TAMPA, Fla. (WFLA) – Hurricane Ian left some with minimal damage and others with catastrophic losses. What you need to know about filing a Hurricane Ian insurance claim Either way, there’s a lot of uncertainty about insurance coverage, how to file a claim and what to expect.

Consumer Attorney Charles Gallagher tells Better Call Behnken that no matter how severe the damage, you should get your insurance company on the phone or notify them online. In fact, he says if you don’t inform them now, they could deny your claim later. For example, damage you assume isn’t a big deal now could lead to mold later, and an insurance company could blame you for not reporting the claim in a timely manner.

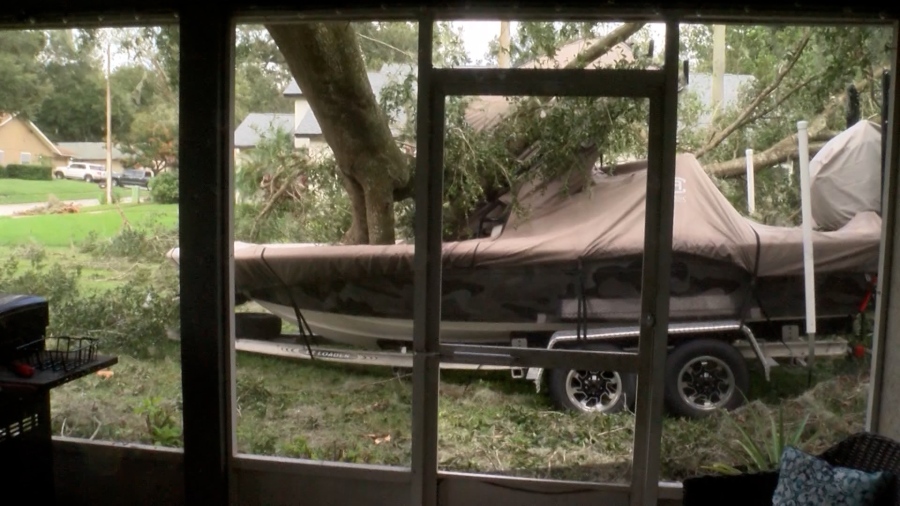

Be patient, though. It could take several days or several weeks to get an adjuster to your house. While you wait: Document damage with photos or videos for your claim.

Prevent further damage, such as covering broken windows with plastic or hiring a professional to cover your roof with tarps. Document expenses and keep receipts for any preliminary repairs. This could include tree removal, tarps, food or hotel stays.

AAA’s Mark Jenkins warns to also be on the lookout for those who may be looking to take advantage of you. “Some contractor may ask you to sign an assignment of benefits form. You want to be very careful about these because these can sometimes lead to fraud.

Contractors in some cases have been known to file claims on your behalf for work they didn’t do or work you didn’t even need and this can lead to lawsuits, your claim being denied and your premiums going up,” Jenkins said. Hurricane Ian is already putting added pressure on Florida’s insurance crisis. Just last year, six insurance companies pulled out of the state.

Keep in mind, flood coverage is not included in homeowners’ insurance policies. People must buy flood insurance separately, but data shows few who live inland do. The vast majority of flood coverage in the U.

S. is sold through the Federal Emergency Management Agency’s National Flood Insurance Program. Even if your homeowner’s insurance struggles to pay claims, there are two backstops in Florida to make sure consumers get their claims paid.

The Florida Hurricane Catastrophe Fund jumps in when an insurer runs out of reserves and cannot pay out claims. The Florida Insurance Guaranty Association pays out claims when an insurance company goes insolvent. If your company is in receivership, you can go to the state website My Florida CFO to find more information on how to file a claim.

Florida’s Chief Financial Officer Jimmy Patronis announced that the Federal Emergency Management Agency (FEMA) authorized the National Flood Insurance Program (NFIP) to approve Florida’s request for a waiver allowing policyholders within the program to access a portion of their claims without going through the full claims process. “Today, FEMA granted a waiver that will allow National Flood Insurance Program policyholders to access tens of thousands of dollars upfront without having to go through a normal claims process or involving an adjuster. This process cuts through a lot of red tape, and provides critical funding to policyholders who can provide FEMA with basic information of out-of-pocket expenses related to repair or replacement of NFIP-insured property.

These advance payments are going to be essential to help Florida families get started on the difficult work of rebuilding,” Patronis said. This program provides NFIP Standard Flood Insurance Policy Holders $5,000 for combined building and contents losses, or up to $20,000 for policyholders who can provide FEMA with photographic evidence of claims and demonstrate proof incurred out-of-pocket expenses related to repairing or replacement of property insured under a Standard Flood Insurance Policy. .

From: wfla

URL: https://www.wfla.com/8-on-your-side/better-call-behnken/experts-dont-delay-in-filing-insurance-claim/