Forbes Business Breaking Will Trump’s Social Network Go Public? Truth Social’s Parent Faces Looming Deadline This Week. Mary Whitfill Roeloffs Forbes Staff I am a Boston-based reporter covering breaking news. Following Sep 3, 2023, 02:02pm EDT | Press play to listen to this article! Got it! Updated Sep 3, 2023, 02:08pm EDT Share to Facebook Share to Twitter Share to Linkedin Topline The parent company of Truth Social—former President Donald Trump’s alternative to Twitter—is facing a critical shareholder vote this week that could decide whether Trump’s media startup goes public, after over a year of delays and scrutiny from regulators.

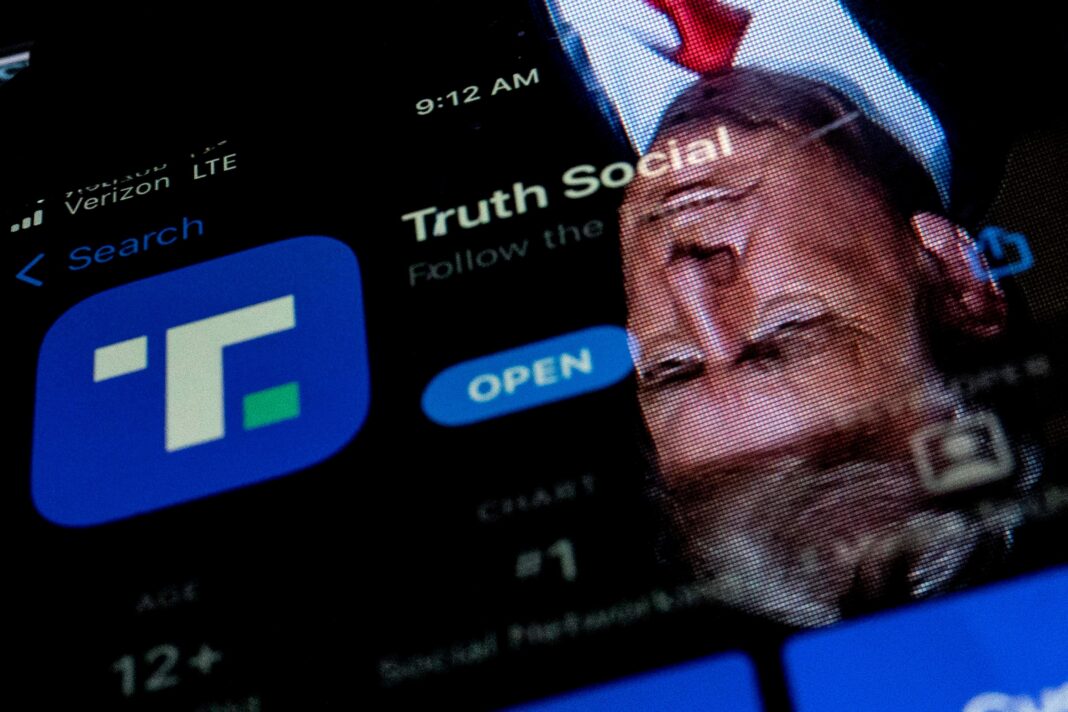

This photo illustration shows an image of former President Donald Trump reflected in a phone screen . . .

[+] that is displaying the Truth Social app, in Washington, DC, on February 21, 2022. AFP via Getty Images Key Facts The long-stalled merger of Trump Media & Technology Group and Miami-based special-purpose acquisition company Digital World Acquisition must either close or extend its deadline before September 8, or Digital World will be required to liquidate and return the $300 million it raised to its shareholders—and Trump Media won’t go public. At least 65% of Digital World’s 400,000 shareholders must cast their votes by September 8 to decide if they’ll extend the deadline for another year, which they’ve already done once, or let the merger expire and see the blank-check company—which closed at $16.

51 a share Friday—return just $10. 24 per share to investors (a shareholder meeting is scheduled for Tuesday but Digital World can delay the final tally until Friday). Deadline extension votes in the SPAC sphere are usually approved, and Digital World has proved to be no exception—if this vote passes, it will be the fifth extension on the Trump Media deal, according to Bloomberg .

If Digital World is forced to liquidate, Trump Media would have gotten nothing out of the proposed merger, but the future of Trump Media or Truth Social is unclear—Trump owns a 90% stake in the company, which the Washington Post reported he would keep if the deal falls through. Law professor Usha Rodrigues told Bloomberg the biggest problem for the extension vote could be that Digital World shareholders “are not paying attention”—many shareholders are small-time retail investors, some of whom likely bought shares out of loyalty to Trump, and may not know the deal is on the line. The CEO of Digital World, Eric Swider, has been working to get the word out and said in a company statement that a “vote for the Extension is a vote for freedom of speech.

” Representatives for the Trump Media & Technology Group (TMTG) did not immediately respond to Forbes request for comment Sunday. Former U. S.

President Donald Trump speaks to the media at Atlanta Hartsfield-Jackson International . . .

[+] Airport after surrendering at the Fulton County jail on August 24, 2023 in Atlanta, Georgia. Getty Images Surprising Fact When Trump first announced TMTG, then a new business, planned to go public via a SPAC, shares soared 550% in one week. They hit their peak at $175 per share in late October, but have since fallen 33.

9% in the last year. The stock was up 0. 5% at closing Friday, trading at $16.

51. Digital World now has a market cap of $614 million. Key Background Digital World Acquisition Corp.

, a Nasdaq-listed blank check firm, agreed to acquire Truth Social’s parent company and take it public in October 2021. At the time, Trump Media & Technology Group billed itself as a vehicle for Trump’s return to social media, months after he was banned from Twitter in the wake of the January 6 riot, and mentioned plans to launch a paid streaming service. The plan was well-received by investors at first—Digital World’s stock soared 550% the week of the announcement, and shareholders included Rep.

Marjorie Taylor Greene (R-Ga. )—but it has since been riddled with problems and delays. Reports quickly emerged that the Securities and Exchange Commission was investigating Digital World, and earlier this year, Digital World agreed to pay the SEC a civil penalty of $18 million.

The SEC accused Digital World of holding talks with TMTG before going public—a violation of security laws since special-purpose acquisition companies, or blank check firms, are typically supposed to launch without any firm merger plans and negotiate deals after going public. Meanwhile, one of Digital World’s former board members was arrested on charges of insider trading: Federal prosecutors said Bruce Garelick and brothers Gerald and Michael Shvartzman, all of Florida, made more than $22 million in 2021 by using insider information to trade Digital World shares. This spring, Digital World’s former CEO was removed from his post by the company’s board.

In May, Trump Media sued the Washington Post for $3. 8 billion and claimed an article about the proposed merger falsely accused the company of securities fraud. Tangent Truth Social had roughly 10.

1 million visits in June of this year, according to Similarweb, a firm that analyzes web traffic data. By comparison, Twitter had 6. 5 billion visits and Facebook had 17.

4 billion. Growth on the platform appears to have stagnated and its total number of users is unclear. Its most-followed member, Trump , has 6.

41 million followers on the platform—a fraction of the 87. 2 million he has on X, formerly called Twitter . Trump had not used his X account for more than two and a half years until August 24, when he tweeted a photo of his own Fulton County mugshot with the message “NEVER SURRENDER!” The post has 1.

7 million likes and 470,700 reposts. The message from Trump marks the first time he’s used Truth Social’s competitor since his 18-month exclusivity deal with the platform ended in June. Neither the company nor Trump has announced an extension to the deal.

Forbes Valuation We estimated Trump’s net worth at $2. 5 billion in April. That’s a roughly $700 million decline from last fall, largely because his social media business has fallen.

What We Don’t Know The estimated value of Trump Media has swung widely since it was founded—a financial disclosure filed by Trump in April valued his stake in the company between $5 million and $25 million, but the initial merger deal valued the company at $875 million . Further Reading Trump’s Truth Social facing a key funding deadline ( Washington Post ) Trump’s SPAC Is Screwing His Own Supporters While Enriching Wall Street Elites ( Forbes ) Checks & Imbalances: Trump’s Social-Media Business Contends With Erroneous Accounting And Bad Press ( Forbes ) Truth Social SPAC Agrees To Pay $18 Million To Settle SEC Investigation Into Merger ( Forbes ) Ex-Board Member Of Trump’s SPAC Arrested For Insider Trading (Forbes) Trump Is Reportedly Mulling A Return To Twitter After Truth Social Exclusivity Deal Expires (Forbes) Follow me on Twitter . Send me a secure tip .

Mary Whitfill Roeloffs Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/maryroeloffs/2023/09/03/will-trumps-social-network-go-public-truth-socials-parent-faces-looming-deadline-this-week/