Asia Semiconductor Surge: Taiwan’s No. 2 Chip Maker Posts 42% Revenue Jump, But How Long Can It Last? Ralph Jennings Contributor Opinions expressed by Forbes Contributors are their own. New! Follow this author to improve your content experience.

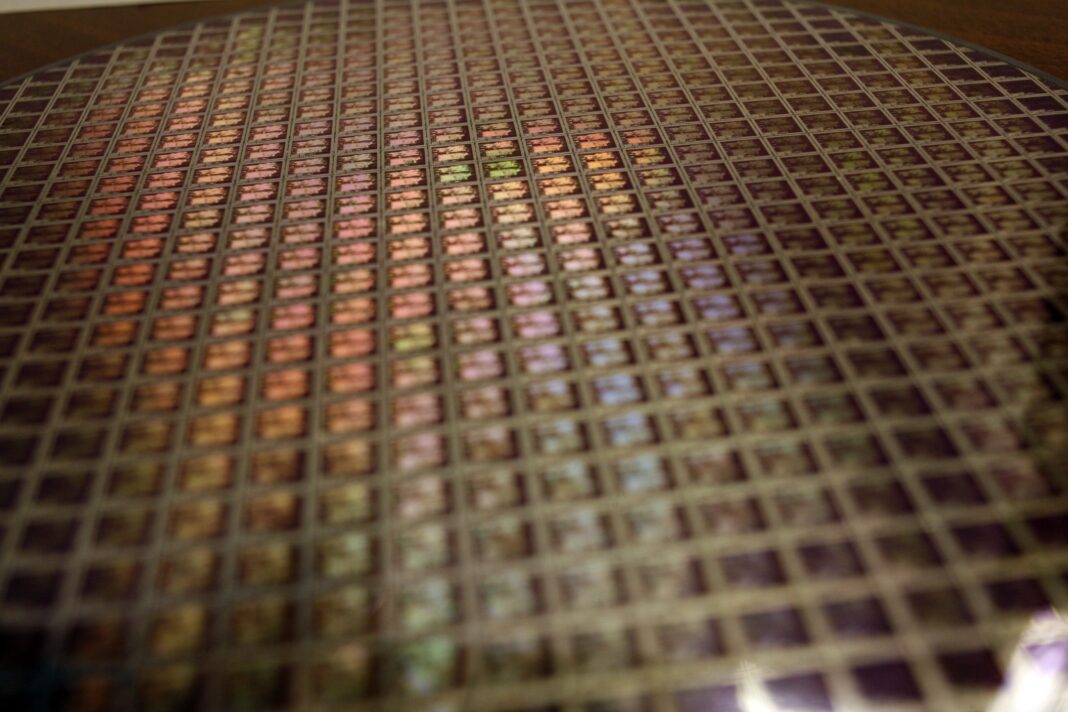

Got it! Jun 17, 2022, 04:40am EDT | Share to Facebook Share to Twitter Share to Linkedin Computer chips Yoray Liberman/Getty Images UMC reported soaring sales for the month of May, boosted by continued strong demand for its semiconductor chips that power consumer electronics and modern vehicles. But analysts warn that the global economy may not sustain that sort of growth for much longer. The company, based in Hsinchu, Taiwan, posted a 42% year-over-year jump in its revenue amounting to $24.

4 billion New Taiwan dollars ($820 million) for the month of May. UMC is Taiwan’s No. 2 contract chip maker after billionaire Morris Chang’s TSMC, which itself is expecting a 37% jump in revenue in the second quarter.

Exports from Taiwan normally thrive on world demand for tech hardware, including semiconductor chips, says Darson Chiu, deputy macroeconomic forecasting director with the Taiwan Institute of Economic Research think tank in Taipei. The pandemic bolstered shipments of chip-laden electronics to consumers who stayed home and needed new PCs for telework and home study. MORE FROM FORBES Why Taiwan’s UMC Is Building A $5 Billion Chip-Making Factory In Singapore By Ralph Jennings Orders for automotive chips help, too.

UMC’s Japanese subsidiary announced in late April that it entered a deal with Toyota-backed car-parts supplier Denso to make semiconductors for a fast-growing automotive segment that includes electric vehicles. The automotive semiconductor market will grow from $35 billion in 2020 to $68 billion in 2026, Taipei-based Market Intelligence & Consulting Institute forecasts. MORE FOR YOU China Detains Fallen HNA Ex-Billionaire Chairman Ahead Of Airline Restructuring Vote Nasdaq Listing Of Freshworks Creates Windfall For Indian Founder And Hundreds Of Employees Ninja Van Becomes Singapore’s Newest Unicorn After Raising $578 Million From Alibaba, B Capital World PC shipments are easing this year as consumers return to work or school, IDC indicated in an April statement .

The statement says global shipments of desktops, notebooks and workstations declined 5. 1% in the first quarter. “While there may be some wafer shipments declining in some areas, average selling prices are still supported by the long-term agreements put in place and increasing silicon content is able to reduce the impact of softness in some semiconductor products,” says Nina Turner, research manager for semiconductor applications with the market research firm IDC.

MORE FROM FORBES Vietnam’s Vingroup Teams Up With Intel To Use IoT Technology In Electric Vehicles And Batteries By Ralph Jennings UMC didn’t comment on the reasons behind its monthly revenues, but guidance given in the company’s first-quarter earnings announcement said wafer shipments would increase 4% to 5% with an average selling price increase of 3% to 4% quarter-on-quarter through June. “We are on track to reaching these guidance figures, supported by strong demand,” a company spokesperson said. But chipmakers may be unharmed by any flatlining of PC shipments, Turner says.

CPU suppliers such as AMD and Intel along with memory chip companies including Micron and Samsung are more likely to be impacted, she says. Exporters on the island anchored by tech hardware manufacturing have reached the “top of a cycle” says Liang Kuo-yuan, president of the Yuanta-Polaris Research Institute think tank in Taipei. He points to the S&P Global Taiwan Manufacturing Purchasing Managers’ Index (PMI) , a measure of trends in factory activity, which fell to 50.

0 in May from 51. 7 in April. May’s reading was the weakest in 23 months.

“I think eventually it’s going into oversupply,” Liang says. Follow me on Twitter . Ralph Jennings Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/ralphjennings/2022/06/17/semiconductor-surge-taiwans-no-2-chip-maker-posts-42-revenue-jump-but-how-long-can-it-last/