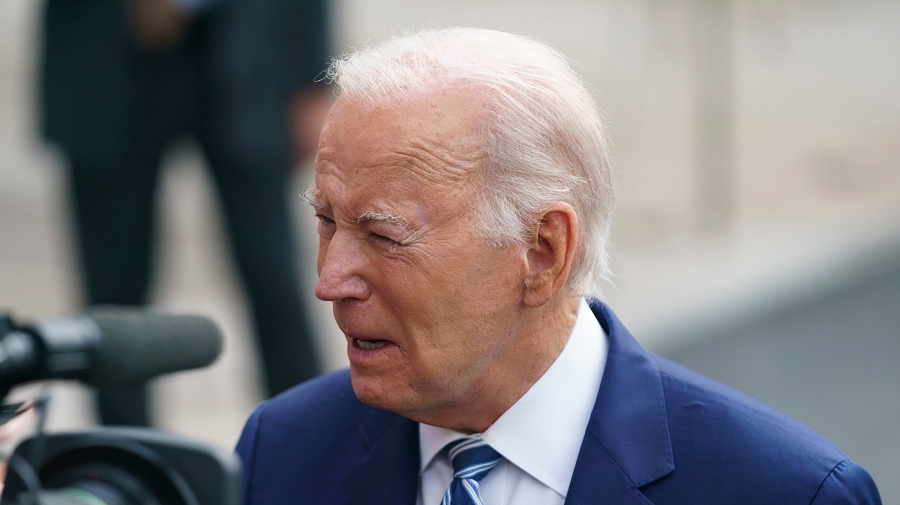

Poor President Biden. Just as he ramps up his to voters, the jobs market gets shaky. Worse, analysts are beginning to question whether those outsized jobs numbers celebrated by the White House in recent months are real.

Some validation of those doubts appeared in the , which contained substantial downward revisions of April and May’s totals. A wobbly jobs picture — only were added last month, fewer than expected and far below the 278,000 added on average over the past six months — is just one of several reasons that the president’s current Bidenomics tour may end badly. First, most economists expect the country to slide into recession between now and the election in November 2024.

The minutes of the Federal Reserve’s last meeting show the staff later this year. Some members look for unemployment to , up from 3. 6 percent today.

How will Biden’s pitch go over with voters when unemployment is rising and people are being thrown out of work? Just as this administration has shown itself tin-eared about the pain caused by , ignoring a slump in hiring will not go down well. Second, “sticky” inflation — the fact that prices are still going up, albeit at a slower pace — means the Federal Reserve is not done hiking interest rates. Already the country has endured one of the .

Wall Street’s top-rated economist, Ed Hyman, has warned clients many times in recent months that such an upward trajectory of interest rates causes a financial or economic shock, like the . This year saw in American history. Hyman suggests more disruptions could occur.

That will be on Biden’s plate. Third, and conceivably most threatening to Biden’s hopes, those much-ballyhooed job gains may not be real, and the employment picture may not be as solid as it looks. If in coming months the numbers are revised sharply lower, Republican opponents will have a field day.

Indeed, we may have seen some indication of that in the June report, in which the jobs total for April and May was revised lower by 110,000. Several analysts have been warning of just such downward revisions and that the tight jobs market is . Among those highlighting doubts about the jobs figures and about hiring overall is the Federal Reserve.

In the from the most recent Federal Open Market Committee meeting June 13-14, participants noted that some “measures of employment—such as those based on the Bureau of Labor Statistics’ household survey, the Quarterly Census of Employment and Wages, or the Board staff’s measure of private employment using data from the payroll processing firm ADP—suggested that job growth may have been weaker than indicated by payroll employment. ” Those comments by Bloomberg economist Stuart Paul, who wrote, “We think the last several months of payrolls estimates will ultimately be revised down. ” He suggests the revisions could total 900,000 jobs when the final figures are released in September.

Paul’s skepticism reflects the possibility that the Bureau of Labor Statistics (BLS) is likely overestimating the increase in jobs stemming from new business startups. Moody economist Mark Zandi also thinks the jobs number is overstated and that job gains 150,000 to 200,000 per month, as opposed to the 283,000 on average reported for the past three months. The birth-death model is an estimation of the number of jobs created or lost by new startups.

In May, for instance, the new non-farm jobs added; the birth-death estimate was 231,000. Without that “guesstimate,” new job additions would have totaled 108,000. In April, the birth-death number was even higher, at 378,000, a big factor in April’s 253,000 figure.

Note that sometimes the figure is negative, as it was in January; the point is not that the government is cooking the books, but rather that the figures are not necessarily reliable. As noted in the Fed minutes, another sign the jobs reports may be overstating reality has been the stark disparity between the household survey and the establishment survey. The BLS reviews businesses to assess payroll figures, while it estimates unemployment data based on a poll of households.

The numbers have of late, with the May payroll number jumping 339,000, while household-reported employment falling 310,000. In June, the figures were better aligned, with both showing gains. Another indicator that the employment picture is not as rosy as Biden suggests is a worrying drop in the number of hours worked, which suggests layoffs may loom and that the jobs picture could change for the worse.

In May, the average workweek in the U. S. fell to the lowest level since before COVID caused wide-spread shutdowns of the economy.

Hours worked have dropped in . In June, the trend reversed, with hours worked ; the gain is not persuasive, especially since the recent report noted that “the number of persons employed part time for economic reasons increased by 452,000 to 4. 2 million in June, partially reflecting an increase in the number of persons whose hours were cut due to slack work or business conditions.

” With employers struggling over the past year to hire workers, some analysts think that businesses will resist firing people as long as possible, instead cutting back their hours to save on costs. In most segments of the economy, including manufacturing, retail, transportation and warehousing, hours worked have slumped. Overall, the jobs picture has become shaky; it may not develop as the White House hopes.

Ed Hyman has repeatedly warned that “everything is fine — until it isn’t. ” Warning to Biden: celebrating Bidenomics is premature, and could be disastrous. .

From: thehill

URL: https://thehill.com/opinion/finance/4085291-joe-bidens-bidenomics-tour-a-risky-bet-as-jobs-market-cracks/