Business-to-business (B2B) ecommerce company ’s valuation has fallen by nearly half to around $1. 8 billion in a down round, marking one of the most precipitous drops for a startup that has raised over $1 billion, people aware of the matter said. Bengaluru-based Udaan was last valued at $3.

2 billion following a funding round in January 2021. Udaan closed a by largely converting debt notes into equity. The round also included a fresh equity infusion.

It did not disclose the valuation. Udaan counts China’s Tencent, DST Global among its top investors. It’s a structured transaction in which first the debt was converted and then fresh equity.

The new valuation would be around $1. 8 billion — that’s how it’s priced now, according to three people aware of the details. A spokesperson for Udaan declined to comment.

Udaan is now the second-largest startup — after — to have raised fresh capital at a significantly lower valuation than its previous round, underlining the challenging funding environment for new economy firms. A down round happens when the company has raised new capital at a lower valuation. Also read | ETtech Explainer: What are down rounds and will they become the norm for Indian startups? For startups like Byju’s — that has constantly seen markdowns by mutual fund investors — it is an indication of the current valuation by the investor.

Byju’s value was recently However, valuations can also be reassessed and marked up as well. For example, A majority of Indian startup founders are still unwilling to raise capital in a down round, , citing its annual State of Startups survey. Udaan, among the highest-funded startups, has been scaling down operations over the past 12-18 months to reduce burn and find a path to profitability.

From a peak of around 5,000 employees, it now has 1,500 employees on-roll. Most recently . “The clear priority is to reduce cost every quarter.

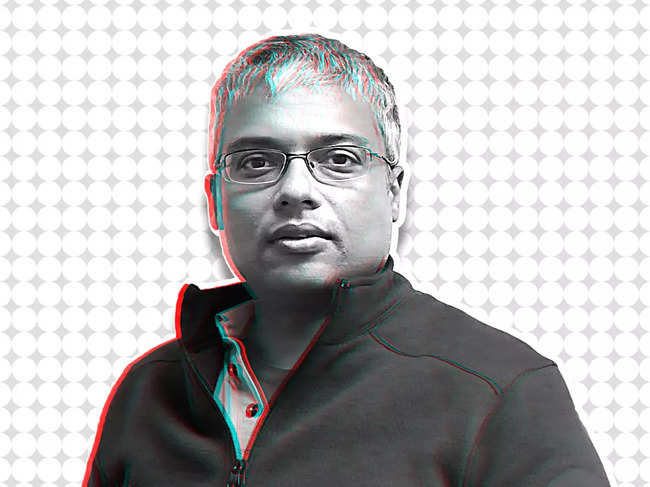

That’s the message from the CEO ( ) and that’s how the team is operating on a quarterly basis,” one of the people aware of the plans said. According to sources, Udaan has set certain operational targets and briefed investors about the goal to reach operational profitability over the next two quarters. As part of the plan, the ecommerce company has also overhauled its logistics policy to a local network instead of national network to reduce operating costs further.

“They (Udaan) have moved to a local network because transportation was the biggest cost avenue. Across segments, moving goods across national warehouses has been challenging so the change has happened,” a source said. Essentially, the day-to-day operational decision-making has been decentralised.

A spokesperson for Udaan had said the latest layoffs were in line with the company’s plans to build a “profitable business” and it ‘resulted in some redundancies in the system’. Sources said there are no plans for additional job cuts at the moment but it cannot be ruled out either. Gupta, who took over as the CEO of Udaan in September 2021, started the company in 2016 with his former colleagues Sujeet Kumar and Amod Malviya.

For about two years now, Malviya and Kumar have stepped away from the company’s operations. After the restructuring, Udaan has internal plans to go for an initial public offering in the next 12-18 months. “There is investor interest for profitable businesses.

That’s very clear. The scale is smaller and the valuation has also been corrected but focus is on building a sustainable operation reiterating on the model with smallest of the tweaks possible,” one of the sources said. Udaan’s parent firm is domiciled in Singapore under Trustroot Internet.

It reported a 43% fall in gross revenue at Rs 5,629 crore for the financial year ended March 2023 while also cutting losses to Rs 2,075 crore from Rs 3,123 crore in FY22. that Udaan is among Indian startups that has discussed moving its domicile back to India. Udaan connects small traders, wholesalers and retailers through its platform enabling commerce between them.

It also has a lending business which is run through its non-banking financial arm. Stay on top of and that matters. to our daily newsletter for the latest and must-read tech news, delivered straight to your inbox.

.

From: economictimes_indiatimes

URL: https://economictimes.indiatimes.com/tech/startups/udaan-valuation-dives-to-1-8-billion-in-down-round/articleshow/106875435.cms