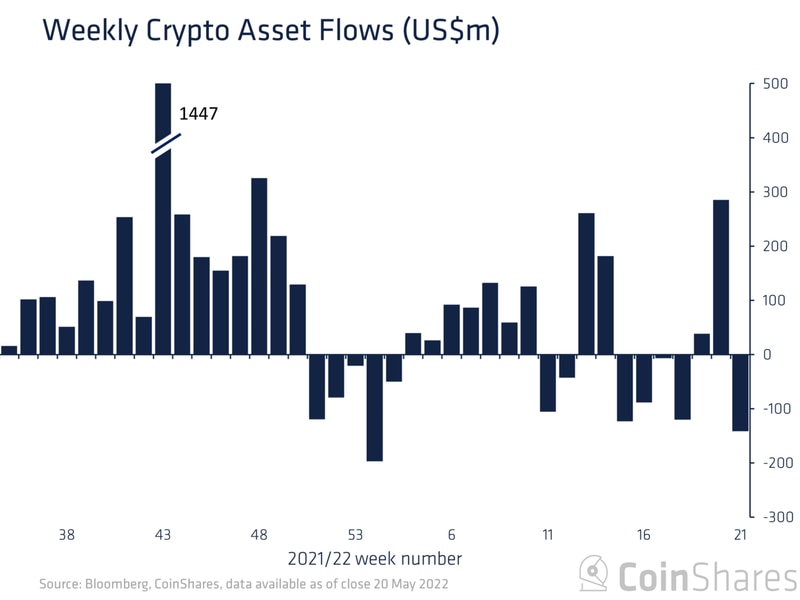

Krisztian Sandor Krisztian Sandor is a reporter on the Crypto Explainer+ team. He has written for Forbes and Reuters. He holds BTC and ETH. Crypto fund assets under management fell to the lowest since July 2021 last week because of the recent price crash in cryptocurrencies and equity markets that has been partly driven by the U.S. Federal Reserve’s move to reduce its balance sheet starting next month. CoinShares reported the value of assets under management held by digital-asset funds dropped to $38 billion, as investors pulled out some $143 million during the week through May 20. It was the year’s second-largest outflow. “Confidence in crypto has been flailing given both retail and institutional investors that got into crypto over the past year are deeply in the red,” said Edward Moya, senior market analyst at the trading platform Oanda. It was a wild swing from the mood just two weeks ago , when investors inflows rose to a 2022 high, apparently buying the market dip amid the implosion of the Terra blockchain’s LUNA token and its UST stablecoin. Bitcoin ( BTC ), the largest cryptocurrency crashed to as low as $25,892 on the week of May 9, the lowest since December 2020. Since then, bitcoin has recovered somewhat and stabilized around the $30,000 level. As of press time it was changing hands around $30,223. Bitcoin-focused funds suffered the lion’s share of the outflows, with $154 million in outflows last week, shedding about the half of the $299 million inflows netted during the prior week. Funds managed by Purpose, a fund provider that manages the largest bitcoin exchange-traded fund in North America, saw $150 million in outflows. Some $154 million flowed out of North American crypto funds, while the funds listed in Europe brought in $12 million. On a positive note, multi-asset funds – funds that hold multiple cryptocurrencies – stacked up $9.7 million in inflows last week. These types funds might be winners from the volatility in crypto markets as investors look to diversify their holdings, with $185 million in inflows since the start of the year. “We believe investors see multi-asset investments products as safer relative to single-line investment products during volatile periods,” James Butterfill, CoinShares head of research, said in a note. Funds that focus on altcoins – other cryptocurrencies beyond bitcoin – didn’t see significant flows in any direction. Funds involving Polkadot’s DOT and Cardano’s ADA were the biggest gainers, with $1 million in inflows each. DISCLOSURE Please note that our privacy policy , terms of use , cookies , and do not sell my personal information has been updated. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies . CoinDesk is an independent operating subsidiary of Digital Currency Group , which invests in cryptocurrencies and blockchain startups . As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights , which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG. Krisztian Sandor Krisztian Sandor is a reporter on the Crypto Explainer+ team. He has written for Forbes and Reuters. He holds BTC and ETH. Krisztian Sandor Krisztian Sandor is a reporter on the Crypto Explainer+ team. He has written for Forbes and Reuters. He holds BTC and ETH.

From: coindesk

URL: https://www.coindesk.com/markets/2022/05/23/crypto-funds-shrink-to-lowest-since-2021-summer-bear-market/?utm_medium=referral&utm_source=rss&utm_campaign=headlines