The last Friday in June began like a normal summer day in sunny Orlando, Fla. : The weather was hot and sticky; obedient crowds filed into Disney World as if on a spiritual pilgrimage. At the Orlando Museum of Art (OMA), a much-hyped exhibition was in its final days.

Billed as a stash of previously unseen pieces by the late ’80s star Jean-Michel Basquiat, whose neo-expressionist paintings sell for tens of millions of dollars, the Heroes and Monsters show of 25 artworks was to be a splashy coup for the museum, a quiet regional institution unaccustomed to the national spotlight. After all, Basquiat’s paintings are not only highly coveted, but his subversive start as a graffiti artist, his crossover appeal—Madonna dated him; Jay-Z rapped about owning his doodle-like work—and his death from a drug overdose at the age of 27 have made him a pop-culture icon. OMA had banked on the show to raise its profile, trumpeting the paintings in the media and developing fundraising opportunities, such as Basquiat’s 1982 Heroes and Monsters Ball, replete with a DJ, a GIF-machine booth and a live art demo.

But in the middle of that June day, a team of FBI agents arrived at OMA with a search warrant. Agents proceeded to pack up the entire contents of the exhibition, carting off the curated canvas contraband like so many sacks of heroin as ejected visitors gaped through the museum’s windows, straining to catch a glimpse of the action. The paintings—all 25 of them—were fake, the government alleged.

That an accredited museum, even a modest one, could get swept up in a major forgery investigation in 2022 might come as a shock to many, but suspect works have become so common that, just weeks earlier, a Palm Beach dealer had been charged with selling bogus Warhols, Lichtensteins, Banksys and yet more Basquiats from his galleries on tony Worth Avenue. As Chris McKeogh, an agent with the FBI’s Art Crime Team , tells Robb Report , “Whenever there’s a fraud scheme or fakes-and-forgeries ring, if you become aware of two or three, multiply by 10, at least. ” If a forger is skilled, “they’ll make 20 or 50—or a thousand.

” The sheer ubiquity of shams has altered his thinking. “I’ve become skeptical whenever I see a new piece of art,” McKeogh adds. “I will assume that it’s fake until I can prove that it’s real.

That speaks to just how many fake artworks are out there. ” And forgeries are but one type of big-dollar crime plaguing the art world with head-spinning frequency these days. Lucrative fraud schemes, systematic thefts and money-laundering cases have all roiled the field in recent years, and global authorities are cracking down on the trade of looted antiquities that spiked as wars in the Middle East raged.

In the past year alone, Inigo Philbrick, an up-and-coming contemporary-art dealer, was sentenced to seven years in federal prison after pleading guilty to an $86 million fraud, billionaire Michael Steinhardt sidestepped possible prosecution by agreeing to surrender at least 180 looted antiquities worth $70 million—and accepting a reputation-damning lifetime ban on acquiring any more relics—and Jean-Luc Martinez, until last year the director of no less vaunted an institution than the Louvre, was charged in France with complicity in an antiquities-trafficking case. The reasons for the surge in high-profile cases may be both blatantly obvious—the astronomical amounts of money floating around the art world, the proliferation of websites selling art online, the lack of transparency or regulations on art transactions—and a bit more mysterious, or at least unique to the art world, with its idiosyncratic, unspoken code of conduct. Few among us would for a second consider buying a seven-figure house without a thorough inspection and a meticulously worded contract drawn up by our lawyer, yet multimillion-dollar artworks are routinely exchanged on the basis of nothing more than a handshake, or even a phone call.

In the clubby art world, no one wants to risk offending a gatekeeper to prime works. “You can have all the money in the world,” says Judd Grossman , a top litigator who specializes in art, “but if you’ve rocked the boat, if you’ve been too demanding, the gallery doesn’t have to sell it to you. People are more likely to go with the flow.

” Many bad actors are also acutely aware that art crimes are notoriously difficult to prosecute. Though banks have long been required to report clients’ suspicious activity, galleries and auction houses accustomed to looking the other way if, say, a client paid with a suitcase full of cash, have only recently begun to feel the heat. The Anti-Money Laundering Act of 2020 covers aspects of the art market, though regulations have not been finalized.

Also contributing to the shroud of secrecy: Valuable art can be held and traded by offshore shell companies in free ports in places such as Geneva and Singapore to avoid taxes and other oversight. Questions about the OMA “Basquiats” simmered for years before the very public FBI raid. The narrative the owners provided when shopping the paintings around—and which the museum parroted—presented their discovery as something of an Antiques Roadshow -on-steroids miracle: Basquiat, the story went, had painted the works on cardboard in 1982 while living in dealer Larry Gagosian’s basement and sold them directly to television screenwriter Thad Mumford ( M*A*S*H, The Cosby Show ) for $5,000, without Gagosian’s knowledge.

Mumford locked them away in a storage unit for 30 years. When that bill went unpaid, the works were auctioned off in 2012. Two men, William Force and Lee Mangin, bought them for a song and, later joined in six of the works by prominent LA lawyer and investor Pierce O’Donnell, proceeded to commission experts to authenticate them.

(The Basquiat estate, like many others, disbanded its authentication arm a decade ago because of expensive litigation from disgruntled art owners. ) One of those experts, though, has since challenged OMA’s representation of her evaluation. Jordana Moore Saggese , an associate professor of American art at the University of Maryland, College Park, who has written a book on the artist, declined an interview but shared a statement with Robb Report claiming that her review, for which she was reportedly paid $60,000, had been “confidential and tentative” and based exclusively on photographs.

She also maintained that she had rejected nine of the works outright and said 11 “could be” and seven “may be” legitimate, though she required an in-person examination to be sure, which was never granted. (O’Donnell disputes Saggese’s account. ) A New York Times investigation reported that the cardboard used for one of the works was printed with a FedEx typeface that was not in use until 1994, six years after Basquiat’s death.

As of press time, no criminal charges had been filed, and the works’ owners have stood by their authenticity. In the decade since Force and Mangin acquired the pieces, they were known to be shopping the works around unsuccessfully, a sign that insiders were unconvinced. If Peter Brant, Steven Cohen or some other big shot hadn’t snapped any up, something must be fishy.

Art adviser Todd Levin tells Robb Report he dismissed a group of them as impostors on the basis of the JPEGs he was sent. Years later, he was startled to read that OMA was devoting a show to these same “Basquiats” and flew to Orlando to see them in the flesh. “I walked in and looked at them and was like, ‘These are faker than fake,’ ” he recalls.

“As I was leaving, I wrote a note” to the museum’s director and CEO, Aaron De Groft, expressing his concern, and left it at the front desk. When De Groft didn’t reply, Levin tried calling the museum, then posting his doubts on OMA’s social media, all to no avail. “There was radio silence.

That’s when I got cross. ” So he dropped a dime to the FBI. “They were aware of the situation,” Levin says, adding that he provided further information but cannot share details.

The FBI moved in before the show’s contents could be shipped to Italy for the second leg of the exhibition. Following the seizure, OMA released a statement proclaiming that it was a witness, not a target of any investigation. But the fallout was swift.

Within days, De Groft was ousted, and the museum handed off the scandal’s press management to a crisis specialist, Theresa Collington, whose response to Robb Report inquiries was to remain silent; she did not reply to repeated emails and voicemails. The bureau’s case reportedly includes an affidavit signed by Mumford before his death in 2018 disavowing the story and denying he’d met Basquiat or acquired paintings from him. Were an indictment to be handed down, the verdict might hinge on whether prosecutors could prove beyond a reasonable doubt that any of the parties had invented a false history for the paintings, shopped them around with phony documentation and benefited financially from that deception, such as with museum funds.

Another quirk of fine art: Though counterfeiting currency is explicitly illegal, the act of copying an artwork or an artist’s style is not. At least some of the paintings at the heart of the Palm Beach gallery case, for instance, initially came to the market—legally—with the caveat that they were reproductions or “after” the artist in question, not the real deal. The gallerist, Daniel Elie Bouaziz, allegedly bought them for a pittance online, then omitted those essential details and dreamed up false provenances before selling them at a steep markup—one of them, to an undercover agent, for $12 million.

Bouaziz has pleaded not guilty. Even replicating the signature of an artist on a knockoff is not breaking any laws, per se, according to Jason Hernandez, the former assistant US attorney who prosecuted the infamous Knoedler Gallery case, in which one of the most venerable galleries in the United States sold dozens of forged canvases over the course of 17 years as works by Rothko, Pollock, Motherwell and other 20th-century greats. In reality, a Chinese math professor living in Queens painted them, though he has claimed ignorance that they’d be marketed as legit.

(When authorities finally raided his garage studio, he had already hightailed it back to China, leaving behind such tidbits as an envelope labeled “Mark Rothko nails. ”) “If you just paint something in the style of a Pollock and you write ‘J. Pollock’ on it, you wouldn’t be committing a crime if someone said, ‘That looks great.

I’ll give you $500,000 for it,’ because you haven’t really made a false representation—you haven’t said that ‘Pollock’ was by the famous artist,” says Hernandez, now a lawyer in private practice in Miami. “You haven’t said anything, as a matter of fact, and you wouldn’t have an obligation to say anything about the signature. Now, if a person came to you and said, ‘That looks great.

Is that a genuine Pollock?’ and you said, ‘Yes,’ now you’ve committed fraud because you reasonably understand what they mean as, ‘Is this by the famous artist Jackson Pollock?’ and you know it wasn’t because you painted it. Then you would be committing a crime. ” Well, yes.

But only if you went ahead and took that person’s money, that is. Hernandez points to a bizarre situation that came to light in 2010, in which a Mississippi man by the name of Mark Landis was discovered to have painted scores of works in the disparate styles of several artists, many of them American Impressionists, and donated them to at least 50 museums over some 20 years, perhaps for the simple pleasure of seeing his work pass muster and hang alongside famous artists. Even after eventually being outed, he was so determined to keep up the ruse that he continued to gift paintings by using aliases such as a Jesuit priest.

Landis has never faced prosecution. “The reason why it wasn’t a crime is that he never got any money for it,” Hernandez explains. Landis neither asked for nor received a fee, nor, wisely, did he take a tax deduction.

(The Feds sometimes nab fraudsters not for their root misdeed but for failing to declare the proceeds. ) “For it to be a crime, you have to have done it for financial gain. This guy just showed up, gave them a painting.

They assumed it was by someone famous, or they were told it was by someone famous. We don’t put people in prison for that. ” Landis did not deprive the museums of funds, only their pride.

Predators know all too well that ego—and its attendant dread of public ridicule—can be a powerful deterrent to reporting art crimes. No one, particularly uber-successful sorts who indulge in big-ticket collecting, or museum professionals whose careers are built on confidently projecting expertise, wants to admit they’ve been had, whether with forgeries or financial shenanigans. Very often, though, victims are not some innocents who’ve never set foot in an auction room; they’re seasoned collectors, even museum trustees.

Take Michael Ovitz, an art-world fixture who has poured millions into top-notch examples of abstract expressionism, pop, minimalism and even Rembrandt etchings and has long held a prestigious spot on the board of the Museum of Modern Art. A cofounder of Hollywood powerhouse CAA , Ovitz is known for his savvy. Yet even he fell victim to an unscrupulous dealer, tripped up by the tendency of art-world denizens to trust each other.

About a decade ago, Ovitz consigned two Richard Prince works to Perry Rubenstein, who had owned a gallery in New York’s Chelsea, then moved it to LA, where it soon skidded into bankruptcy. He allegedly sold one of Ovitz’s Princes but withheld the funds and tried to sell the other below the minimum price Ovitz had set. The LA County district attorney’s office also accused him of selling another collector’s Takashi Murakami scroll to the renowned Eli and Edythe Broad Foundation but deflating the price when he paid the consigner, pocketing the six-figure difference.

In 2017, Rubenstein pleaded no contest to two counts of grand theft by embezzlement and was sentenced to six months in prison. (Rubenstein, who expressed remorse and became an art adviser and writer after his release, died in July. ) Ovitz tells Robb Report that he was hesitant to report the dealer’s misconduct to the authorities.

“Look, I didn’t want the Rubenstein publicity,” he explains. “I felt embarrassed by it. I felt stupid.

” Now he says he transacts, as a rule, only with “top, reputable people. I don’t deal in the fringes. Most of this stuff happens with people in the fringes, excluding Knoedler, which took down very heavy people.

When I buy something from Larry [Gagosian], I wouldn’t think for a second that there’s anything wrong with it. I bought a piece of African sculpture from a dealer in Paris. I had it authenticated by someone in New York, and he told me it was a fake, and the guy gave me my money back.

These are the kinds of people I deal with. ” Ovitz is also cautious to employ a proper contract up front when consigning a work for sale. “I won’t do it without paper anymore,” he says.

“Let me rephrase that—with Gagosian or [Pace’s Marc] Glimcher or [David] Zwirner, I will do it. I won’t do it with someone that isn’t in business that way. ” He empathizes with Domenico De Sole, the chairman of Tom Ford International and former chairman of Sotheby’s who was hoodwinked into buying what turned out to be a fake Rothko from Knoedler.

“Domenico De Sole is not stupid,” Ovitz says. “In his defense, if I was buying something from Knoedler [before the scandal], I wouldn’t think twice about it. ” A courtroom sketch depicts plaintiff Domenico De Sole testifying in a 2016 civil trial about the fake Rothko painting he bought from Knoedler Gallery.

Elizabeth Williams/Associated Press To be sure, the establishment popped into Knoedler for a Picasso as comfortably as they dropped by Bergdorf’s for a new tie, and the forgery ring shook the art world like no other scandal when it came to light in 2011. Founded in 1846, the gallery supplied the likes of Andrew Mellon and Henry Clay Frick and in the early 21st century remained a reliable source for canonical modern artists. But it turned out Knoedler’s longtime director, Ann Freedman, had sold nearly 40 fakes for an alleged $63 million.

They all came from one source, a woman named Glafira Rosales, who delivered them to the gallery’s fashionable Upper East Side address in her car. Rosales later confessed to concocting the canvases’ fever dream of a backstory about a mysterious European collector, “Mr. X,” acquiring them through a well-known art-world figure who was close to several abstract expressionists, who were happy to personally accept the client’s cash and didn’t think to record either the transactions or the very existence of the works themselves.

Like the plot in any good soap opera, the scheme later featured a twist, naming another well-connected intermediary, who was also said to be Mr. X’s gay lover. But conveniently—err, tragically—every character in both tales was by then dead, and the “son” of Mr.

X now dispersing this trove demanded complete anonymity, to hide his late father’s sexuality from their conservative clan. Cue eye roll. “In the art world there’s this reversal of logic: The more incredible the story is, the more likely people are to accept it,” says Thiago Piwowarczyk, a founder of New York Art Forensics , which researches both physical objects and their accompanying documentation for authenticity.

In addition to De Sole, the deceit ensnared hedge-fund manager Pierre Lagrange, whose lawsuit accusing Knoedler of off- loading a fake Pollock on him—his hired experts found a yellow paint not produced until 1970, 14 years after the artist’s death—unleashed a torrent of litigation and prompted the gallery’s closure. In the end, Rosales pleaded guilty to wire fraud, money laundering and tax evasion, served just three months in prison and was ordered to pay $81 million in restitution to her victims. Swearing she was duped, Freedman has steadfastly maintained her innocence and was never charged.

“If we thought we had a case we could prove beyond a reasonable doubt, we would have brought it,” says Hernandez, who describes the Knoedler affair as an “extreme, crazy case. ” Not every crook has a skilled mimic on call to ape the brushstrokes of Titian or Twombly. These days all they need is a tech whiz.

NFTs, which were all the rage in 2021 and are fast sliding into pet-rock territory in 2022, have become tantalizing prey for hackers, who have swiped millions of dollars’ worth of the digital works this year from OpenSea and other marketplaces. Since the items in question are mere strings of code, not physical objects, NFTs are vulnerable to the extracurricular whims of your average computer-science grad student. Those thefts are no doubt profitable, but they lack a certain je ne sais quoi, a style and glamour befitting the art world.

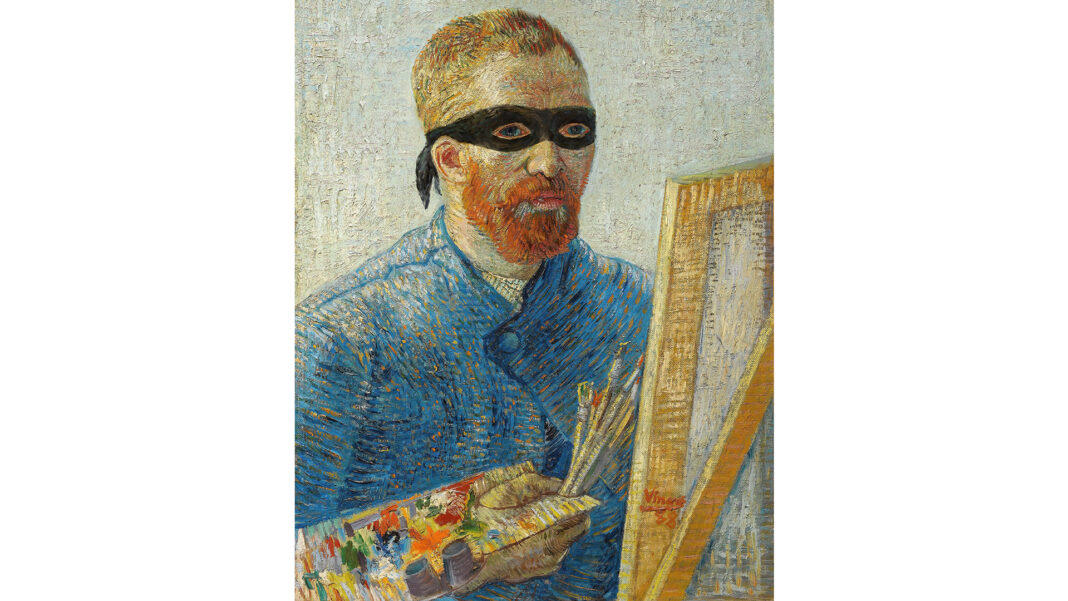

Hackers might as well target, well, Target. A worthier example of grand larceny occurred in the predawn hours of March 18, 1990, when robbers disguised as cops—a nod to performance art, perhaps?—tied up two guards at the Isabella Stewart Gardner Museum , a jewel box of a collection built at the turn of the 20th century by the Boston doyenne. The rogues made off with 13 treasures worth hundreds of millions of dollars, including works by Rembrandt, Vermeer, Manet and Degas.

Thirty-two years later, the case has been so cold for so long that if the artworks ever do materialize, the FBI will probably find them buried next to Jimmy Hoffa. The empty frame from which thieves cut Rembrandt’s Storm on the Sea of Galilee in Boston’s Isabella Stewart Gardner Museum in 1990. Josh Reynolds/Associated Press The Gardner break-in, though not alone in remaining unsolved, is the one that has most captivated and flummoxed the art world.

(Except for a heavy sigh, McKeogh cannot comment on the case because the investigation is ongoing. ) But that kind of old-fashioned, headline-grabbing heist has been on the decline, as stolen artworks of value are easily identified and therefore notoriously risky to pawn, unlike, say, precious gems. It’s no coincidence that armed robbers brazenly snatched jewelry, not paintings, from a booth at TEFAF , the international art fair in Maastricht, the Netherlands, in a smash-and-grab job this past June.

Instead, art thefts have become more insidious, often occurring little by little over the course of years. In 2014 James Meyer, who served as Jasper Johns’s studio assistant for 27 years, pleaded guilty to and was sentenced to 18 months in prison for transporting stolen goods across state lines. Those goods were dozens of unfinished works on paper by the towering artist that Meyer, who had been entrusted to organize them in a drawer, had instead spirited out of the Connecticut studio over time.

He funneled the pieces through a New York dealer, telling him they were gifts from the artist, a plausible story for a longtime employee, and covered his tracks with fake ledger pages. For an entity with a substantial cache of art, the failure to notice its disappearance is not as unusual as you might think, according to McKeogh. “The initial call will be, ‘I’m aware of five works that were stolen,’ ” he says.

“By the end of the day, that number is usually much, much higher. ” In one astounding case, about 50 works were initially reported missing. “By the time we were ready to execute the search warrant, we were confident there were at least 150,” McKeogh says.

“When we actually knocked on the door and conducted the search, we found 2,300. ” All from the same victim. The suspect was peddling the works online, according to McKeogh.

“I have to laugh because he actually left the inventory numbers of the victim’s system on the back of the artworks. There’s really no better proof than that. ” Art crime has been around almost as long as art, or at least the commercial variety.

The Romans routinely copied Greek sculpture. The Spanish churned out faux artifacts to keep up with the European demand for pre-Columbian objects in the colonial period. And, of course, conquering nations have plundered defeated ones since time immemorial.

The Nazis’ larceny was so pervasive that an entire body of statutes has arisen to govern restitution, which Holocaust victims’ heirs continue to seek nearly 80 years after World War II. The Art Crime Team was founded in response to abject looting of relics during the Iraqi War. In recent decades, the art world has grown exponentially, and hucksters want their share.

Enter rakish Inigo Philbrick, our young swindler with a name straight out of a hardboiled detective movie. In one of the largest frauds to beset the industry, Philbrick, who’d opened galleries in London’s Mayfair and Miami, conned investors out of some $86 million, which he reportedly spent on a soigné lifestyle to rival those of his ritzy clients. Philbrick was no outsider: His father is a respected former museum director, and his mother is an artist.

His mentor was Jay Jopling, the White Cube gallerist forever linked to the Young British Artists. Philbrick’s many schemes ranged from selling a work in fractional shares that added up to more than 100 percent (à la The Producers ) to using art he didn’t fully own as collateral for loans. As authorities closed in, he fled to the South Pacific, where the Feds soon caught up with him in June 2020.

After he pleaded guilty in New York, he didn’t mince words when the judge asked his motive: “For the money, your honor. ” One of 28 Turkish artifacts seized from the US government and restituted to Turkey this year. Anadolu Agency/Getty Images Though the criminal phase of his case appears to be over, the extensive civil litigation remains a tangled mess, as sharp-elbowed investors maneuver to recover either the artworks or their money.

Grossman, the art litigator, is involved in four of the disputes. “We like to look at it as following the bouncing ball,” Grossman says, adding that “in the art world, possession really is nine-tenths of the law. ” A little like kids outsmarting their middle-aged parents with ever-evolving mastery of technology, criminals are adept at staying one step ahead.

Forgers keep abreast of the market. Lately, for example, as auction prices for Black artists have heated up, McKeogh says, the FBI has noticed a spike in fakes. Grossman tells Robb Report that a rip-off of Joan Mitchell, an abstract expressionist recently celebrated in a traveling retrospective, is sitting beside him as he speaks, a vivid souvenir of a resolved case.

Experts advise collectors to remember the adage that if something seems too good to be true, it probably is. That goes for being offered a “great deal. ” Don’t fool yourself into thinking the seller is too naïve to realize what a work should go for, urges McKeogh.

Or as Grossman puts it, “Buying a Picasso in a back alley out of someone’s van should tell you something. ” For big-ticket items, collectors can also insist on third-party authentication, enlisted by the buyer. Levin, the art adviser, recommends hiring a certified appraiser approved by the IRS, the gold standard.

In this age of DNA testing and carbon dating, the popular imagination envisions conservators-slash-scientists conducting a battery of lab tests on an artwork to determine its genesis. But Piwowarczyk, the forensics specialist, says he examines “not only the object but the documentation around it. History is not only a series of stories but a study of documents.

” McKeogh seconds that notion. Though many collectors are eager to go straight to forensic testing, he says, “we almost never have to go to forensic testing because we can prove the fraud through documentation or other measures. I think a lot of people who try to prove a negative with forensic testing are also ignoring some blazing red flags out there related to the documentation.

” High on the list of warning signs: an abundance of previously unknown works by an important artist with murky or hard-to-verify provenances (beware “estate of a gentleman”). No catalogue raisonné, a compendium of an artist’s output, is fool-proof—and many artists don’t even have one—but “there’s a problem with any collection that comes to light where there are dozens of new artworks by an artist that the world has never known about,” McKeogh cautions. “Take Jackson Pollock, for example.

If there were a new ‘drip’ painting somebody were to find, that would be on the front page of every art section of every newspaper. Now imagine if someone found 30 of them, 50 of them. It’s just not realistic.

And there are a lot of people who will look the other way because they might make tens of millions of dollars if that Pollock was real. ” Hernandez, the federal prosecutor turned private litigator, advises not limiting your scrutiny to the artwork or its documentation. He reminisces about John D.

Re, an East Hampton, N. Y. , man he prosecuted in 2014.

Re’s sales pitch to the scores of customers he defrauded consisted of a story about acquiring dozens of Pollocks and de Koonings from the basement of a late friend of the artists; he ultimately admitted the tale was fiction, pleaded guilty to wire fraud and was sentenced to five years in prison. “It shows the value of doing diligence on who you’re buying from because John Re [already] had a conviction for counterfeiting US currency when he was selling this stuff,” Hernandez says, appearing to stifle a chuckle. “That’s what we call in my business a red flag.

”.

From: robbreport

URL: https://robbreport.com/shelter/art-collectibles/art-world-shady-secrets-cases-1234739359/