Leadership Strategy Will China And India Become The World’s Top Economies? It Depends Stuart Anderson Senior Contributor Opinions expressed by Forbes Contributors are their own. I write about globalization, business, technology and immigration. Following New! Follow this author to stay notified about their latest stories.

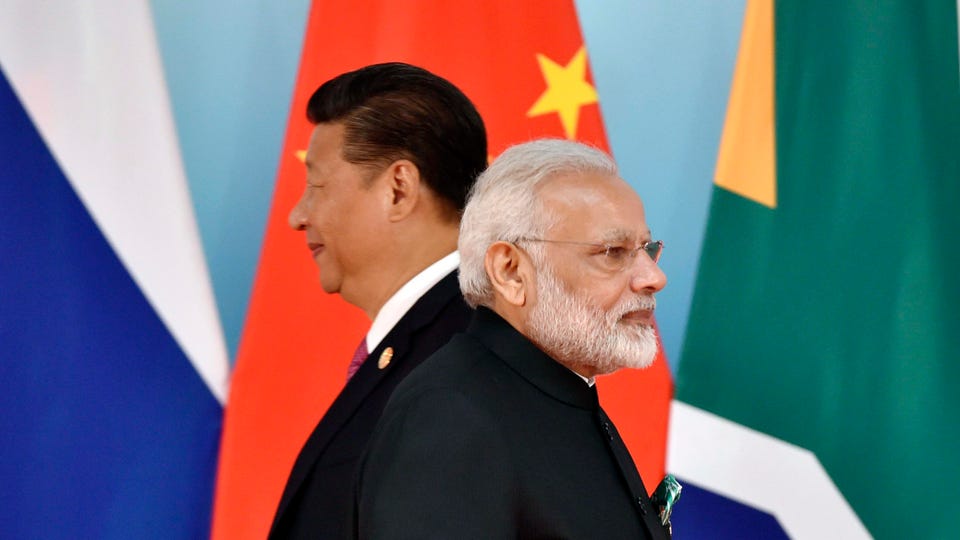

Got it! Nov 1, 2022, 12:04am EDT | New! Click on the conversation bubble to join the conversation Got it! Share to Facebook Share to Twitter Share to Linkedin Chinese President Xi Jinping (L) and Indian Prime Minister Narendra Modi attend the group photo . . .

[+] session during the BRICS Summit at the Xiamen International Conference and Exhibition Center in Xiamen, on September 4, 2017. (KENZABURO FUKUHARA/AFP via Getty Images) AFP via Getty Images A new study projects China and India to become the world’s leading economies in the coming decades, and the United States and Western Europe to decline in prominence. The analysis depends on productivity growth and demographics, which means U.

S. immigration policy, China’s move away from the free market and other factors will affect the future influence of nations in the global economy. In a National Bureau of Economic Research (NBER) paper , “The Future of Global Economic Power,” the authors project a rise in the global economic strength of China and India.

The paper’s authors are Seth G. Benzell, Laurence J. Kotlikoff, Maria Kazakova, Guillermo LaGarda, Kristina Nesterova, Victor Yifan Ye and Andrey Zubarev.

According to the study, the U. S. share of world GDP [gross domestic product] will decline from 16% in 2017 to 12% by the year 2100, and China’s share will rise from 16% to 27%.

The study projects India’s share of world GDP to rise from 7% in 2017 to 16% in 2100, while Western Europe’s share (including the UK) will fall from 17% in 2017 to 12% in 2100. According to the research, the combined GDP of India and China will rise from 23% in 2017 to 43% in 2100. Productivity Growth: The results are “highly sensitive to our assumed region-specific rate of productivity catch up,” according to the authors.

They disagree with but cite a 2019 NBER study by economists Ulrich K. Müller, James H. Stock and Mark W.

Watson, who predicted much lower growth for several countries, including “an almost complete end to Chinese, Indian, Russian, Eastern European, and former Soviet Union catch-up labor productivity growth. ” Benzell et al. note that using Müller, Stock and Watson’s model, the United States would be the “end-of-century economic kingpin” by producing 18% of the world’s GDP in 2100.

Sub-Saharan Africa would be second with 17. 5%. “The China plus India output share [under the Müller, Stock and Watson scenario] takes a sharp drop—from 24.

2% in 2017 to 15. 8% in 2100. ” MORE FOR YOU The Inside Story Of Papa John’s Toxic Culture Results: How To Get Good Stuff Done Even With Disagreement In The Air San Siro, Milan: How To Visit Italy’s Biggest Soccer Stadium Under another possible outcome, Benzell et al.

explain that if one assumes growth rates are the same as the 20 years before 2017 (i. e. , “recent growth rates”), “India now becomes the planet’s super superpower with its 2100 share of the global economy rising from 6.

8% to 33. 8%. ” It would mean an increase in China’s share of world GDP from 15.

7% to 22%. Still, India’s economy would be 50% bigger than China’s under this scenario because its population would be 50% larger than China’s but with the same labor productivity. “All other economies see their economic influence shrink or remain roughly fixed compared to the base case,” write Benzell et al.

“For the U. S. , the picture is particularly grim.

Its share of the world economy falls to just 10% by Century’s end. The story for Western Europe, including the UK, is even more shocking. In 2017, WEU and UK accounted for 25.

2% of world output. But if recent catch-up rates prevail, their 2100 share will be just 6. 4%! I.

e. , Western Europe will evolve from being the world’s largest economy to being one of its smallest. ” One can also see the significant difference in a nation’s economic output due to the size of its labor force and the productivity of its workers.

“[C]consider the U. S. and China, which currently account for roughly the same share of world GDP,” write Benzell et al.

“Were today’s Chinese workers as productive as American workers, China’s GDP would exceed U. S. GDP by a factor of 4.

3. ” The average American’s standard of living remains high relative to much of the world. “In 1997, the Chinese living standard was just 3.

5% of the U. S. level,” note Benzell et al.

“In 2017, the Chinese share was 13. 8% or 3. 94 times higher than 20 years earlier.

India’s living standard also grew compared to the U. S. , with the 2017 ratio 2.

06 times the 1997 value. ” Economists view it as positive that millions of people in China, India and elsewhere have risen out of poverty due to market-oriented reforms. Immigration, Demographics and Productivity Growth: Immigration is crucial to labor force growth—it is an essential element of economic growth—and has been shown to improve productivity growth.

“When we aggregate at the national level, inflows of foreign STEM [science, technology, engineering and math] workers explain between 30% and 50% of the aggregate productivity growth that took place in the United States between 1990 and 2010,” according to economists Giovanni Peri (UC, Davis), Kevin Shih (RPI) and Chad Sparber (Colgate University). Studies show higher immigration levels would boost the U. S.

economy, particularly in the long term. “Increasing legal immigration by 28% a year would increase the average annual labor force growth in the United States by 23% over current U. S.

projections, which would help economic growth and address a slower-growing U. S. workforce,” according to an analysis by the National Foundation for American Policy (NFAP).

On the other hand, reducing legal immigration would put the U. S. economy on a much slower growth path.

“If the United States continued the Trump administration’s policies that administratively reduced legal immigration by approximately 49%, average annual labor force growth would be approximately 59% lower than compared to a policy of no immigration reductions,” according to an NFAP analysis . In 40 years, the United States would have only about 6 million more people in the labor force than today if immigration fell by half. China’s Turn Away From Free Market Policies: The study by Benzell et al.

assumes China’s economic growth will not decline due to bad economic policies. Yet that may already be the case. “Some signs point to trouble for the country’s growth potential,” reports the Wall Street Journal .

“An IMF [International Monetary Fund] analysis estimates that growth in productivity averaged just 0. 6% in most of the past decade under Mr. Xi’s watch.

That was a sharp decline from an average of 3. 5% in the previous five years. ” China under Xi has supported less efficient state enterprises over the more successful private sector, notes The Economist , and the effects of maintaining a one-child policy for many years are being felt in the country’s demographics.

“Over a longer horizon, China’s growth outlook is constrained by demographics, falling productivity, and more significantly, the failed structural reforms of the past decade,” according to Logan Wright of the Rhodium Group . “China’s potential growth rate at present is probably closer to 3% than 5%, and China is currently growing well below that potential rate. ” James Pethokoukis, a fellow at the American Enterprise Institute and editor of the Faster, Please! newsletter, believes the United States can grow faster than China in the coming decades—if America enacts the right policies.

“Can the US grow at least 3% going forward?” writes Pethokoukis. “I think it can. There’s nothing wrong with the American economy that cannot be fixed with what’s always been right with the American economy.

That means an economy that welcomes and attracts global talent, spends massively on R&D (both public and private), regulates with a consideration to how new rules affect the ability to build and innovate in the physical world, and continues to reward high-impact entrepreneurship. . .

. The immigration piece is obviously super important here and something China cannot match. ” The study by Benzell et al.

projects the future economic influence of China, the United States and other nations, predicting China and India will rise while U. S. economic influence will fall.

U. S. immigration policy and China’s economic choices will have a say in whether that prediction comes true.

Follow me on Twitter . Check out my website . Stuart Anderson Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/stuartanderson/2022/11/01/will-china-and-india-become-the-worlds-top-economies-it-depends/