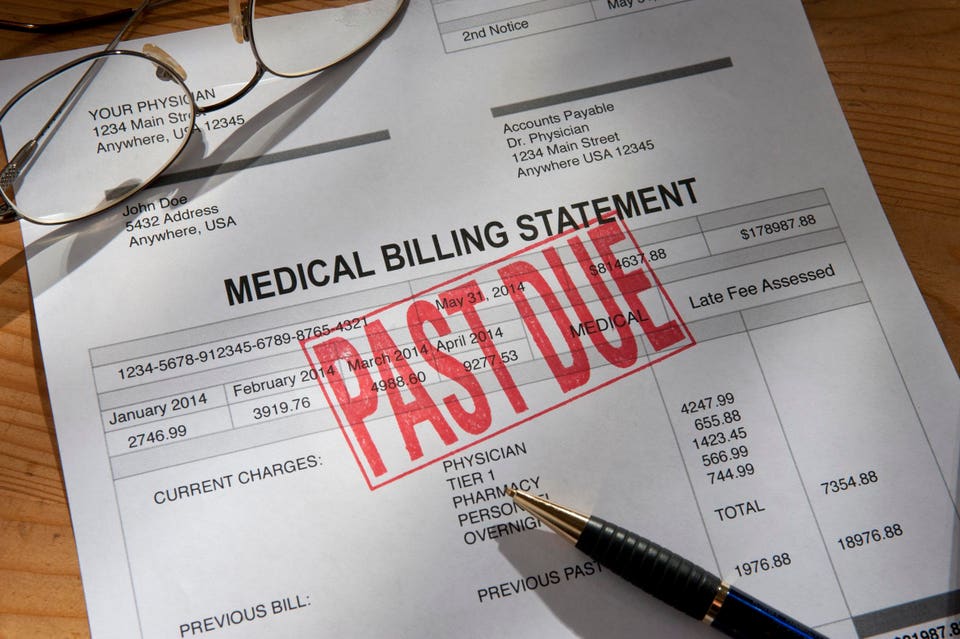

Forbes Innovation Healthcare Half Of Americans Struggle To Afford Healthcare Costs, New Study Shows Deb Gordon Contributor Opinions expressed by Forbes Contributors are their own. I write about how healthcare business and policy impact consumers. Following Oct 26, 2023, 12:30pm EDT | Press play to listen to this article! Got it! Share to Facebook Share to Twitter Share to Linkedin PAST DUE stamped on a past due Medical invoice.

PAST DUE in RED. Form is on a desktop. Camera angle .

. . [+] is looking down on the form.

Dramatic lighting. getty It may not be breaking news that healthcare in the United States is difficult to afford, but new research released today quantifies just how much strain healthcare costs are putting on Americans. The Commonwealth Fund 2023 Health Care Affordability Survey shows what many Americans know all too well: healthcare costs are crushing and putting their health in jeopardy.

In a nationally representative sample of more than 6,000 adults under 65, half (51%) said that it was very or somewhat difficult to afford their healthcare costs. Not surprisingly, healthcare costs presented the greatest burden to people without health insurance, 76% of whom reported difficulty affording these costs. Others were not immune from financial strain.

More than four in ten (43%) people with health insurance through a job reported affordability challenges, too, as did 45% of people on Medicaid, 51% of Medicare beneficiaries, and 57% of people insurance through the Health Insurance Marketplace or other individual health insurance. Among people with job-based insurance who reported having trouble affording medical costs, lower-income workers were more likely than higher-earning people to struggle with costs. Still, 30% of covered employees who earn more than 400% of the federal poverty level—or about $58,000 per year—reported these challenges.

MORE FOR YOU InnovationRx: Ransomware Attacks On U. S. Health Systems Have Cost The Economy Nearly $8 Billion CDC Advisors Recommend Mpox Shots For Routine Prevention Among At Risk Adults Here s What To Know Forget Crushing It Startup Founders Open Up About Mental Health Problems “While the survey findings show that it’s much better to have insurance than to go without, they also indicate that insurance frequently fails to provide affordable access to care for large segments of the U.

S. population,” said Sara R. Collins, senior scholar and vice president of Health Care Coverage and Access and Tracking Health System Performance at The Commonwealth Fund, and the study’s lead author, in a briefing.

This survey underscores prior surveys that show worries about healthcare costs lead people to avoid or delay seeking care. Overall, 36% of respondents said that they or a family member had put off or skipped needed healthcare, including prescription drugs, because of cost. Nearly two-thirds (64%) of uninsured people said they had gone without care, as did approximately 40% of people on Medicaid, Medicare, and Marketplace plans.

Costs get in the way even for people with employer-sponsored health insurance, 29% of whom said that they had skipped or postponed needed care because of cost. Joseph Betancourt, M. D.

, president of The Commonwealth Fund and a primary care provider, said in a briefing that the findings did not shock him at all. “Almost every day, I see the challenges that patients face in regards to healthcare affordability,” Betancourt said. “Patients’ experience ranges from confusion to frustration to legitimate threats to their health and well-being.

” Delaying or avoiding care can have serious consequences. A majority (57%) of survey respondents reported that their health problems got worse as a result of putting off needed care. Though the rates varied by type of coverage, more than half of every group reported that health issues worsened after skipping care due to affordability.

Medical costs are not just threatening people’s physical health but their financial health as well. Fifty-seven percent of respondents said 10% or more of their monthly household budget goes toward healthcare costs; 17% said healthcare costs account for 25% or more of their budget. These budget-busting expenses are making it harder for American households to afford other basic costs such as utilities, food, credit card bills, housing, and car payments.

People without health insurance were most likely to report that healthcare costs make it more difficult to pay for other necessities. But even people with private insurance reported this financial strain. For example, 57% of uninsured people and 30% of people with private insurance said healthcare costs made paying for food more difficult.

The reverse is also true: inflation is also making it harder for Americans to afford their healthcare costs. Overall, 65% of respondents said that rising prices on other goods and services affected their family’s ability to pay for healthcare. This experience was common regardless of insurance type.

The fear of unmanageable medical costs that prevents many people from getting care they need is well-founded. One-third (32%) of respondents said that they currently have medical or dental bills they’re paying off over time. This figure was highest for people without insurance and lowest for people on Medicaid coverage, which is typically heavily subsidized and meant to shield lower-income people from medical expenses.

The vast majority (85%) of respondents with current medical debt owe at least $500. Nearly half (48%) reported $2,000 or more in outstanding medical or dental bills or other health-related debt. The survey also shed light on what is putting people into medical debt.

The number-one driver was hospital care, reported by 54% of debt-holding respondents. The second most common source of medical debt (for 37% of respondents) were office visits, followed by emergency room care (35%), which is often assumed to be the primary driver of debt. Another 30% cited dental bills as the source of their debt.

Of survey respondents with medical debt, about half (54%) blamed a new health condition while another 52% cited an ongoing health condition. The study findings suggest that other measures of medical debt which use credit reports may undercount the true debt burden. While one-third of respondents with medical or dental debt report making payments to a collection agencies, two-thirds said they’re making payments directly to their healthcare or dental provider.

Those payments, typically made through a negotiated payment plan, are not likely to appear on credit reports. The report points to potential policy prescriptions to improve affordability. The authors suggest automatically enrolling low-income people into Medicaid and keeping them continuously enrolled for longer stretches of time.

Private sector employers and insurers could adjust premiums and cost-sharing based on employee income. And Congress could extend subsidies to help make Marketplace health plan premiums affordable for more people. But even if these proposals could be implemented in the long-term, they won’t help patients who are struggling today.

“The tough part for me as a doctor is I rarely have an answer or a solution, but one thing is for sure, patients are impacted by this every day,” Betancourt said. “These affordability challenges are real. They’re getting worse, and there are clear and present danger to people’s health and well-being.

” Follow me on Twitter . Check out my website or some of my other work here . Deb Gordon Editorial Standards Print Reprints & Permissions.

From: forbescrypto

URL: https://www.forbes.com/sites/debgordon/2023/10/26/half-of-americans-struggle-to-afford-healthcare-costs-new-study-shows/