A screenshot appearing to be from an actual Internal Revenue Service (IRS) job description has gone viral online because of one of its alleged requirements. A new agent applying for the position must “carry a firearm and be willing to use deadly force, if necessary,” the screenshot of the listing said. This comes as false claims have circulated about the IRS in connection with funding it would receive from the Inflation Reduction Act of 2022 .

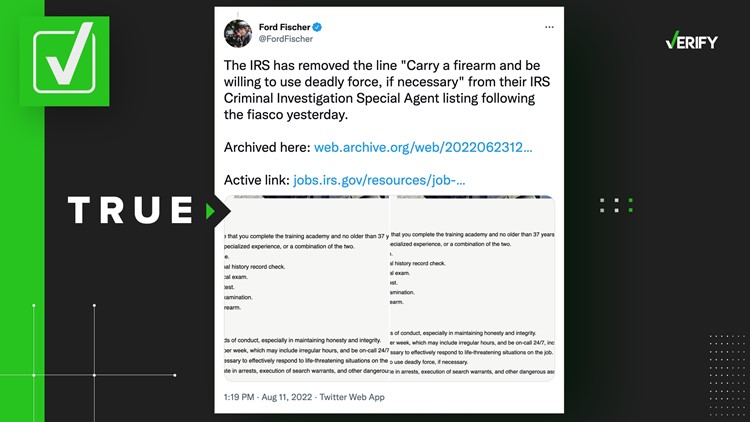

VERIFY views Mic and Donna asked us to look into whether or not the job posting was real, while some Twitter users claimed the IRS deleted the line about the use of force job requirement after the listing went viral. Did the IRS edit a job description to remove a requirement that new agents may need to use deadly force? Yes, the IRS did edit a job description to remove a requirement that new agents may need to use deadly force. Sign up for the VERIFY Fast Facts daily Newsletter The IRS has a website that lists the qualifications and requirements for certain positions within its criminal division.

One of those websites provides the description for an IRS Criminal Investigation special agent . The IRS Criminal Investigation (IRS-CI) division is a federal law enforcement agency that conducts criminal investigations on things like tax violations, money laundering, cyber crimes, and organized crime involving drugs and gangs. There are more than 2,000 sworn special agents in the division.

A spokesperson for the IRS told VERIFY the agents that work under the Criminal Investigation division are required to carry weapons as part of their everyday duties. The requirement to “carry a firearm and be willing to use deadly force, if necessary” should be on the job description for that reason, they said. The IRS also confirmed to VERIFY someone edited the page to remove that requirement from the post.

“It does appear that last week someone from within the employment office edited the job posting on this site to remove what they erroneously thought was language that should not be there,” an IRS spokesperson told VERIFY on Aug. 15. “They were told to put that language back as it is part of the [job] announcement for special agents.

” Using Wayback Machine, an archiving tool that allows someone to save webpages, VERIFY was able to confirm the page was edited on Aug. 11. On Aug.

11 at 11:25 a. m. EST, under the “Major Duties” section of the job description, the page said a new agent must: By 12:55 p.

m. EST that same day, the page was edited and the fourth bullet point referring to carrying a firearm and being willing to use deadly force was removed. This means sometime between 11:25 a.

m. and 12:55 p. m.

someone with authority to edit the page removed the fourth bullet point. As of Aug. 15, that requirement was not listed on the job description website .

By the time of publication, the IRS had not yet responded to VERIFY’s question when asked why the page was still not updated with the deadly force provision added back in. The provision that a special agent may be required to carry a firearm and may have to use deadly force is not brand new. VERIFY found an archive from Jan.

31, 2022, and the description included that requirement. The VERIFY team works to separate fact from fiction so that you can understand what is true and false. Please consider subscribing to our daily newsletter , text alerts and our YouTube channel .

You can also follow us on Snapchat , Twitter , Instagram , Facebook and TikTok . Learn More » Text: 202-410-8808.

From: wfaa

URL: https://www.wfaa.com/article/news/verify/government-verify/fact-check-irs-job-description-edited-to-remove-deadly-force-requirement/536-0769804a-dfcc-4443-b43c-7a68074f3e9f