks under different NGFS scenarios. NGFS, 2022 What stayed the same The latest set of NGFS scenarios nonetheless retains many elements from last year’s scenarios.

The consortium of modelers who support the NGFS scenario development remains the same. As a result, the underlying models that generate the scenarios have remained consistent. The backbone of the NGFS scenarios is still generated by three integrated assessment models (IAMs): MESSAGE by the International Institute for Applied Systems Analysis (IIASA) , REMIND by the Potsdam Institute for Climate Impact Research (PIK) , and GCAM by the Joint Global Change Research Institute (JGCRI) .

The model used to assess macroeconomic impacts was NiGEM , developed by the National Institute for Economic and Social Research (NIESR) . For physical risks, pathways were developed by Climate Analytics , PIK, and ETH Zurich . The scenario categories and narratives remain consistent with last year’s vintage.

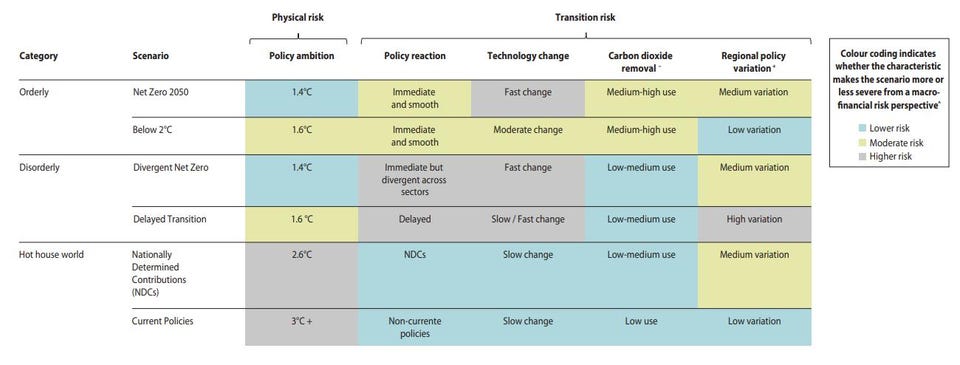

Scenario categories include: Orderly scenarios (lower physical risks, lower transition risks) assume global climate action occurs steadily and efficiently. The two associated narratives within this category are the Net Zero 2050 scenario, which limits end-of-century warming to below 1. 5°C, and the Below 2°C scenario, a slightly less ambitious pathway that results in below 2°C of warming in 2100.

Disorderly scenarios (lower physical risks, higher transition risks) assume significant climate action but with delays or regional tensions. The two associated narratives within this category are the Divergent Net Zero scenario, which reaches net zero by 2050, but where action only commences in 2030, and the Divergent Transition scenario, where different regions pursue uncoordinated policies of transition. These scenarios both result in around 1.

5°C of warming in 2100, respectively, but with much more severe economic disruption. Hot-House World scenarios (higher physical risks, lower transition risks) assume limited additional climate action is taken, and physical damages from climate change continue to mount. In the more optimistic narrative, countries fulfill their Nationally Determined Contributions (NDCs) but nothing more, leading to warming of over 2.

5°C in 2100. The more pessimistic narrative (termed “Current Policies”) assumes climate policies are not strengthened, leading to warming of over 3°C by 2100. Emissions and carbon prices across the different NGFS climate scenarios.

NGFS, 2022 The precise end-of-century temperatures reached in these scenarios have changed slightly since last year’s NGFS scenarios. These changes reflect new climate policies and commitments, updates to the growth trajectory of low-carbon energy, updated expectations regarding carbon dioxide removal, and other assumptions. Strengths, limitations, and next steps The new NGFS scenarios are the most comprehensive scenarios available to explore the implications of the low-carbon transition, mounting physical hazards, and macroeconomic impacts of both.

The latest enhancements make them even more valuable to financial users. Those setting net-zero targets or developing transition plans will benefit from the additional sectoral granularity and updated data. Those conducting climate stress tests and risk analyses will benefit from the more sophisticated physical risk assumptions.

Despite these advances, significant limitations still exist. These include the lack of alignment of scenario time horizons with financial risks. The long-term NGFS scenarios focus less on the short-term volatilities and price swings that can drive credit and market risks.

Similarly, the scenarios do not include business cycles. Climate risk impacts may be significantly more severe if they occur during periods of economic stress or imperil financial markets. Another challenge relates to the downscaling of the scenarios as transition pathways may be incompatible with local economic and political realities.

Further limitations are applicable to other use cases. For example, when setting targets in certain sectors (especially end-use sectors), the industry-level dynamics of the scenarios may not be sufficiently detailed. Fortunately, the NGFS has been gathering feedback on applications of their scenarios and intends to work on further updates.

They seek to enhance the technical elements of the scenarios and broaden their user base. Technical priorities include further improving sectoral and geographic granularity, introducing short-term scenarios, providing further detail on acute physical risks, and updating the scenarios to include the latest data. Application priorities include improving the useability of the scenarios and creating more detailed documentation on scenario methodologies.

It is an ambitious program but trying to model a changing world always will be. Further detail on the NGFS scenarios and the associated data can be found here . Follow me on Twitter or LinkedIn .

David Carlin Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/davidcarlin/2022/10/18/climate-scenarios-for-finance-whats-new-in-the-latest-ngfs-pathways/