Do you want to get the latest gaming industry news straight to your inbox? Sign up for our daily and weekly newsletters here . In 2023, U. S.

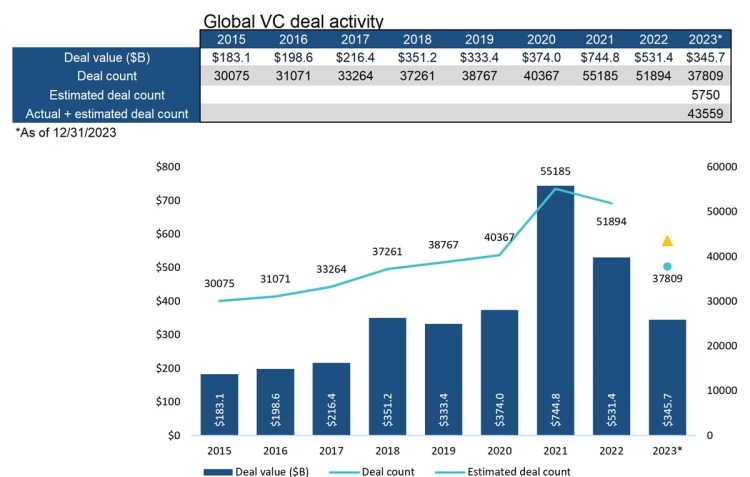

venture capital deal activity continued its slump from the highs two years ago, and global VC investments fell to the lowest levels since 2019. In 2023, 15,766 deals were completed in the U. S.

, but, more importantly for the industry, just $170. 6 billion was invested into companies, which is roughly half of the amount invested in 2021 and highlights the shortage of capital availability private companies are facing, according to a report by Pitchbook and National Venture Capital Association . U.

S. exits returned just $61. 5 billion to investors during the year.

Large tech initial public offerings (IPOs) were especially sparse considering the high number of unicorns that remain private. The inability to return money to investors has challenged the free-flowing capital into VC, based on the first look details of the report. After a record year for closed funds in 2022, just $66.

9 billion was committed to VC funds during the 2023 in the U. S. That amount represents the lowest total since 2017, and will likely hamper a potential rebound in dealmaking during the new year.

Though dry powder remains high, investors have become much more cautious when deploying capital to new portfolio companies. Despite the slowdown in dealmaking, media deal sizes for EU-based startups remained at or new all-time-highs across all stages of VC. Concurrently, valuations continued to be historically high within the market.

Europe dealmaking continues its descent, with Q4 deal count falling to the lowest total since Q3 2018. Each quarter during 2023 realized less than $4. 38 billion in exit value.

The $12. 92 billion in annual exit value was the lowest for the market in a decade. The 140 fund closings during 2023 marked the first year since 2013 to see fewer than 200 VC funds close in Europe.

The $17. 7 billion in commitments is also the lowest total since 2018. The less than $77 billion invested in global VC deals during Q4 was the lowest total since Q2 2019, and capped off a slow year for venture.

The quarter was also the first since Q2 of 2017 that Asia-based companies failed to raise at least $20 billion, marking a decline of more than 70% from the high in 2021. Deal counts fell across all regions, as the venture market continues to look for a new normal. Though exit activity remains subdued globally, Asia markets realized the highest exit value during each quarter of 2023.

More than $143 billion in exit value was generated in Asia over the course of the year, while in North America just $66. 6 billion was generated through VC-backed exits. Though Asia as a region is made up of many individual country markets, just once since the beginning of 2019 has a quarter seen less than $20 billion in exit value created collectively, while in North America, just one quarter in the past five has generated more than $10 billion.

Fundraising sluggishness in 2023 will add to the low capital availability within the venture market moving forward. 2023 was the lowest year for global VC fundraising since 2015. The $160 billion raised by VCs during the year is more than $200 billion less than in 2021.

GamesBeat’s creed when covering the game industry is “where passion meets business. ” What does this mean? We want to tell you how the news matters to you — not just as a decision-maker at a game studio, but also as a fan of games. Whether you read our articles, listen to our podcasts, or watch our videos, GamesBeat will help you learn about the industry and enjoy engaging with it.

Discover our Briefings. .

From: venturebeat

URL: https://venturebeat.com/games/vc-investments-and-exits-were-tepid-in-2023-nvca/