Forbes Money Investing Leon Cooperman Curbs 2 Top Holdings, Enters Elevance Health Position GuruFocus Contributor Opinions expressed by Forbes Contributors are their own. Following Sep 8, 2023, 05:01pm EDT | Press play to listen to this article! Got it! Share to Facebook Share to Twitter Share to Linkedin Guru reveals 2nd-quarter portfolio Summary The guru established five new positions, including in Elevance Health and DT Midstream. He curbed his holdings of Alphabet GOOGL , Chimera Investment and Apollo Global.

Omega Advisors leader Leon Cooperman ( Trades , Portfolio ) disclosed his portfolio for the second quarter earlier this month. At the end of 2018, the guru converted his New York-based hedge fund into a family office structure. In a letter to clients, Cooperman, who is in his 80s, said he decided to make the change because he did not want to spend the rest of his life “chasing the S&P 500 and focused on generating returns on investor capital.

” His investment strategy combines a macro view with fundamental valuations. During the three months ended June 30, 13F filings show Cooperman entered five new positions, sold out of four stocks and added to or reduced a number of other existing investments. His most notable trades included new holdings in Elevance Health Inc.

( ELV , Financial ) and DT Midstream Inc. ( DTM , Financial ) as well as reduced bets on Alphabet Inc. ( GOOGL , Financial ), Chimera Investment Corp.

( CIM , Financial ) and Apollo Global Management APO Inc. ( APO , Financial ). Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.

S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

MORE FOR YOU ‘One Piece’ Already Dethroned In Netflix’s Top 10 List By A New Show Indian Billionaire Ranjan Pai Is Looking To Cement His Legacy With A Billion-Dollar Windfall. Is A Calculated Bet To Fund Troubled Startups The First Step? New Pixel 8 Pro Leaks Reveal Google s Smart Decision Elevance Health The guru invested in 60,000 shares of Elevance Health ( ELV , Financial ), allocating 1. 45% of the equity portfolio to the position.

The stock traded for an average price of $461. 29 per share during the quarter. Previously known as Anthem, the Indianapolis-based health insurance company has a $106.

24 billion market cap; its shares were trading around $450. 84 on Tuesday with a price-earnings ratio of 16. 89, a price-book ratio of 2.

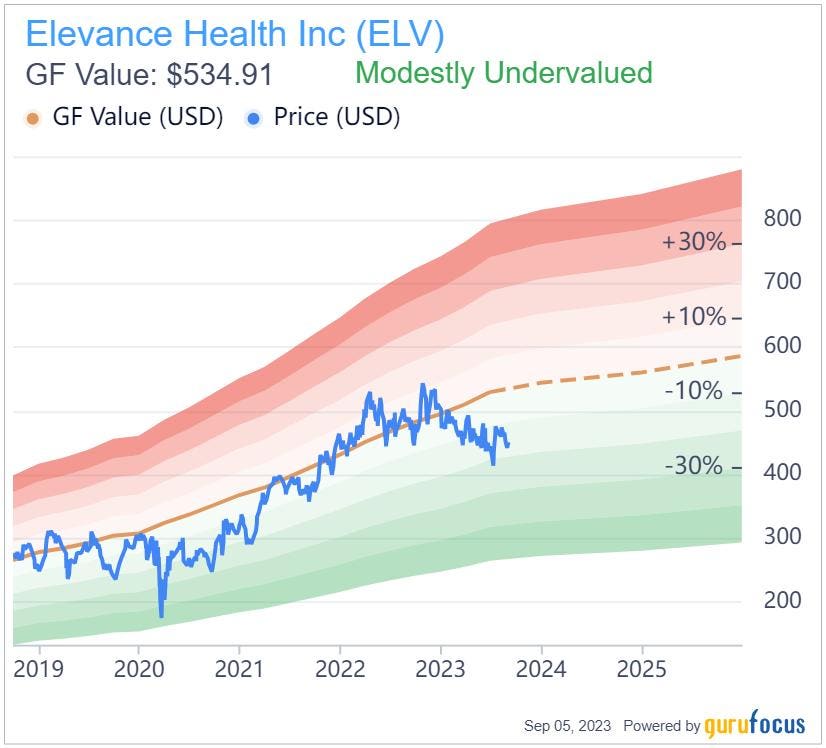

78 and a price-sales ratio of 0. 64. The GF Value Line VALU suggests the stock is modestly undervalued currently based on its historical ratios, past financial performance and analysts’ future earnings projections.

Elevance Health’s GF Value Line GuruFocus. com At 93 out of 100, the GF Score indicates the company has high outperformance potential. While it received high ratings for profitability, growth, value and momentum, the financial strength rank is more moderate.

Elevance’s GF Score GuruFocus. com Of the gurus invested in Elevance, Baillie Gifford ( Trades , Portfolio ) has the largest stake with 1. 33% of its outstanding shares.

The Vanguard Health Care Fund ( Trades , Portfolio ), First Eagle Investment ( Trades , Portfolio ), Hotchkis & Wiley and several other gurus also have notable holdings. DT Midstream Cooperman picked up 300,000 shares of DT Midstream ( DTM , Financial ), dedicating 0. 81% of the equity portfolio to the holding.

Shares traded for an average price of $47. 87 each during the quarter. The midstream energy company, which is headquartered in Detroit, has a market cap of $5.

07 billion; its shares were trading around $52. 27 on Tuesday with a price-earnings ratio of 13. 76, a price-book ratio of 1.

25 and a price-sales ratio of 5. 51. According to the price chart, the stock has gained nearly 25% since being spun off of DTE Energy DTE ( DTE , Financial ) in July of 2021.

DT Midstream’s price chart GuruFocus. com The GF Score of 26 also warns the company has poor performance potential. However, since it only received ratings for profitability and financial strength, its full prospects are not reflected.

DT Midstream’s GF Score GuruFocus. com With 0. 31% of its outstanding shares, Cooperman is DT Midstream’s largest guru shareholder.

Other top guru investors include Paul Tudor Jones ( Trades , Portfolio ), Joel Greenblatt ( Trades , Portfolio ), Jefferies Group ( Trades , Portfolio ) and John Hussman ( Trades , Portfolio ). Alphabet The investor curbed his investment in Alphabet’s ( GOOGL , Financial ) Class A stock by 23. 53%, selling 200,000 shares.

The transaction had an impact of -1. 25% on the equity portfolio. During the quarter, the stock traded for an average per-share price of $114.

92. Cooperman now holds 650,000 shares in total, which make up 4. 22% of the equity portfolio.

GuruFocus estimates he has gained 46. 72% on the investment, which is currently his 10 th -largest holding. Cooperman’s holding history of Alphabet.

GuruFocus. com The communications services company based in Mountain View, California, which owns the Google GOOG search engine, YouTube and a number of other businesses, has a $1. 72 trillion market cap; its Class A shares were trading around $135.

77 on Tuesday with a price-earnings ratio of 28. 76, a price-book ratio of 6. 42 and a price-sales ratio of 6.

12. Based on the GF Value Line , the stock appears to be fairly valued currently. Alphabet’s GF Value Line GuruFocus.

com With high ratings for four of the criteria and a more moderate value rank, the GF Score of 98 means the company has high outperformance potential. Alphabet’s GF Score GuruFocus. com Ken Fisher ( Trades , Portfolio ) is Alphabet’s largest guru shareholder with a 0.

34% stake. The stock is also being held by PRIMECAP Management ( Trades , Portfolio ), Dodge & Cox, the Harbor Capital Appreciation Fund ( Trades , Portfolio ), Philippe Laffont ( Trades , Portfolio ), Bill Nygren ( Trades , Portfolio ) and several other gurus. Chimera Investment The guru slashed his position in Chimera Investment ( CIM , Financial ) by 98.

79%, dumping 2. 51 million shares. The transaction impacted the equity portfolio by -0.

88%. The stock traded for an average price of $5. 31 per share during the quarter.

He now holds 30,834 shares, which occupy 0. 03% of the equity portfolio. GuruFocus data shows Cooperman has lost 10.

40% on the long-held investment. Cooperman’s holding history of Chimera. GuruFocus.

com The American real estate investment trust, which is invested in a diversified portfolio of mortgage assets, has a market cap of $1. 34 billion; its shares traded around $5. 90 on Tuesday with a price-book ratio of 0.

52 and a price-sales ratio of 14. 35. While there is not enough data for a GF Value Line, the stock has gained 0.

51% year to date. Chimera’s price history GuruFocus. com The GF Score of 48 implies the company has weak performance potential on the back of a high momentum rank and low ratings for profitability, financial strength and value.

Chimera’s GF Score GuruFocus. com Caxton Associates ( Trades , Portfolio ) is now the REIT’s largest guru shareholder with 0. 06% of its outstanding shares.

Cooperman holds 0. 01%. Apollo Global Management Cooperman trimmed the Apollo Global Management ( APO , Financial ) stake by 11.

61%, shedding 213,400 shares. The transaction had an impact of -0. 81% on the equity portfolio.

During the quarter, shares traded for an average price of $66. 81 each. He now holds 1.

63 million shares, making up 6. 77% of the equity portfolio as the fourth-largest position. GuruFocus found he has gained 30.

75% on the investment to date. Cooperman’s holding history of Apollo Global. GuruFocus.

com The private equity firm headquartered in New York has a $50. 32 billion market cap; its shares were trading around $88. 77 on Tuesday with a price-earnings ratio of 41.

87, a price-book ratio of 6. 56 and a price-sales ratio of 1. 92.

According to the GF Value Line , the stock is modestly undervalued currently. Apollo’s GF Value Line GuruFocus. com Driven by moderate to high ratings for all five criteria, the GF Score of 84 suggests the company has good outperformance potential.

Apollo’s GF Score GuruFocus. com Holding a 2. 18% stake, Chase Coleman ( Trades , Portfolio ) is Apollo Global’s largest guru shareholder .

Glenn Greenberg ( Trades , Portfolio ) and Tom Gayner ( Trades , Portfolio ) also have notable holdings. Additional trades and portfolio composition During the quarter, Cooperman also sold out of Aspen Group Inc. ( ASPU , Financial ) and boosted his holdings of Citigroup C Inc.

( C , Financial ), WillScot Mobile Mini Holdings Corp. ( WSC , Financial ), Energy Transfer LP ( ET , Financial ), Arbor Realty Trust Inc. ( ABR , Financial ) and Mirion Technologies Inc.

( MIR , Financial ). Omega’s $1. 84 billion equity portfolio, which is composed of 54 stocks, is most heavily invested in the energy, financial services and industrials sectors.

Overview of Cooperman’s portfolio by sector GuruFocus. com Disclosures I/we have no positions in any stocks mentioned, and have no plans to buy any new positions in the stocks mentioned within the next 72 hours. Follow me on Twitter .

GuruFocus Editorial Standards Print Reprints & Permissions.

From: forbes

URL: https://www.forbes.com/sites/gurufocus/2023/09/08/leon-cooperman-curbs-2-top-holdings-enters-elevance-health-position/